Live

- Nominations of 158 candidates found valid in Prakasam dist

- Anantapur: These will be last democratic polls if Modi returns, warns CPI

- EC rejects former MP Manda’s nomination

- Tirupati: ‘Work hard for the victory of Srinivasulu’

- Bad omen for BRS as more leaders look to jump ship

- Visakhapatnam: She may be CM’s sister, but Sharmila is rival, says Botcha Satyanarayana

- Modi is scared, he may cry on stage any time now: Rahul

- Harvey Weinstein's landmark #MeToo rape conviction overturned

- Indian-origin man killed while evading arrest in US

- WhatsApp will leave India, if asked to break encryption

Just In

India ranks 3rd in absolute increase in UHNWI population over the next 10 years: Knight Frank Wealth Report 2016

Knight Frank today released its 10th edition of the Wealth Report. This yearly issue provides a unique insight into the attitudes of ultra-high-net-worth individuals (UHNWIs) towards property, investments and spending patterns across the globe and provides an annual analysis of wealth flow and property investment around the world.

Mumbai: Knight Frank today released its 10th edition of the Wealth Report. This yearly issue provides a unique insight into the attitudes of ultra-high-net-worth individuals (UHNWIs) towards property, investments and spending patterns across the globe and provides an annual analysis of wealth flow and property investment around the world.

KEY TAKEAWAYS – INDIA

- In the last 10 years, billionaire counts in India jumped by 333% to 78 people; global growth was just 68% to 1,919 people

- In the last 10 years, UHNWI count in India rose by 340% to 6,020 people; global growth was just 61% to 1,87,468 people

- India to account for 5% of the total UHNWI population and 6% of the billionaire population across the world by 2025

- India ranks 3rd in absolute increase in UHNWI* populations over the next 10 years; after US (1st) and China (2nd)

- Out of 97 cities globally, Mumbai and Delhi currently ranked at 21 and 33 respectively; slated to move up to ranks 14 and 29 respectively by 2025

- Currently, with 1,094 UHNWIs, Mumbai leads in India followed by Delhi with 545. The next decade will see Mumbai increase to 2243 and Delhi to 1128 UHNWIs

- Average number of residential properties owned by wealthy Indians stands at 4; highest in the world - the global average stands at 3.7

- Fine arts and antiques have replaced watches; while jewellery continues to be the most preferred collectible investments followed by cars & bikes

- In the last 10 years 31% Indians UHNWIs increased their asset allocations to residential real

- estate (primary or secondary home) and the number is likely to drop to 22% by 2025

- Indian UHNWIs saw an increase of 78% in philanthropic activities in the past 10 years and the number will be around 94% over the next 10 years (by 2025)

- 78% of women in India have taken a more significant role in managing family wealth as against 82% globally

- Around 91% of UHNWIs in India are involving their children in their business at an early age as compared to 73% globally

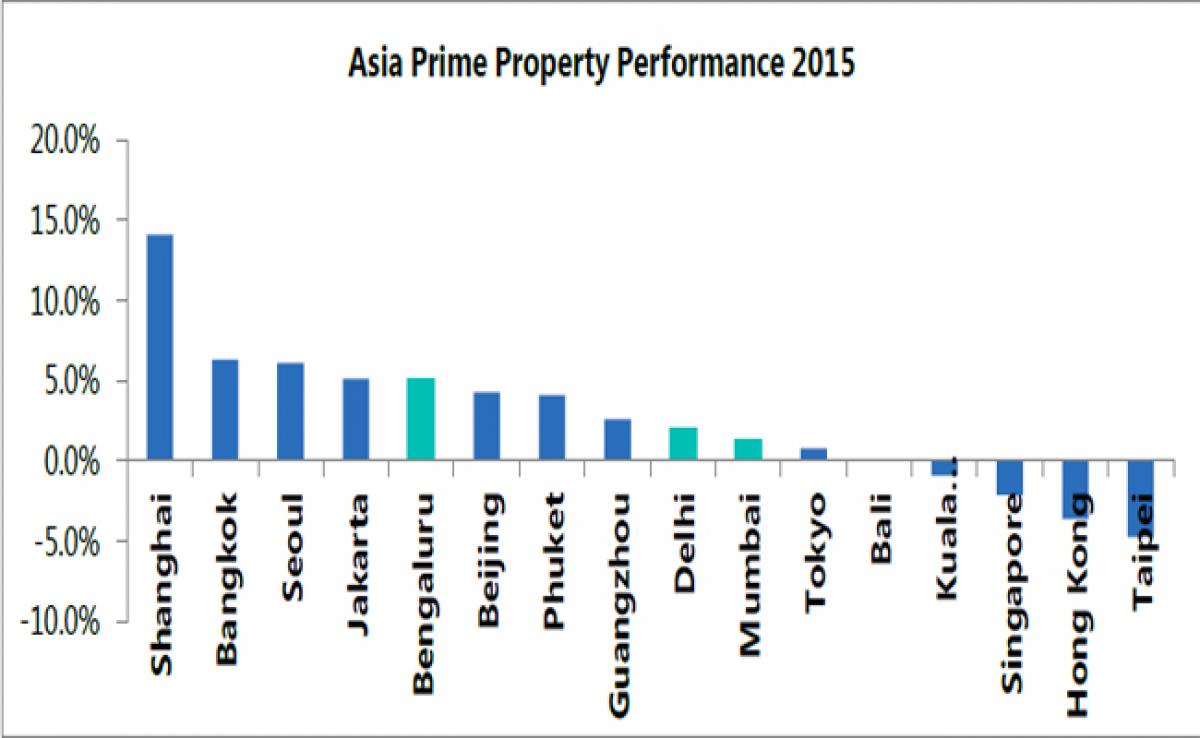

- Bengaluru among top 20 cities globally for investment according to Prime Investment

- Residential Index (PIRI); Delhi and Mumbai rank 44 & 51 respectively in the list

Dr. Samantak Das, Chief Economist & National Director - Research, Knight Frank India said, “Even though the rate of growth in the number of Indian UHNWIs (wealthy Indians) over the next ten years in India will slow down, it will still be much higher than the global average. Globally, India’s share of UHNWI population, which was one percent in 2005, will continue to grow and is expected to increase to five percent in 2025. Among Indian cities, Mumbai leads the pack followed by New Delhi.

Going forward, Mumbai will continue to maintain its number one position but the rate of growth in UHNWI population will be marginally higher in New Delhi than in Mumbai. Financial instruments remain the preferred investment asset class among wealthy Indians. Within real estate sector, the commercial asset class is preferred over the residential segment. Wealthy Indians will maintain this status quo with regards their investment preferences in future.”

Nicholas Holt, Head of Research for Asia Pacific said, “While the slowdown in China continues, the growth trajectory of Asia’s other giant, India, continues to be a positive story for the region. The strength and diversity of the Indian economy will continue to provide entrepreneurial and wealth growth opportunities, with the country set to see a doubling of its UHNWI population over the next 10 years. This growth in wealth, not only at the UHNWI level but also across other wealth brackets will be a key driver in the demand for prime residential property in the key Indian cities going forward.”

© 2024 Hyderabad Media House Limited/The Hans India. All rights reserved. Powered by hocalwire.com