Live

- Vedamrit Honey’ launched

- Arjun Das Brings Mufasa to Life in Tamil

- Odisha move to prepare maritime perspective plan

- Jal Jeevan Mission empowering women in rural areas: PM Modi

- Pradhan urges Nadda to set up pharmacy unit in Odisha

- Assembly winter session ends ahead of schedule

- Nepali Army Chief General Ashok Raj Sigdel Strengthens Ties With India In Four-Day Visit

- BRS MLAs, MLCs Skip Second Day of Orientation Classes

- Andhra Pradesh Student Dies in Tragic Car Crash in Leicestershire, 4 Others Injured

- Oppn assails delinking of Waltair div from ECoR

Just In

Prime Minister Narendra Modi on Monday ordered a multi-agency probe team on the global expose by the International Consortium of Investigative Journalists (ICIJ), popularly called as \"Panama Papers\", which named 500 Indians having alleged offshore links. Whether or not such funds exist and also if they were illegal is what the probe team ordered by Modi is expected to look into.

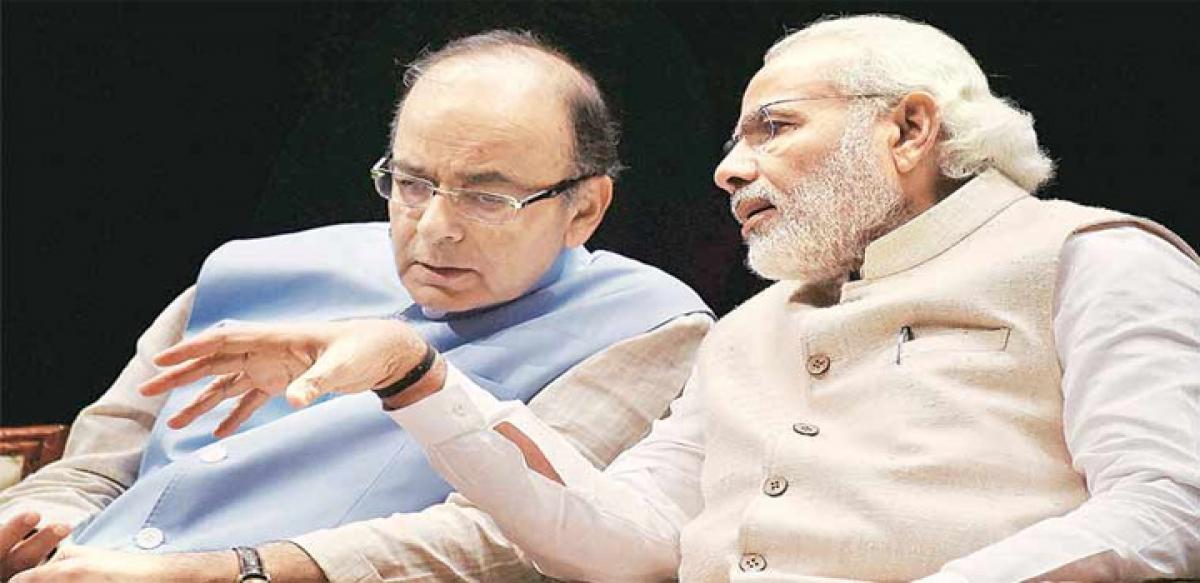

New Delhi: Prime Minister Narendra Modi on Monday ordered a multi-agency probe team on the global expose by the International Consortium of Investigative Journalists (ICIJ), popularly called as "Panama Papers", which named 500 Indians having alleged offshore links. Whether or not such funds exist and also if they were illegal is what the probe team ordered by Modi is expected to look into.

"A multi-agency group is being formed to monitor the black money trail," Finance Minister Arun Jaitley said, adding that ‘details of the assets worth Rs 6,500 crore have already been found.’ As per a statement issued by his ministry, the probe team will comprise officers from the Central Board of Direct Taxes' Financial Intelligence Unit, its Tax Research Unit as also officials from the Reserve Bank of India.

"The group will monitor the flow of information in each one of the case. The government will take all the necessary actions as required to get maximum information from all sources including from foreign governments to help in the investigation process," the statement added.

The journalists' consortium had said late on Sunday that its members and more than 100 other news organisations around the globe have found offshore links of some of the planet's most prominent people. The list included over 500 Indians.

"In terms of size, the Panama Papers is likely the biggest leak of inside information in history - more than 11.5 million documents - and it is equally likely to be one of the most explosive in the nature of its revelations," the consortium said of its investigation published.

In the context of the commitment of the Central government to bring out undisclosed money both from abroad and from within the country, information brought out by any investigative journalism was welcome, the Finance ministry said. The ministry said in the past too, based on the investigations by ICIJ in 2013 -- that showed the links of 700 Indians with business connection with off-shore entities -- the agencies of the government were able to identify 434 persons as Indian residents.

It also said 184 persons admitted their relationship with such off-shore entities/transactions. "Although, in the previous report of ICIJ, information relating to financial transactions/bank accounts was not available, the government authorities have detected credit in the undisclosed foreign accounts of such Indian persons in excess of Rs 2,000 crore." As a consequence, 52 prosecution complaints have been filed against the alleged offenders so far.

"The government is committed to detecting and preventing the generation of black money. In this context the expose of Panama Papers will further help the government in meeting the objective," the Finance ministry added. The government expressed concern that tax havens were making countries like India suffer tax losses. "The recent initiative of 'Base Erosion' and 'Profit Shifting' (BEPS) will help India and other countries in checking the practice of tax-avoidance through such tax havens. India is also fully committed to the BEPS initiative."

© 2024 Hyderabad Media House Limited/The Hans India. All rights reserved. Powered by hocalwire.com