Live

- ED conducts raids at two places in Bengal in chit fund case

- BJP Tamil Nadu President Expresses Confidence In Resolving Tungsten Mining Concerns In Madurai

- Karnataka Reviews Lake Safety Ahead of Monsoon: Minister Bhosaraju Tells Upper House

- Udupi MP’s queries, More key highways on high-priority

- Investing in Skills: Education Loans Paving the Way for Career Success

- Ghaggar river’s two stretches identified as polluted: Govt

- ICC chief Jay Shah meets Brisbane 2032 Olympics organising committee CEO

- Oxford Grammar High School Celebrates 44th Annual Sports Day with Grandeur

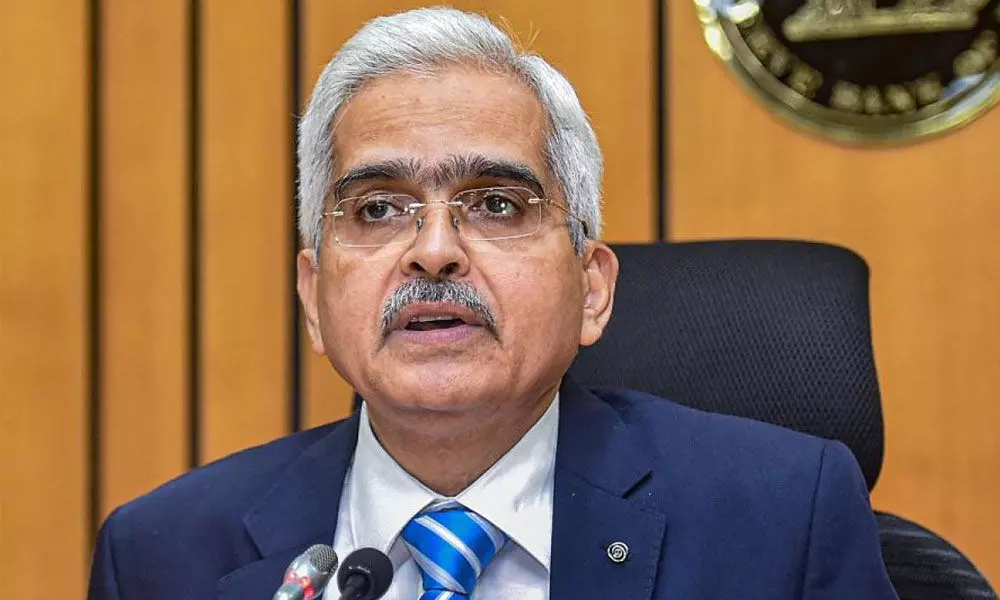

- Indian banking sector’s health remains robust, govt policy working very well: Top bankers

- iOS 18.2 Unveiled: New Features with ChatGPT Integration Revolutionize Your iPhone