Why Should You Buy a Home Insurance Policy and How to Get the Right Deal?

According to the AON Benfield Catastrophe Recap Report of November 2015, India reported an economic loss of around Rs 200 billion due to natural calamities; however, India's general insurance

"There is nothing more important than a good, safe and secure home." These words belong to Rosalynn Carter, the former first lady of the United States, but are apt for all of us.

According to the AON Benfield Catastrophe Recap Report of November 2015, India reported an economic loss of around Rs 200 billion due to natural calamities; however, India's general insurance companies received insurance claims of around Rs 20 billion only. There were several car insurance claims, but home insurance claims had a few numbers. It is surprising people spend lakhs or sometimes crores towards building their dream homes, but do not pay a few thousand rupees towards home insurance policies.

Why are people reluctant to buy home insurance policies?

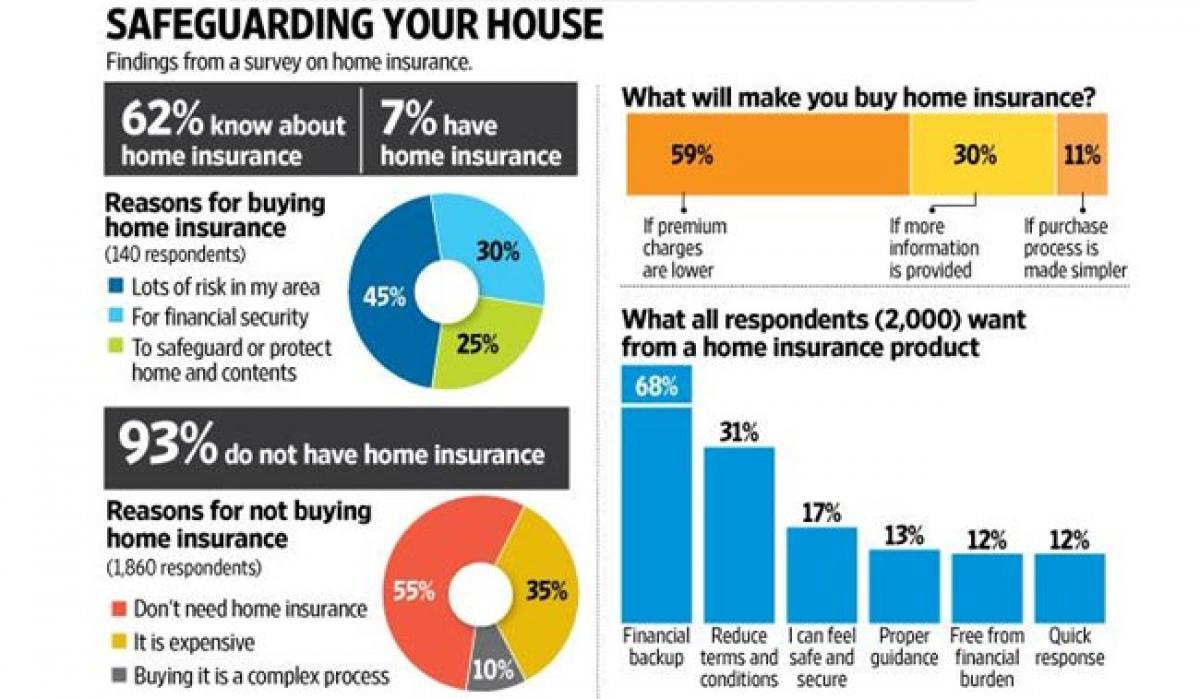

Despite playing an important role in safeguarding our houses against both natural and man-made calamities, home insurance is not a very popular policy in India. According to the survey of ICICI Lombard, 93% of the respondents did not buy a home insurance. Even though 62% were aware of the policy, merely 7% had bought it. Out of 93% respondents who did not buy the policy, 55% believed that they did not need it, and 35% felt it was costly. Also, 10% believed that the entire process was complex.

Why should you go for a home insurance?

Compared with the measures taken to guard the home, like electronic alarms, fire extinguishers, etc.; a home insurance policy would be a most concrete step taken towards protecting your haven. An effective home insurance offers coverage against different types of calamities like fire, flood, explosion, lightning, etc. The cost of securing your asset is as low as Rs 5 per day for Rs 9 lakhs sum insured, and the policy protects both structure and its content as well.

If you think it is worth picking a home insurance plan, the next step is to buy a good policy that offers comprehensive protection and safeguards against calamities— even Acts of God! Here is a complete checklist of buying a good home insurance policy in India.

