Regulate pvt education shops!

Recently my friend paid Rs 1.25 lakh as School Development Fund, apart from regular fee, to a reputed school in Hyderabad for a seat in Class I, but did not insist on receipt, fearing denial of admission. He had to shift family to a different country on job. The school refused to refund this amount.

Recently my friend paid Rs 1.25 lakh as School Development Fund, apart from regular fee, to a reputed school in Hyderabad for a seat in Class I, but did not insist on receipt, fearing denial of admission. He had to shift family to a different country on job. The school refused to refund this amount.

It is a common problem that private schools extract huge money without giving receipt. Apart from this black money, the schools impose heavy fee, insist on purchasing their own books and goods at a cost, which give them huge profit margin. Educational institutions enjoy tax benefits. The societies running these schools are generating black money which is the root cause of all ills.

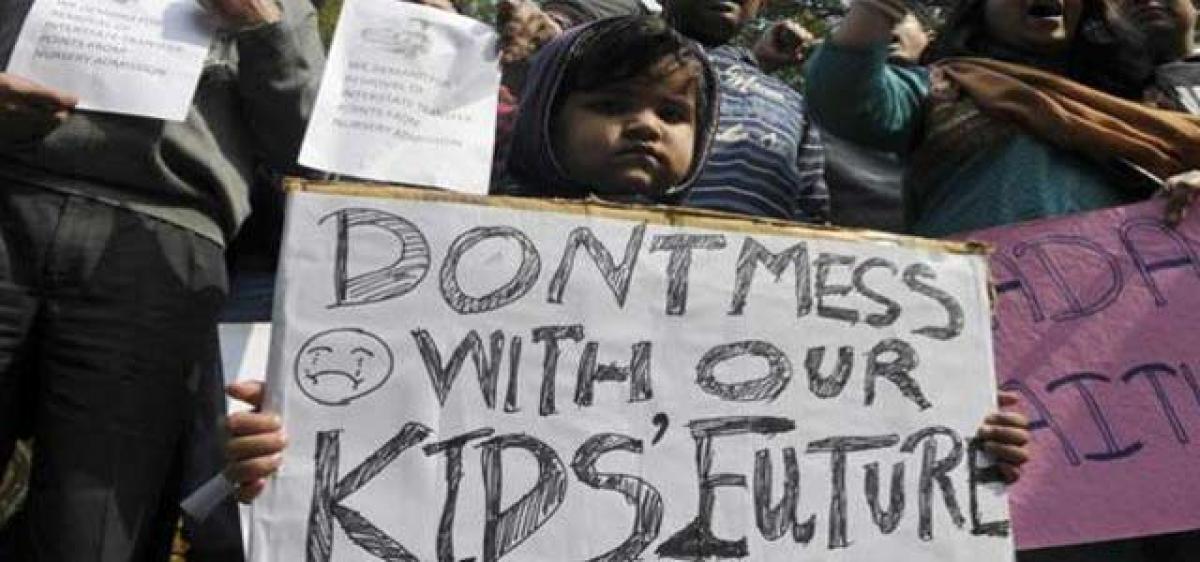

All India Parents’ Association (AIPA) met in New Delhi in March 2016 and demanded regulation of private school fee structure. Parents from 18 states attended the conference and resolved that “Laws should be enacted to regulate fees and other charges in private schools, besides bringing all minority schools in the country within the ambit of the Right to Education.”

It opposed the "commercialisation of education" and said the quality of school education has kept declining post-liberalisation and has now reached its nadir. Opinion emerged from this meeting was that unless the government spends more and rationalises its expenditure on education like in the UK and France, state-run schools will continue to remain "bureaucratic exercises."

This meet concluded that mushrooming of private schools and rising drop-out rates were the result of the failure to focus on the ‘holistic development’ of school education. The meet sought a central regulatory body for fee structuring with sufficient representation of parents and amendment to Right to Education Act to make schooling compulsory up to class 12 and school education should be made completely free.

Delhi Government is now contemplating reforms in regulating educational institutions. The Delhi School (Verification of Accounts and Refund of Excess Fee) Bill, 2015 is the latest in the line of state legislations seeking to regulate fees in private schools.

Earlier, besides Delhi, Maharashtra, Rajasthan and Tamil Nadu have passed similar regulations. Parents in states like Uttarakhand, Madhya Pradesh, Assam and Telangana too have been asking their governments to curb the high fees charged by private schools.

