A glance at history of our Budgets

Budgets may not be a failsafe instrument against economic instability, but do serve the purpose of minimising the chances of failure. They are a powerful tool for transferring ideas into productive action oriented goals, a device to identify and focus on the underprivileged sections of society and the backward areas of the country, apart from the neglected aspects of the developmental effort. Most importantly, they provide, year after year, a benchmark to evaluate success and failure and so that the lessons learnt can be fed into future strategies.

While tracing the history of the processes of the preparation and presentation of the Union budget in India, it is necessary to remember that P C Mahalanobis, also known as the ‘Data Man’ of India, who was responsible for the establishment of the erstwhile Planning Commission of India was among those who, whose ideas substantially influenced it.

Interestingly, Indira Gandhi was the only woman Finance Minister, who was also the Prime Minister, when the Union budget of 1970–71 was presented in the Lok Sabha. And, curiously enough, the somewhat superstitious habit of financial ministers carrying their budget papers in a briefcase, initiated as long ago as 1860, continued till 2019 when Nirmala Sitharaman dispensed with the colonial legacy and introduced a ‘BahiKhata’ instead. Another valuable practice which Union governments have persisted with, ever since the first budget was presented in 1950–51, is the conduct of a pre-budget Economic Survey which assesses the state of the country’s economy, while summarising its performance on key parameters and highlighting aspirations that the upcoming budget may want to look at.

Article 202 of the Constitution mandates the states to place a budget before their Legislatures, a statement of estimated revenues and expenditure also known as the Annual Financial Statement. Given the primarily unitary, but substantially federal, structure of the state apparatus of India, the states enjoy a considerable degree of autonomy, and freedom, in many areas, including the budget making exercise. It is a well-known fact, however, that, particularly after some recent innovations brought in by the Union government, the states have little,if not none, by way of room for maneuverability in terms of their financial status. What is worse, ever since the way was shown, long ago, in Tamil Nadu and Andhra Pradesh, through subsidised rice and midday meal schemes, which, one must concede, well thought out welfare measures, a slew of reckless and irresponsible programmes followed in many states, primarily in the nature of distribution of freebies and doling out goodies. And, thanks to the uncertain political climate in the country, there is an atmosphere of reckless competition between the states to curry the favour of the electorate through such unproductive practices. Not only have such programmes crowded out precious investment space, but have also created an ambience that encourages laziness and lack of ambition, especially in young people in the productive age. The worst of it all is that the Union government, charged with the task and responsibility of bringing the states in line, has merrily joined the rat race. Given the primarily unitary, but substantially federal, structure of the state apparatus of India, the states enjoy a considerable degree of autonomy, and freedom, in many areas, including the budget making exercise.The Union and the State governments are learning to cut their coat according to their cloth. Plans and decisions should be such as to correspond to the available resources and not inspired ideas generated by wishful thinking. One only hopes that the situation which the country faced in 1991 when it was forced to sell its gold reserves, will not repeat itself.

And, in Delhi as well as in all the states, a meeting of the Council of Ministers is convened shortly before the budget is presented. I have never been able to understand how, in that short period, such a vast amount of information, and analysis, can be digested by Ministers. When an official can be trusted with the responsibility of maintaining the secrecy of the budget papers, why not the Ministers? The Finance Minister also, is, after all, a Minister! The pre-budgetary meeting of the Council of Ministers, therefore, is merely an empty ritual, a formality without any, significance. Sad, if you look at it from the point of view of the collective responsibility of the Council of Ministers.

The budgetary process is the means by which the Executive and Legislative wings of the State together formulate a coherent set of taxing and spending proposals. The mechanics of this process, and the relative roles of the two parts of government, differ considerably among countries.

In the USA, for example, every year, the Congress begins work on a Federal budget for the next fiscal year. The federal government’s fiscal year runs from October 1 of a calendar year, to September 30 of the next. The House and the Senate create their own budget resolutions, which must be negotiated and merged. Both Houses must pass a single version of each funding bill. The Congress then sends the approved funding bills to the President to sign or veto.

Likewise, in UK, the budget is submitted to Parliament by the Chancellor of the Exchequer, who is responsible for its preparation. The emphasis of the Chancellor’s budget speech is on taxation and the state of the economy, rather than on the detail of expenditures. Public discussion is devoted mainly to the Chancellor’s tax proposals. The Budget, or Financial Statement, is a statement made to the House of Commons by the Chancellor on the nation’s finances and the government’s proposals for changes in taxation. The budget also includes forecasts for the economy by the Office for Budget Responsibility (OBR).

Another example is that of Japan according to whose Constitution the Cabinet has the responsibility of preparing the national budget, which must then be submitted to the Lower House of the Diet. Taxes can be imposed or modified only as prescribed by laws enacted by the Diet. The budget is prepared on a fiscal-year basis by the budget division of the Ministry of Finance.

Those who were expecting inspiring fresh initiatives and sound long-term investments from the budget will do well to collect the old cartoon about a producer whose film had gone to the film Censor Board for the usual formality of checking the content for anything objectionable, offensive, etc. After the exercise, was completed the cartoon shows the secretary

of the Censor Board, handing over a foot long piece of celluloid to the producer, telling him that that was all that was left after the Board had done its duty!

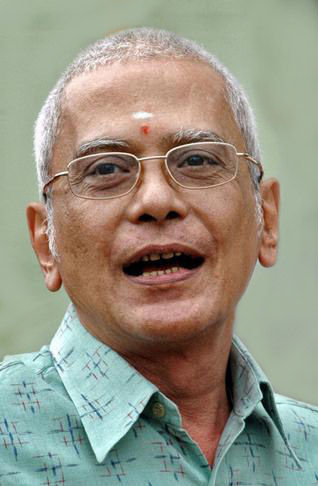

(The writer was formerly Chief Secretary, Government of Andhra Pradesh)