Live

- Suryakumar Yadav hopes to implement winning mantra he learnt from Rohit Sharma in series against Sri Lanka

- Hyderabad: Three killed, two injured as car turns turtle

- Hyderabad: RPF rescues two children

- DCA seizes medicines for misleading claims

- ABVP urges 30% increase in education budget

- Wreath-laying ceremony in memory of Kargil heroes

- Demolished mosque in Chilkur will be constructed by Wakf Board

- CS Santhi Kumari oversees arrangements for I-Day celebrations

- Gold rates in Hyderabad today surges, check the rates on 27 July, 2024

- Gold rates in Delhi today surges, check the rates on 27 July, 2024

Just In

Indian stock markets were under intense pressure for the third consecutive day on Wednesday as sustained foreign fund outflows and sell-off in global markets driven by sliding crude oil prices weighed on the bourses.

Sensex sheds 316 points; Nifty down by 94 points

Mumbai: Indian stock markets were under intense pressure for the third consecutive day on Wednesday as sustained foreign fund outflows and sell-off in global markets driven by sliding crude oil prices weighed on the bourses. In addition, weakening rupee which again breached the 68-mark against the dollar also had its bearing on the markets.

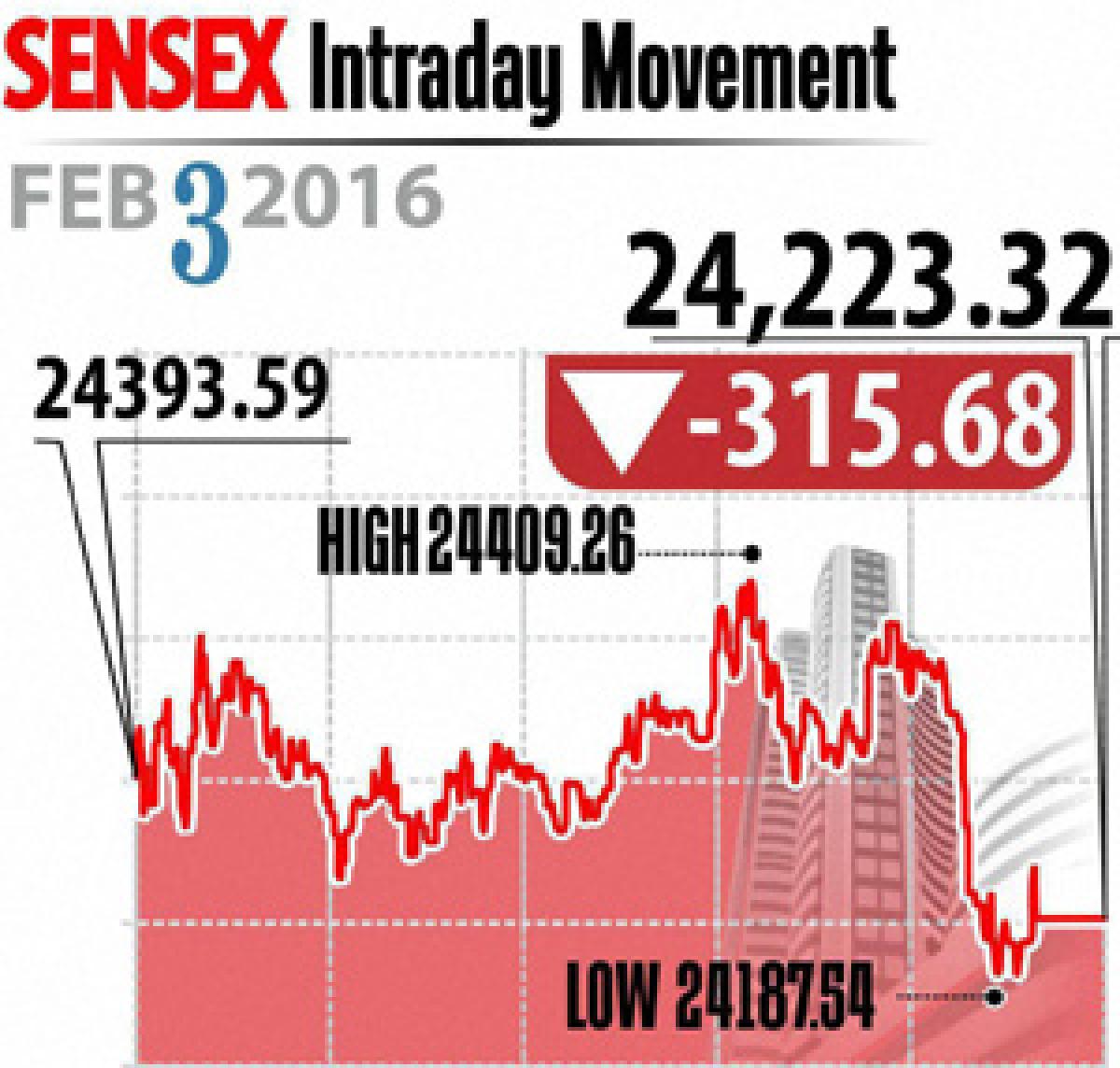

Benchmark BSE Sensex tumbled 315.68 points, or 1.29 per cent, to end at 24,223.32, its lowest closing since January 21. The NSE Nifty also remained under pressure and slipped below the 7,400-level by dropping 93.75 points, or 1.26 per cent, to close the day at 7,361.80.

Resuming lower at 24,393.59, the Sensex touched the day's low of 24,187.54 following widespread losses in blue-chip stocks as selling activity accelerated. However, the index later recovered a bit to touch a high of 24,409.26 before the close. The gauge has lost 647 points in the three straight days.

Out of the 30-share Sensex pack, 26 scrips ended lower as global sentiment already dampened by concerns over China's economic growth, took a further hit after oil again dipped below $30 a barrel in Asian trade. Moreover, a monthly PMI survey showing that India's services sector activity touched a 19-month high in January failed to lift the market mood.

At the Sensex, BHEL was the worst-hit, down 4.86 per cent followed by NTPC at 4.10 per cent. Others laggards included Tata Steel, ICICI Bank, Tata Motors, Axis Bank, Cipla, RIL, SBI, Asian Paints, Wipro, ONGC and Adani Ports. Bucking the trend, HUL gained the most by surging 2.66 per cent, while TCS rose 0.77 per cent, while Sun Pharma and Bajaj Auto rose by up to 0.24 per cent.

Sectorwise, the BSE power index suffered the most by falling 4.16 per cent, followed by capital goods 2.79 per cent, realty 2.63 per cent, infra 2.30 per cent, metal 2.03 per cent, PSU 1.96 per cent, banking 1.63 per cent, auto 1.62 per cent and oil&gas 1.58 per cent. The broader markets also performed weak with the BSE small-cap index ending 2.25 per down while the mid-cap fall 1.30 per cent.

Elsewhere, key indexes in Asia, like Hong Kong, Japan, Singapore, China, South Korea and Taiwan moved down by up to 3.15 per cent. In Europe, France, Germany and the UK based indexes fell by up to 2.47 per cent in early trade.

© 2024 Hyderabad Media House Limited/The Hans India. All rights reserved. Powered by hocalwire.com