A growth-oriented Budget with inflation risks

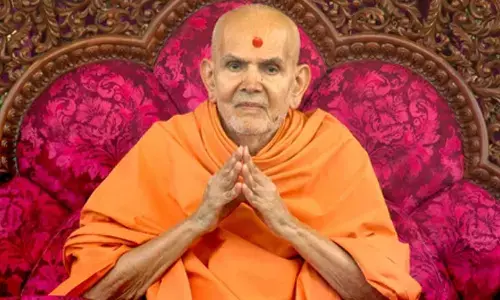

Finance Minister Nirmala Sitharaman

Finance Minister Nirmala Sitharaman presented her fourth consecutive Union Budget on Tuesday.

Finance Minister Nirmala Sitharaman presented her fourth consecutive Union Budget on Tuesday. In her 92-minute Budgetspeech which is her shortest one so far, the Finance Minister said the Union Budget 2022-23 would lay a solid foundation for India's growth story for next 25 years when our country would celebrate 100 years of Independence. It's too early to say this Budget will create such a foundation, but the Finance Minister has set herself several ambitious targets.

As per the numbers dished out by her, the central government will incur an expenditure of Rs 39.45 lakh crore in the next financial year while the total receipts are estimated at Rs 22.84 lakh crore. There is a huge gap between expenditure and income. Furthermore, as it happened in the current financial year, Centre's expenditure will overshoot the budget estimates while revenues will be lower than projections. Furthermore, she left taxesmostly untouched.So, the government will have to go for higher borrowings which come at a huge cost. The other ambitious target is to achieve a fiscal deficit of 6.4 per cent of gross domestic product (GDP) in FY23. In the current financial year, the Centre aimed at achieving a fiscal deficit of 6.8 per cent. But as of now, it is expected to go up to 6.9 per cent. This percentage may stretch further when real numbers come in. So, the target of reaching a fiscal deficit below 4.5 per cent by 2025-26 is unlikely to be realized if the Centre doesn't maintain a strict fiscal discipline.

But the most important takeaway from the Budget 2022-23 is the outlay for capital expenditure which has been increased by a whopping 35.4 per cent to Rs 7.5 lakh crore from Rs 5.54 lakh crore in the current financial year. That is equal to 2.9 per cent of GDP. Private investment is yet to pick up in the country owing to fall in the consumption levels triggered by the ongoing Covid-19 pandemic. In this backdrop, an increased government spending is the need of the hour to fuel economic recovery.That way, the Finance Minister has done the right thing by enhancing the capital expenditure.

In the same breath, Sitharaman extended the Emergency Credit Line Guarantee Scheme (ECLGS), which offers additional credit to over 1.3 crore MSMEs, till March 2023. She also expanded the guarantee cover under the scheme by Rs 50,000 crore to Rs 5 lakh crore. The increased cover will go to the crisis-hit hospitality sector, a right move.

Other takeaways include incentives for startups, digital push, significant outlays for infrastructure and focus on urban development. A 30 per cent tax on digital assets is a clear indication that the Indian government will not ban cryptocurrencies. A digital rupee is also on the way. But the Finance Minister was silent on the disinvestment target. This came as a surprise for many.

Overall, it's a growth-oriented Union Budget though inflationary pressures may flare up, hitting the poor hard. Will the government walk the talk on the Budget numbers? That's a trillion-dollar question!