D-effect throws AP State budget into disarray

The acute liquidity crisis unleashed by the Prime Minister Narendra Modi’s surgical strike against black money looms large over the State government’s budget exercise for the 2017-18 fiscal.

Amaravati: The acute liquidity crisis unleashed by the Prime Minister Narendra Modi’s surgical strike against black money looms large over the State government’s budget exercise for the 2017-18 fiscal.

The government which embarked on the exercise a month ago seemingly feels hand-tied now, thanks to the demonitisation after shocks.

In what could be viewed as a pointer to ponder for managers of the State finances, the D-effect shows up signs of a sharp decline in proceeds from various departments since November 8.

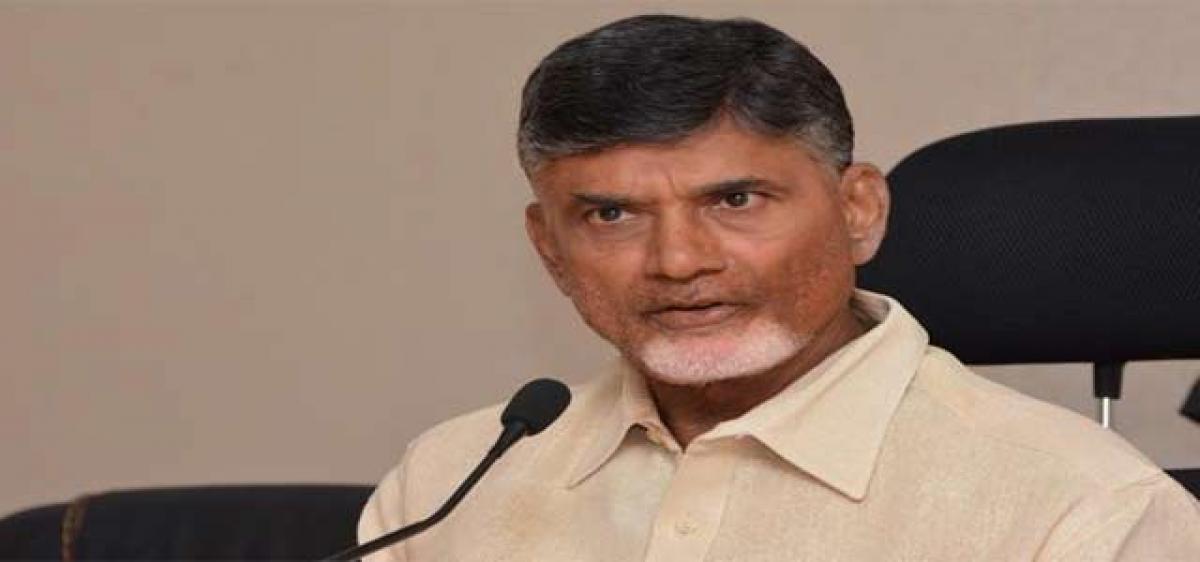

The gloomy scenario on the revenues front is certain to impact the exercise involving budget preparations. Chief Minister N Chandrababu Naidu initially put up a brave front with the State clocking double digit growth regardless of the bruises caused by the bifurcation and truncated promises with regard to Central assistance

As per the initial reports, the decline in tax revenues is estimated at Rs 1,000 cr in the current month. “Actual picture on the revenue front is expected to emerge in the first week of December”, an official source from the Finance department told The Hans India.

According to estimates, the government will receive Rs 4,000cr per month in the last quarter of the financial year from Value Added Tax, Transport, Excise and Stamps and Registration Department, Commercial Taxes and Sales Taxes and the other non-tax revenue sources like mines.

These proceeds are likely to come down by Rs 1,000 cr due to the demonetisation effect.Cash transactions in transport, excise, stamps and registration and Commercial Taxes department came to a grinding halt due to the ban on the higher value denominations.

The realty, which continued to be a safe haven for black money in view of a huge gap between the market value and government value, took the brunt of demonetisation of Rs 500 and 1000 notes since the property registrations came to a halt.

The Department of Stamps and Registrations in a normal course receives Rs 12 cr per day in the form of stamp duty. But the proceeds fell to Rs 6 cr, the sources said.

Commercial Taxes department is targeted to net Rs 35,000 cr which accounts for a lion’s share in the proceeds coming under the indirect taxes head.

The government, which is obligated to spend Rs 35,000 cr towards salary bill, pins hopes mainly on the tax revenues flowing from the Commercial Taxes department.

The gloomy scenario on the revenues front is certain to impact the exercise involving budget preparations.

Chief Minister N Chandrababu Naidu initially put up a brave front with the State economy clocking double digit growth regardless of the bruises caused by the bifurcation and truncated promises with regard to Central assistance.

All such positive postures began to fade into thin air. The State government presented the budget for 2016-17 with a gross State domestic product estimated to be Rs 6,83,233 cr.

The total expenditure for the fiscal estimated to be 1,35,689 cr while the total receipts (excluding borrowings) estimated at Rs 1,10,578 cr.

The revenue deficit for the next financial year is targeted at Rs 4,868 cr or 0.7 per cent of the GSDP.

The fiscal deficit is targeted at Rs 20,497 cr even as the primary deficit targeted at Rs 8,239 cr. But the impact of demonetisation is sure to send the budget estimates into disarray.

Meanwhile, AP Revenue Minister Yanamala Ramakrishnudu speaking to this correspondent said that the State has achieved the Gross State Domestic Production (GSDP) rate close to 15 per cent over 13.2 per cent in the previous year.

But the demonitisation appears to be posing a major challenge to the State’s growth story.