Exchange-traded Funds

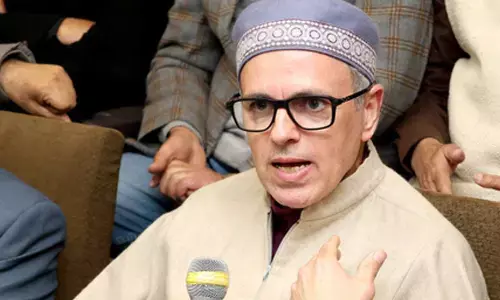

Finance minister Arun Jaitley said the ETF will have a diversified portfolio of companies from six sectors with a 20% cap on each sector and a 15% cap on each stock.

The government on Friday announced the launch of its second exchange-traded fund (ETF) named Bharat 22, which will comprise 22 stocks including those of public sector enterprises, public sector banks and its holding in SUUTI (Specified Undertaking of Unit Trust of India).

Finance minister Arun Jaitley said the ETF will have a diversified portfolio of companies from six sectors with a 20% cap on each sector and a 15% cap on each stock.

In recent times, Exchange-traded funds (ETFs) have gained a wider acceptance as financial instruments whose unique advantages over mutual funds have caught the eye of many an investor.

These instruments are beneficial for investors that find it difficult to master the tricks of the trade of analysing and picking stocks for their portfolio. Various mutual funds provide ETF products that attempt to replicate the indices on NSE, so as to provide returns that closely correspond to the total returns of the securities represented in the index.

ETF's available on NSE are diverse lot. Equity, Debt, Gold and International Indices ETF's are available. An ETF is a basket of stocks that reflects the composition of an Index, like Nifty 50.

The ETFs trading value is based on the net asset value of the underlying stocks that it represents. They allow long-term investors to diversify their portfolio at one shot at low cost and insulate them from short-term trading activity due to the unique "in-kind" creation / redemption process.

They provide liquidity for investors with a shorter-term horizon as they can trade intra-day and can have quotes near NAV during the course of trading day. As initial investment is low, retail investors find it simple and convenient to buy / sell. They facilitate FIIs, Institutions and Mutual Funds to have easy asset allocation, hedging, equitising cash at a low cost.

They enable arbitrageurs to carry out arbitrage between the Cash and the Futures markets at low impact cost. ETFs are highly flexible and can be used as a tool for gaining instant exposure to the equity markets, equitising cash or for arbitraging between the cash and futures market. Retail investors can trade in small lots, on the same terms as institutional investors.