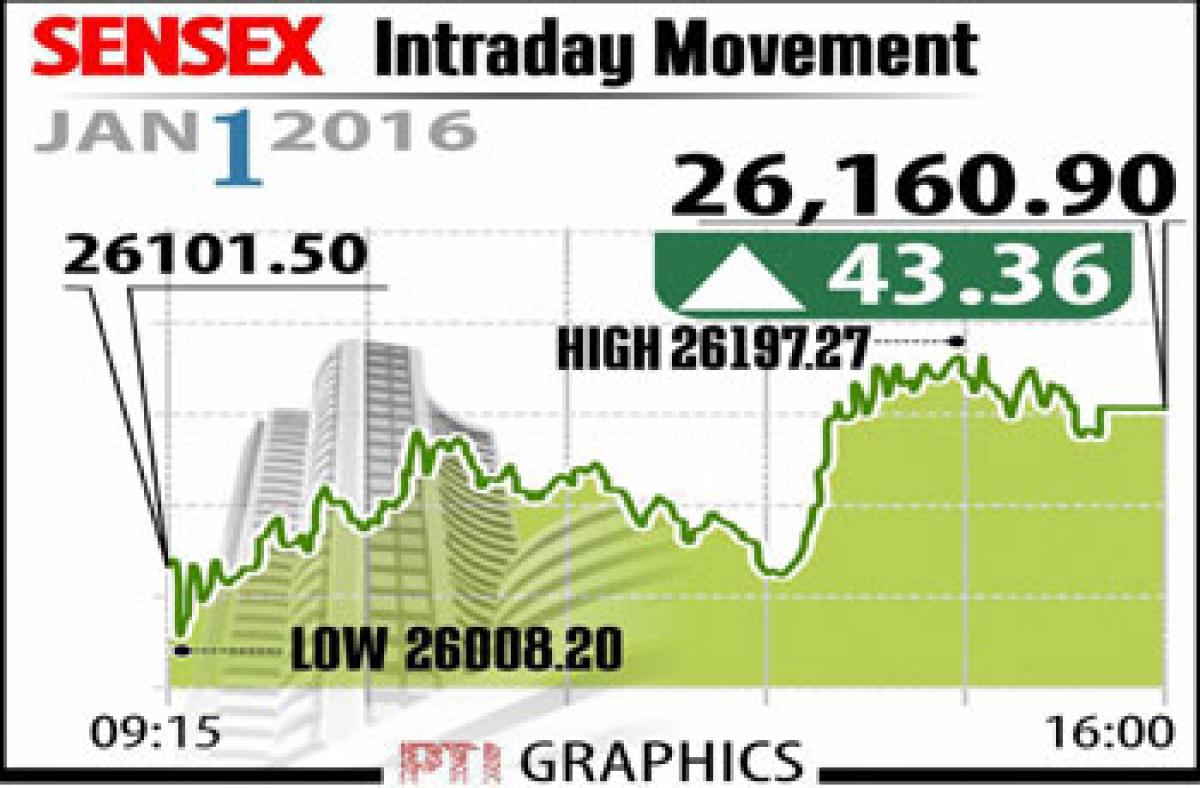

Markets post marginal upswing

Sensex rises by 43 points while Nifty up 17 points

.jpg) Mumbai: Indian stock markets had begun the New Year on a positive note with some select stocks in auto and realty sectors helping the bourses post marginal upswings.

Mumbai: Indian stock markets had begun the New Year on a positive note with some select stocks in auto and realty sectors helping the bourses post marginal upswings.

The benchmark Sensex closed higher by a modest 43 points at 26,160.90 - a one-month high - on the first trading day of 2016. It started on a weaker note, but ended higher by 43.36 points, or 0.17 per cent, at 26,160.90, its highest closing since December 1. The 50-share Nifty edged up 16.85 points, or 0.21 per cent, to close at 7,963.20, a level last seen on November 4 last year. It shuttled between 7,909.80 and 7,972.55 intraday.

Some stocks in auto, capital goods and realty sectors helped the bourses end into positive territory on a day when most international markets were closed for the New Year. The near-absence of overseas cues meant investors remained directionless despite the beginning of the January monthly derivatives contracts.

On a weekly basis, both indices - the Sensex and the Nifty - ended 1.25 per cent and 1.30 per cent higher, marking their third straight weekly gains. Among Sensex stocks, Tata Motors emerged as the top gainer by surging 2.66 per cent, followed by Adani Ports (2.65 per cent). Investors also bought second-line stocks with mid-cap and small-cap indices outperforming the Sensex with gains of 0.92 per cent and 0.88 per cent, respectively.

Among auto stocks, country’s largest carmaker Maruti Suzuki gained 0.43 per cent after it reported a 8.5 per cent increase in total sales in December. Other auto stocks such as Tata Motors, Ashok Leyland and Eicher Motors also ended in positive terrain. Stocks of aviation companies caught buyers’ fancy following a steep cut of 10 per cent in aviation turbine fuel (ATF) prices by oil marketing companies following a sharp fall in global oil prices.

Sectorally, the BSE realty sector index gained the most by surging 1.99 per cent, followed by capital goods (1.01 per cent), auto (0.93 per cent), power (0.89 per cent), PSU (0.83 per cent), metal (0.65 per cent) and banking (0.62 per cent), among others. Meanwhile, foreign portfolio investors (FPIs) bought shares worth Rs. 1,123.41 crore on Thursday.

Next Story