Of tax breaks and balanced growth path, ahead of Budget 2023

Entrepreneurs from textile sector hope for a slash in GST

Visakhapatnam: From increasing disposable income of the consumers to focusing on the infrastructure for the unorganised sector and boosting wealth creation, there are expectations galore ahead of the Union Budget 2023 presentation.

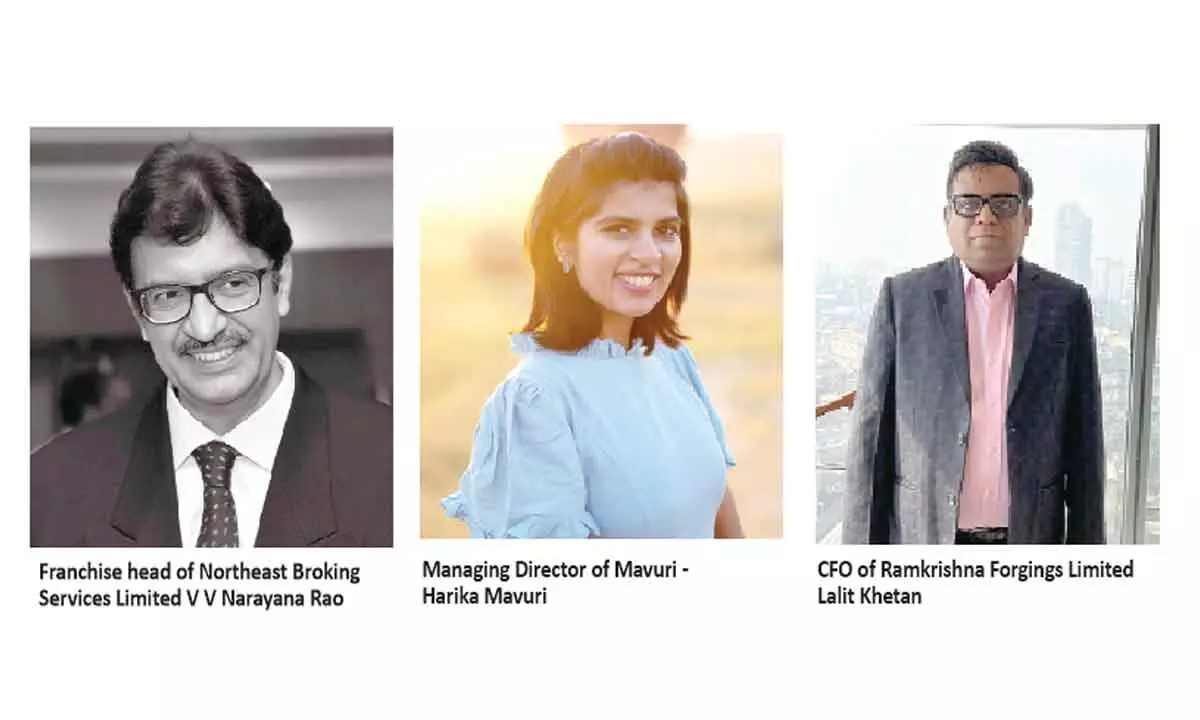

Laying emphasis on the need to increase disposable income, franchise head of Northeast Broking Services Limited Dr V V Narayana Rao, says, "With rising inflation, consumer spending needs boosting. For this to become a reality, the limit under Section 80C could be raised to Rs.2.5 lakh from the present Rs.1.5 lakh. With more disposable income, the spending pattern of the consumers would improve. Eventually, it has a spin-off effect towards leveraging more buying power for consumer goods such as television, refrigerator, air conditioners and mobile phones."

Further, Narayana Rao opines, to boost housing, home loan interest deduction should be raised or special tax rebate has to be facilitated for first time home buyers. Also, the tax structure on employee stock ownership plan (ESOP) should be simplified for start-ups in order to help attract and retain talent. "This in turn will help in wealth creation. Apparently, the budget should look into ways to provide special incentives for early adoption of digital rupee by banks as well as Non-Banking Financial Companies," he explains.

Meanwhile, the Indian textile sector is one of the significant employment generators and second largest exporter in the world. However, entrepreneurs from the textile business find 12 per cent GST on readymade garments is pretty high and hope that it could be sliced to 5 percent as it was earlier.

Sharing her pre-budget expectations, Harika Mavuri, managing director of Mavuri, says, "Although post Covid-19 the market for sustainable and traceability has increased, the Russia-Ukraine war has led to a rise in costs of raw material. The cotton prices in India sprout unpredictably, deteriorating the profit margin for spinners. The government has to stabilise the rising prices. Sufficient amount of funds in order to achieve international standards for Indian cotton would be a great relief."

By focusing on infrastructure for the unorganised sector, Harika Mavuri says that there will be space for increased productivity. The farmers, spinners and weavers of the handloom sector could use single facility centres which will subsequently boost productivity, create an ecosystem to facilitate easy access to buyers and exports for Indian natural fibres, she adds.

Those belonging to the commercial vehicle segment stress on industry-friendly policies and schemes to bolster small industries and business units. "This would have a positive impact on the prices as bridging the supply chain gap would restore balance in the market.The government should take initiatives to promote new investments in this segment through providing tax breaks, development incentives, infrastructure improvement and robust transport networks," shares Lalit Khetan, CFO of Ramkrishna Forgings Limited.

With just a day left for the budget session to begin, people from various sectors hope that it would unfurl a balanced approach towards maintaining the growth path, while keeping a check on inflation.