Running schools is considered as one of the business freedoms and those businessmen think that such freedom is absolute. It is obvious that education cannot be considered as commerce or profiteering enterprise. In the interest of educating the coming generations, the state has to regulate and to protect the interests of students and their parents.

The fees charged by private unaided educational institutions need to be properly controlled, as explained by the Supreme Court in TMA Pai Foundation v. State of Karnataka (2002). It wanted states to devise appropriate machinery to ensure that there is no profiteering and capitation fees.

However, a "reasonable surplus" to further education was permissible. Several courts explained "reasonable surplus." In Islamic Academy of Education v. State of Karnataka (2003), the court observed that each institute could fix its own fees structure taking into consideration the need to generate funds for running it and providing necessary facilities for the students.

The surplus so generated should be used to further the growth of that institution. The Supreme Court in PA Inamdar, affirming the TMA Pai (2005) allowed private institutions the freedom to devise their own fee structure which could be regulated to prevent profiteering and capitation fee.

Agreeing on autonomy and right to generate ‘reasonable surplus’ for development and expansion, the Supreme Court in 2004 cautioned in Modern School v. Union of India (2004), this autonomy should not lead to commercialisation of education.

Further, the private schools should follow the principles of accounting used by non-profit organisations. Relying on this, Delhi High Court in Justice for All vs GNCTD, decided on 19th January 2016, directed the Director of Education to ensure compliance of the condition of letter of allotment executed by the Delhi Development Authority in favour of Private Unaided Recognized Schools regarding prior sanction of the Director (Education) before any increase in fee by such schools. The court ordered both education department and DDA to take appropriate steps to implement this condition.

The Government of Delhi has directed the schools to reduce the increased fee and refund. Tamil Nadu passed an Act in 2009 for a state-appointed committee to review the fee charged was in accordance with prescribed factors. Madras High Court upheld it in 2010. Rajasthan sought to emulate this model in 2012, but Rajasthan High Court has raised some issues with the uniform fee-fixation formula. It is pending.

Maharashtra enacted a different model, under which schools are required to get their fee structure approved by an executive committee comprising parents and teachers, failing which the decision is forwarded to a district-level committee. This law came into force at the end of 2014. This faced fresh protests by private schools.

Schools to submit financial returns

The Delhi School (Verification of Accounts and Refund of Excess Fee) Bill requires schools to submit their audited financial returns and proposed fee structures to the government, but a complaint from at least 20 parents or one-fifth of the total number of students in a class before it can act.

If a school is found charging extra fee or diverting money, the committee can direct refund of excess fee and even ask schools to recalibrate its fees. The government has also attempted to regulate nursery admissions. Those schools caught taking donations can be fined up to five times the donation or Rs 5 lakh, and a fine of Rs 10 lakh for a second contravention.

Maharashtra enacted a similar fee-regulation legislation, the Maharashtra Educational Institutions (Regulation of Fee) Act, 2011, to constitute Fee Revision Committees which were not set up. Delhi, Tamil Nadu and Punjab have fee regulation committees, but without legislative backing.

Three Bills in Delhi

The Delhi School Education (Amendment) Bill (DSEAA) and the Delhi School (Verification of Accounts and Refund of Excess Fee) Bill which are passed by Delhi Assembly stipulate hefty fine and imprisonment for violators of various provisions.

According to DSEAA, offenders can be levied penalty of different grades for taking interviews at the entry levels including the nursery admission and charging capitation fees. Under this amendment, offenders will be liable for a fine which may extend up to Rs 5 lakh for the first contravention and Rs 10 lakh for each subsequent contravention.

The Delhi Schools Verification of Accounts and Refund of Excess Fee Bill contemplates that private schools show greater accountability in fees accepted and money spent. Erring schools shall be punishable with fine which may extend to 10 times the capitation fee charged or Rs 5 lakh whichever is more, the bill envisages.

The repeated offenders may also be imprisoned ranging from 3-5 years. Government will also ensure that teachers of private schools get their salaries as per 6th Pay Commission and 7th Pay Commission.

A committee shall be constituted for the purpose of verification of the accounts of schools in accordance with the provisions of the proposed Delhi School (Verification of Accounts and Refund of Excess Fee) Bill. It shall consist of a retired high court judge or a retired district judge or a retired officer not below the rank of Principal Secretary.

In the Education Act Amendment Bill, the government has proposed to extend the ambit of the existing law till “elementary level.”Each state has to take the issue of private education seriously and regulate them effectively.

In alternative, they should ensure standard education to all in public schools so that private schools are not preferred.

(Based on my address at Telangana Parents Association, in Hyderabad recently)