SSIs need govt support to address problems of interest rates

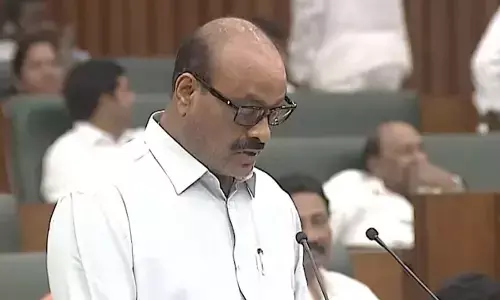

Centre should come to their rescue to give a fillip to the sector: FETAL general secretary K Appi Reddy

Hyderabad: The Federation of Telangana Small (MSME) Industries Association (FETAL) general secretary K Appi Reddy has said that the small-scale industrial (SSI) units are facing multiple issues and the Centre should come to their rescue to give a fillip to the sector.

Speaking to The Hans India, he said that the first problem is the frequent fluctuation of the interest rates. Generally, the quotation is being finalised in April, with the financials to supply goods to the industry by the SSI units. Once the quotations are finalised even the public sector undertakings (PSUs) are not prepared to change the finalised rates due to an increase in the interest rates causing an additional burden on SSIs.

"We are asked to supply as per the quoted rates for the whole year. Besides, the SSIs are also threatened with invoking the provisions of the loss caused due to supply (LD clause)." This is where the SSI sector needs the Central government support to fix the interest rates for the SSI sector for the whole year in case of RBI changing in the interests rate to provide subvention

Representatives of the SSI sector have submitted several representations to the Centre as well as the Union minister concerned highlighting the issues faced by the SSI sector. Also, payments to SSI units should be made statutory bringing amendments to the existing laws. This makes the statutory auditor of the industries to which SSI units provide supplies notify delayed payments in the loss and profit account reports. Once a statutory auditor notifies the delayed payments, it will reflect in their profit and loss account and there will be fear and timely payments would be made to the SSI units.

"SSI units have no might to mount pressure on big industries to which they provide supplies for timely payments. So industries, both in the public and private sectors make advance or timely payments for the big industries providing supplies to them but liberally take credit lines for longer periods in case of SSIsa", he added.

Even in the case of GST input tax payments are delayed to SSIs ranging from 45 to 90 days. In some cases, the time taken ranges from a minimum of six months. Even public sector undertakings are taking similar periods. If delayed payments are notified by the statutory auditors then the input tax and GST of industries will have to be reversed and recalculated. It will help timely payments to SSI units. It is, for this reason, the sector makes the demand to make payments to SSI units statutory.

Appi Reddy said the SSI sector is only next to agriculture in contributing revenues and providing livelihoods. But, agriculture is extended lower interest rates and with payment of income and other taxes. On the other SSIs will not only create jobs, but also pay all kinds of taxes. Besides, unlike agriculture, SSIs provide welfare measures to workmen, like ESI. All say the SSI sector is the backbone of the country and creates large-scale employment opportunities for people. but none is ready to address their problems. The FETAL general secretary pointed out an anomaly with banks and others recording higher growth rates in the sector based on increasing GST revenues.

"Prices of steel, cement, petroleum products and the like have gone up. The GST revenue generation is based on inflation in the prices of this and not the actual growth in production in the bottom line of SSIs," he said.

A visit to the SSI estates would reveal how many units have been shut. Job losses are caused and units are not in a position even to purchase materials to keep the units running. "It is not that I am saying there is no growth at all. If five SSI units out of 100 registered growth, it won't represent that the entire sector has registred growth," Appy Reddy said. The sector is not asking to reduce tax rates; but, to keep the interest rates fixed for the whole year. Besides, treat the SSI sector next to agriculture. The time to clear the GST should be 20th of the subsequent month.