Options data signals strong resistance ahead

Put-Call Ratio of OI stood at 1.49 indicating more Call writing more than Puts

Resistance level rose by 1,000 points to 25,000CE, while the support level remained at 23,000PE for a second consecutive week. The 25,000CE has highest Call OI followed by 24,500/ 24,900/ 24,800/ 24,600/ 24,400/ 25,500/ 25,600/ 24,750 strikes, while 25,000/ 24,500/ 24,900/ 25,500/ 24,700 strikes recorded heavy build-up of Call OI. All Call strikes recorded positive OI addition.

Coming to the Put side, maximum Put OI is seen at 23,000PE followed by 22,800/ 24,000/ 22,500/ 23,900/ 23,700/ 20,500/ 23,300/ 23,200 strikes. Further, 23,000/ 23,500/22,900/ 23,400/ 23,700 strikes witnessed moderate addition of Put OI. Marginal fall in Put OI is visible in 22,050-21,600 range. Dhirender Singh Bisht, associate vice-president (technical research) at SMC Global Securities Ltd, said: “Analyzing Nifty’s derivatives data, the highest Call writing was seen at the 24,500 and 24,200 strikes, while Put writers were most active at the 24,000 and 23,800 strikes.”

“After hitting an all-time high, Nifty ended the week with a gain of over two per cent, while the Bank Nifty saw a weekly increase of more than one per cent. Energy, oil & gas, along with infrastructure sectors outperformed last week, whereas the realty and media sectors lagged,” added Bisht.

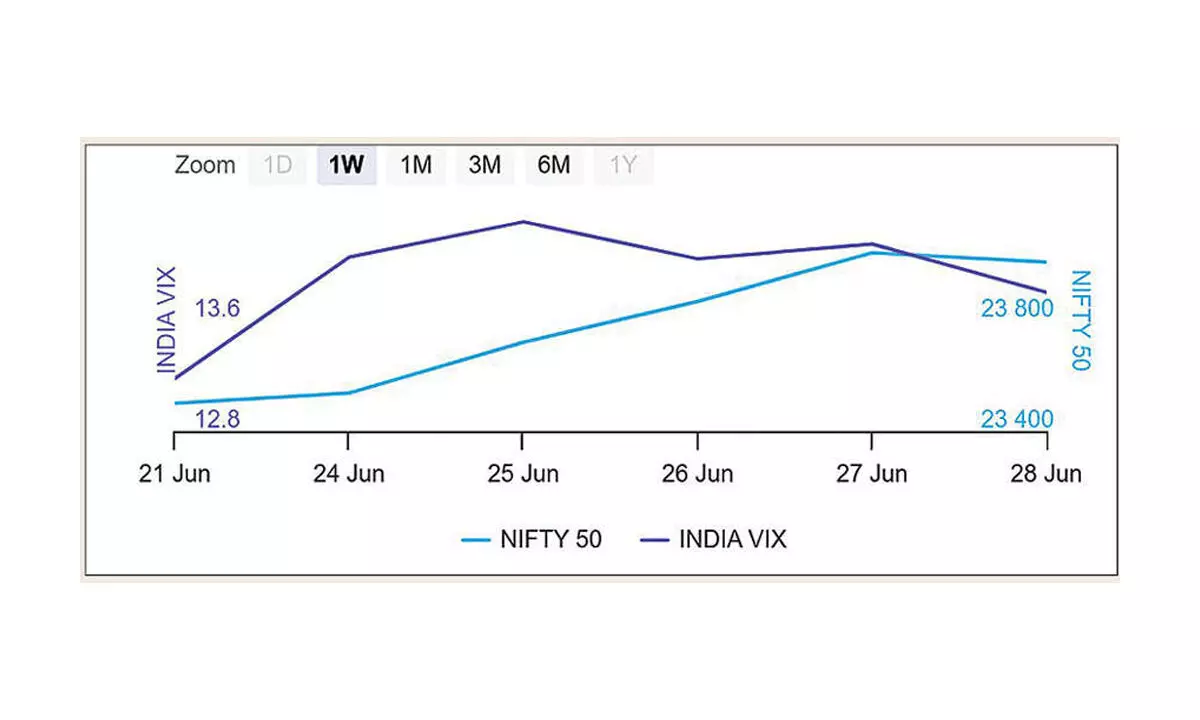

BSE Sensex closed the week ended June 28, 2024, at 79,032.73 points, a net surge of 1,822.83 points or 2.36 per cent, from the previous week’s (June 21) closing of 77,209.90 points. For the week, NSE Nifty also rose by 509.50 points or 2.16 per cent to 24,010.60 points from 23,501.10 points a week ago. Bisht forecasts: “Technically both the indices look good on charts as well and traders are advised to use any dips for creating fresh longs. The immediate support for Nifty stands at 23,800 to 23,700 zone.”

India VIX fell 2.47 per cent to 13.80 level on last Friday. “Implied Volatility (IV) for Nifty’s Call options settled at 13.09 per cent, while Put options concluded at 14.01 per cent. The India VIX, a key indicator of market volatility, concluded the week at 14.15 per cent. The Put-Call Ratio of Open Interest (PCR OI) stood at 1.49 for the week indicating more Call writing than Puts,” said Bisht. “The rollover rate for Bank Nifty to the July series has increased from 67.66 per cent to 70.68 per cent compared to the previous series. Similarly, Nifty’s rollover rate has risen to 76.25 per cent, exceeding both the previous month’s rate and its three-month average of 68.88 per cent. This indicates Nifty’s outperformance compared to Bank Nifty,” observed Bisht.