Scattered OI signals indecisiveness in market

As per the latest options data on NSE after the last Friday session, the 22,000CE has highest Call OI followed by 22,500/ 22,200/ 21,700/ 21,900/ 22,100/ 22,600/ 22,800/ 21,800 strikes, while 22,700/ 22,650/ 22,500/ 22,000/ 22,200/ 22,400 strikes recorded reasonable addition of Call OI.

As per the latest options data on NSE after the last Friday session, the 22,000CE has highest Call OI followed by 22,500/ 22,200/ 21,700/ 21,900/ 22,100/ 22,600/ 22,800/ 21,800 strikes, while 22,700/ 22,650/ 22,500/ 22,000/ 22,200/ 22,400 strikes recorded reasonable addition of Call OI.

Coming to the Put side, the maximum Put OI is seen at 21,500PE followed by 21,000/ 21,700/ 21,600/ 21,400/ 20,800/ 20,500 strikes. Further, 21,500/ 21,700/ 21,750/ 20,500 strikes witnessed moderate build-up of Put OI.

The resistance level rose by 700 points to 22,000CE and the support level was up by 250 points to 21,500PE.

Dhirender Singh Bisht, associate vice-president (technical research) at SMC Global Securities Ltd, said: “In the Nifty options segment, the highest Call Open Interest is held at 22,200 strike followed by 22,200 strike whereas on the Put side, the highest Open Interest is at the 21,500 and 21,000 strike.”

“Nifty ended the week nearly unchanged, experiencing slight losses, while Bank Nifty concluded with a 0.7 per cent decrease, following the RBI’s decision to maintain the Repo rate. The market witnessed elevated intraday volatility last week, ultimately closing with modest losses. In the previous week, major gains were witnessed by PSU banks, Oil & Gas, and healthcare sectors, while profit-booking activities were noted in the private bank, FMCG and consumer durable counters,” added Bisht.

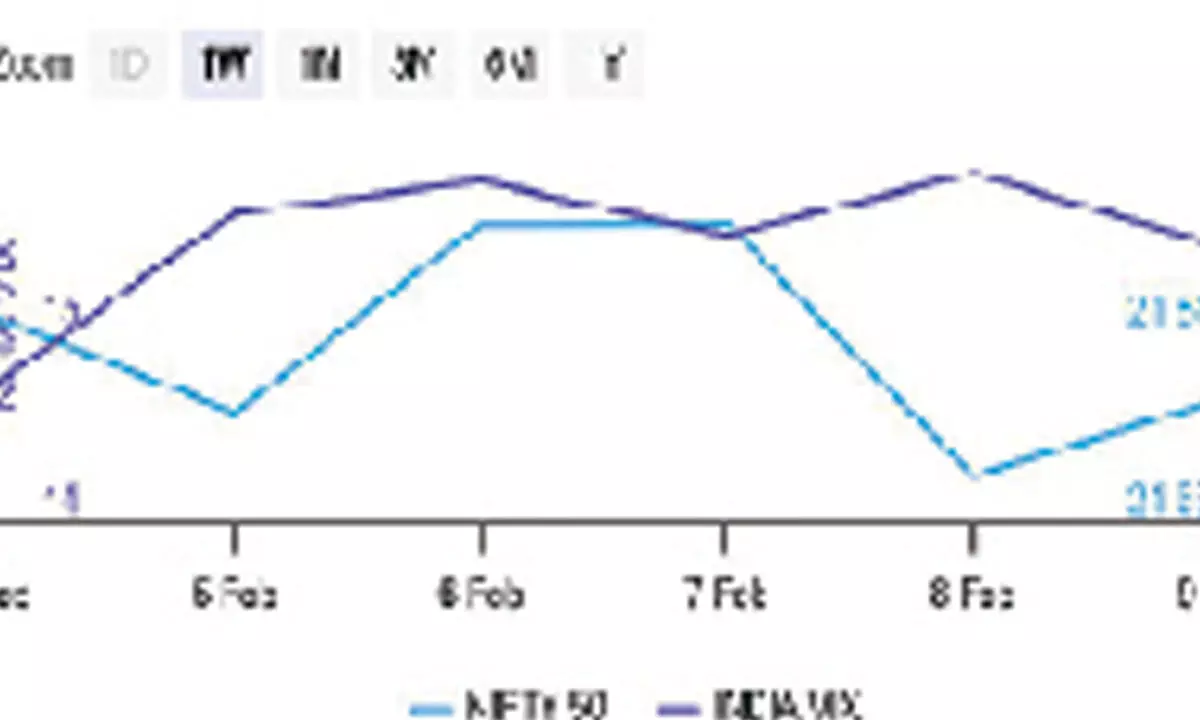

BSE Sensex closed the week ended February 9, 2024, at 71,595.49 points, a net recovery of 490.14 points or 0.67 per cent, from the previous week’s (February 2) closing of 72,085.63 points. During the week, NSE Nifty too gained by 71.30 points or 0.32 per cent at 21,782.50 points from 21,853.80 points a week ago.

Bisht forecasts: “From the technical front, the immediate support for Nifty lies in the range of 21,500 -21,400 zone, while on the higher side 22,000-22,200 zone would act as an immediate hurdle for the index.”

India VIX fell 2.50 per cent to 15.45 level. The volatility index has remained above 15 level. The sustainability below 13 will be crucial for uptrend continuation in the market.

“Implied Volatility for Nifty’s Call options settled at 14.66 per cent, while Put options concluded at 15.03 per cent. The India VIX, a key indicator of market volatility, concluded the week at 15.83 per cent. The Put-Call Ratio of Open Interest stood at 1.20 for the week,” remarked Bisht.

Bank Nifty

NSE’s banking index closed the week at 45,634.55 points, arise of 336.40 points or 0.73 per cent from the previous week’s closing of 45,970.95 points.