Affordable housing, co-working space in focus

With the recent sluggish conditions pushing major builders away from the market, affordable housing segment has become a preferred choice, while co-working space is emerging as the new buzzword in the real estate sector.

With the recent sluggish conditions pushing major builders away from the market, affordable housing segment has become a preferred choice, while co-working space is emerging as the new buzzword in the real estate sector. The share of affordable homes among new projects rose from 53 per cent in 2016 to 83 per cent in 2017 indicating developers’ focus towards properties within Rs 50 lakh price bracket, according to latest report by Knight Frank.

Builders prefer affordable housing projects on peripheral areas of the city and in the near future, this focus is expected to shift to tier-2 and tier-3 cities in Telangana and Andhra Pradesh, said Samson Arthur, Director (Hyd) at Knight Frank.

“Coming to AP, the focus is on Amaravati, Vizag, Tirupati and other major towns. The IT sector is witnessing a momentum in Vizag and this is going to give a boost to realty sector more importantly affordable housing,” Arthur told The Hans India.

New markets have complete huge potential. New capital and enthusiasm is great for AP as many local developers are reaching customers in Hyderabad for housing and commercial space.

Buyer’s market Vs Investor’s market

“We’re waiting for end users to take interest. The main reason for demand in Hyderabad or any mature market is end-user buying for self-use, not for any other investment purpose or return on investment. Amaravati, Vijayawada offer new potential. Vizag is huge market for IT and ITeS segments and this will boost real estate there,” said Arthur.

The AP government is promoting IT and manufacturing sectors and this will no doubt boost real estate as well. For instance, a large manufacturing unit is coming up near Pengugonda and Hindupur and it’s very close to Bengaluru. Generate employment. Bondage point on Hyderabad-Bengaluru way. New level of interest at Anantapur area as well.

“We need anchors such as Sri City. New airport at Gannavaram will also be an added advantage,” said Arthur while adding that when employment generation takes place. He said that it’ll create demand for affordable housing. To begin with, it’ll be a buyer’s market of purchases for self-use and later it’ll grow as an investor’s market.

“Initially, it’ll be self-occupation only, May be later, the realty purchases would be investment-specific. Amaravati is new capital in progress and Vizag is emerging destination. So naturally, it’s takes some time to become potential real estate space for investments,” opines Arthur.

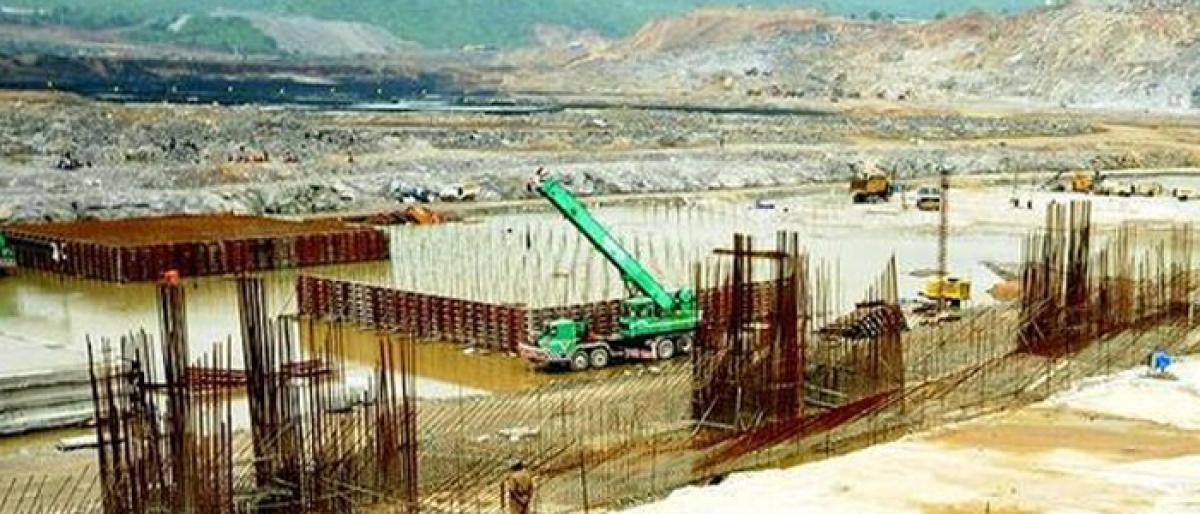

“We’re seeing a rising demand in Amaravati as the new capital city of AP is gearing up. Once the capital city infrastructure is in place, then naturally this will push realty prices upwards. Meanwhile, other towns led by Vizag will catch up with the trend. Affordable housing across the Andhra Pradesh and office space demand in Vizag and Amaravati will take off in the near future.

Commercial space is expected to stage a recovery in 2018-19, while housing segment a modest growth,” says Knight Frank.

Co-working

A latest study by Jones lang LaSalle, made a forecast on investment in co-working space. The property consultant expects investments to the tune of $400 million by 2018 in the co-working space as the demand from not only freelancers, but also corporates is rising.

The current average size of co-working space is 12-16 million seats. JLL India CEO and country head Ramesh Nair said: “The staff at small emerging businesses as well as large corporate offices are also looking to co-working spaces to maximise their productivity.”

While freelancers are primarily focussed on the cost factor, start-ups and small and medium-sized enterprises (SMEs) focus on cost as well as infrastructure. “Co-working is a new sector. There’re space takers and space creators. They take 10,000 sft to 100,000 sft and they will give back to single seaters. They sublease it to small offices or individuals with 1 seater to 15 seats capacity. This co-working space comes with all infrastructure facilities including data connectivity, power, security, refreshments, etc.

Co-working service is an emerging space in the national real estate segment, while cities including Hyderabad and Bengaluru are adding demand to this new sector. Begun in 2017, co-working space fortified its position by taking up approximately 1.3 mn sft of office space in second half,” said Arthur.

By: Sreenivasa Rao Dasari