Warangal Urban Cooperative Bank Limited records rapid growth

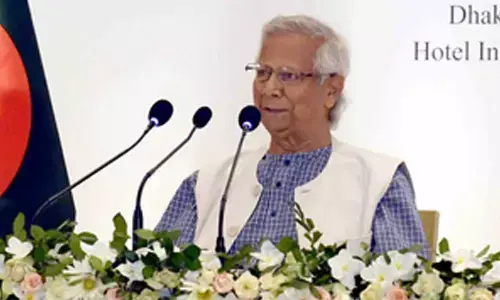

Warangal Urban Cooperative Bank Limited chairman Errabelli Pradeep Rao presenting the 27th annual progress report in Warangal on Sunday

Warangal: Warangal Urban Cooperative Bank Limited has been growing strength to strength, the bank chairman Errabelli Pradeep Rao said. Presenting the 27th annual progress report at the bank’s general body here on Sunday, Pradeep Rao said that the bank earned a profit of Rs 3.61 crore during the 2022-23 financial year. It’s a record profit since the bank was established, he added.

The chairman said that the bank collected deposits to the tune of Rs 173.45 crore and granted Rs 117.54 crore loans to its customers, registering an overall turnover of Rs 290.99 crore in the last financial year.

During this period, the bank’s Warangal branch was shifted to new premises, besides setting up two ATM kiosks in addition to the existing four. Efforts are on to purchase a building or a piece of land in Hanumakonda where the bank has three branches, Pradeep Rao said. The account holders can avail swiping services using the bank’s debit cards all over the country. The bank is also extending e-Commerce and online transactions on its ATM cards, the chairman said.

Pradeep Rao said that the Warangal Urban Cooperative Bank Limited was also providing an app facility with which the account holders can access mini statements, cheque book requests and enquiry balance. The account holders can avail mobile banking services such as IMPS, G-pay , PhonePe, PayTM etc with an upper transaction limit of Rs 1 lakh, the chairman said. The bank also has a check transaction system (CTS) clearance and sms facility. Warangal Urban Cooperative Bank Limited is eligible for subscribing to Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY) and Pradhan Mantri Suraksha Bima Yojana (PMSBY), Pradeep Rao said. The managing committee declared a 12 per cent dividend to its shareholders on the occasion.

Shareholders are covered under Rs 50,000 insurance in case of accidental death; Rs 20,116 for those undergoing kidney transplantation, and the children suffering from heart diseases. As part of social service, the bank has been providing textbooks and uniforms to the orphans; tricycles to the physically challenged and financial assistance to poor students who excel in their academics, Pradeep Rao said.

The meeting was attended by Vice-chairman Thota Jagannadham, Directors M Venugopal, K Chandramouli, T Sampath Kumar, Md Ghousuddin, V Pavan Kumar, B Papi Reddy, P Harinath, P Ravi Kumar, Bandari Bhargavi and Manda Swapna, nominated directors A Rajendra Kumar and Pulluru Sudhakar were among others present.