Money does good things, but it can harm too!

Money does good things, but it can harm too!

Famous American actress and singer Liza Minelli was famously reported to have said, “money makes the world go round''

Famous American actress and singer Liza Minelli was famously reported to have said, "money makes the world go round." While, of course, thanks to the pioneering investigations of great scientists such as Aristarchus of Samos, Ibn Yunus, Aryabhatta, Copernicus, Galileo Galilee and Isaac Newton, we know that this is not quite true, it still remains a widely accepted point of view! A somewhat similar sentiment was expressed by great Chanakya in his Artha Sastra when he said Dhanam Moolam Idham Jagat… The word 'Jagat' refers to the earthly world. 'Dhanam Moolam' means wealth is the root or the base. Freely translated, it means - the Vedas are the foundation of the effort to attain divine knowledge, the housewife is the fulcrum of the home, agriculture provides food, and wealth leads to pleasure.

That money and wealth play an important role in the happiness of human beings is evidenced by the fact that references to it are found in the scriptures of major religions of the world as well as in the depiction wealth in the shape of Gods and Goddesses. In the Hindu religion for instance, Goddess Laxmi stands for prosperity and wealth, while Brutus is the God of riches in Greek mythology. The Holy Quran preaches that "giving of your wealth is the source of true prosperity", while the Holy Bible tells us, "for what will you profit, if you gain the whole world and lose your own soul"?

On a more down to earth note, the legendary 'Beatles' of the 1960s sang memorable numbers which went, "money can't buy me love" and "… give me money that's what I want". In a somewhat more serious vein, Marvin Germo, author, said that money was a "tool to make a difference in the lives of people… a starting point to write your passion…".

Now, looking at the commodity of money from the point of view of day to day life of the human beings, one finds that it means different things to different kinds of people. For some people, it is simply a means of survival, nothing more. As, for instance, it was to the Vicar, described by Oliver Goldsmith in his famous poem 'The Deserted Village' as "passing rich, on forty pounds a year". Then there are others for whom it becomes obsession and accumulation signifies accomplishment. Then there are those for whom it is an insurance against future adverse events. Such people put away a part of their earnings so that it can come in handy on a rainy day. There are many others for whom it is the means to being able to afford to pursue some favourite hobbies in addition to leading a comfortable life.

And nearly everyone would like to have enough money to bequeath to future generations. Very few, fortunately, belong to the category of spendthrifts who splurge vast sums on extravagant luxuries, and subscribe to the philosophy of instant gratification, believing that, after all "you can hardly take it with you". Those are the people who belong to the category of "nouveau riche", or those to whom money is a recently acquired commodity. In contrast, people who have inherited what is known as family wealth have a much more sensible attitude towards money and, without being stingy, are frugal, as they realise the value of the commodity.

When all is said and done, there can be no argument about the fact that, given good intentions, the possession of money in abundance gives one to the ability to spread happiness or as PG Wodehouse would have it, "spread sweetness and light". Mere possession of money, however, can only go that far and no more. There is, after all, the law of diminishing marginal utility. Beyond a point, money can no longer continue to have the same value, which had till then. A little like the air that we breathe, we may not be able to live without money but cannot live only on it. Life is much more than what money can give. While money has its role in everyday life, it also can take away the ability to be warm and compassionate towards fellow human beings. Money, in other words, is money. And life is life. Mixing the two can be a dangerous combination.

It is widely accepted that money is the lubricant that smoothens and facilities the exceptions between desirable features of a good life such as health, wealth and relationships. They are interconnected and each possesses the ability to weaken or strengthen the other two.

One must remember that money can be a tool, an instrument, and not more than that. And just as a scalpel can, in the hands of a surgeon, do as much good as it can harm. What money can result in depends, to a large extent, on the intentions of the person from whose hands it is flowing. And then the perception of money as a commodity in that person's mind is clearly a function of value systems and cumulative life experience. As Jonathan Swift said, in the ultimate analysis, wise people should have money "in their head, but not in their heart". It must also be realised that, no matter what the end result, money must come out of a source where it was accumulated with noble intentions and in a morally acceptable manner. The means, as Gandhiji emphasised, are as important as the ends. Tainted money can hardly have intended results even if spent on the noblest of purposes.

And we cannot rest the case of money without mention of the fascinating history its form has gone through over the ages after the barter and gift economies of 9000 BCE vintage were gradually replaced, first by metal objects around 5000 BCE by coins.

Time was when money in the form of currency or coins was stored in steel vaults, heavy affairs with fancy locks and keys. Its value increases over time, as it was largely used for the purpose of lending on interest. The tinkling of coins, and the crinkling of paper, provided no end of happiness to the possessor. One recollects, in this context, the nursery rhyme, "sing a song of sixpence…", where the King was supposed to be in the counting house counting all his money. Then came banks and, with them, the habit of opening accounts, in which money earned interest. Those were the days of cheque-books and tokens given out at banks and then encashed after a long wait. That era, in turn, gave way to the realm of plastic money or bank cards, credit or debit as the case maybe. And now crypto currencies (Bitcoin, Ripple or Litecoin to name a few), have taken over, a form of digital money, 'mined' and stored in a 'digital wallet'. One wonders what the next innovation will be!

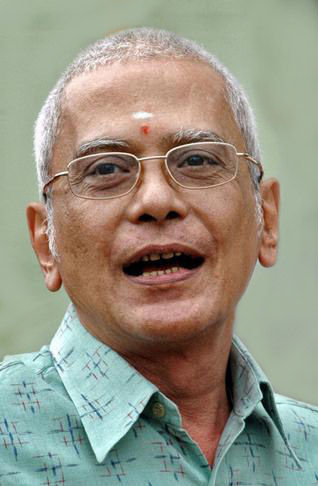

(The writer is former Chief Secretary, Government of Andhra Pradesh)