- Evaluate risks your house may face: Before you start your search for a home insurer, it is pertinent to evaluate risks your house may face. If you live in a theft-prone area, it is important to insure the contents of the house also. You should buy a burglary coverage, which covers damage caused due to burglary or an attempted burglary. There are various home insurance plans which you can customize as per your needs. So carefully evaluate the risk your house may face and choose the policy accordingly. However, a comprehensive insurance plan wins hands down in terms of popularity as it offers an extensive coverage against all kinds of risks, varying from fire, theft to lightning and burglary.

- Don't fall into the trap of under insurance: By minimizing coverage, you can save your money, but it also puts you at a high risk of paying out expenses from your pocket in case of any loss or damage. For instance, if the house is underinsured by 20%, the claim paid will also be 20% less than the actual claim amount. Underinsurance is as bad as no insurance. Therefore, it is always advised to choose the correct sum insured by keeping in mind the structure of the house and its content so that one can easily make up for the loss in case of any damage.

- Location plays an important role: Does your friend pay low premium rates than you for a high sum insured when you both have a property valued at Rs 50 lakh? Along with size and overall condition, the location of your house also plays a significant role in deciding your premium rates. If your house is situated in a high earthquake zone, you need to shell out a higher premium. Similarly, if you have a basement floor, you might find it tough to get a home insurance policy for it. Moreover, proximity to coastline also decides your premium.

Handy tips to cut premium:

- Fix wires and renovate your house: If you want to save on your home insurance premium, fixing up the content of your home is essential. Fix any damage to eliminate the chances of loss

- Install safety items: Any step taken by you to increase the safety of your property can reduce premium costs. For instance, if you install fire-fighting equipment and safety alarms, you can get discounted premium rates

- Increase voluntary deductibles: The voluntary deductible is the amount of loss paid by the policyholder at the time of a claim. The bigger the deductible, the lower the premium rates. Also, a high deductible encourages you to use insurance in case of catastrophic situations only when it is truly required

- Don't cover everything: Leave out old items. A 12- year old microwave might be in a working condition, but there is no point in insuring an old item at a decreased value. Be prudent while deciding what to cover

- Check exclusions: While, it is important to know what your home insurance policy entails, it is equally essential to know what is not included. For instance, some insurance policies do not cover losses or damages if the property has remained unoccupied for more than 30 days without prior notice to the insurer. Also, do not expect to get the coverage if the loss is caused due to the fault of your domestic help. You do not want your claim to fall under the exclusion head, therefore, check the exclusions beforehand.

- Go online to buy the policy: When you decide to buy the policy online, you do not need to pay any commission to the agent and thus, you can save money. Moreover, there is minimal paperwork involved in the online insurance process, and thus, it lowers the operational cost. The insurer passes the same benefit to policyholders in the form of low premium rates. Also, getting online quotes helps you to see what different insurers are offering. However, don't just fall to lower premium rates. You should check the coverage offered by the insurer along with their services.

- Buy long-term insurance policies: Buying a long-term home insurance policy will not only save you from renewing the policy every year but will also reduce the premium cost. You can save up to 20%, which is not a bad idea. For instance, some insurance companies offer coverage for up to 10 years for the structure only.

- Upgrade your policy: Make sure to increase your sum insured if some renovation work has been done after the home insurance policy has been bought. By spending some extra amount, you can opt for rent coverage also in the case of total loss. Various insurance companies offer an alternative accommodation cover for a limited tenure in case you are forced to shift into an alternative accommodation because your home is damaged due to an insured peril. The maximum coverage depends on the insurance company.

- Compare before you buy the policy: In today's world, where we research and compare modest items like creams, baby diapers, etc., before buying, committing to a long-term product like insurance without comparing is a disaster. Also, in today's competitive world, insurers are vying for their space in the market. This intense competition has emerged as a boon for buyers. Most of the home insurance companies in India are trying to attract buyers' attention by offering lucrative plans at highly affordable premium rates. Before choosing a policy, you should check and compare different home insurance policies so that you do not miss out on a profitable deal. You should read customer reviews and talk to the insurer to know more their products.

- Know the insurer's claim settlement ratio: A claim settlement ratio shows the number of claims that has been honored out of the total outstanding claims. A high claim settlement ratio means that the insurer is honoring most of its claims. It acts as the yardstick to know the reliability of the insurer.

- Know the insurer's claim process: How long will it take to settle my insurance claim? How to file a claim in the absence of policy documents? There are many such questions which you might have in your mind. It is important to get the answers to all these questions before buying the policy. Many people assume that the home insurance involves a lengthy claim settlement process. However, it is not the case. If you know how to file a claim, then the entire process becomes hassle-free. For instance, in the case of an eventuality, the policyholder may need to inform the claim to the local office or the company's call center. Once the information is received, the insurer deploys a surveyor and claims are settled after the assessment of losses. A policyholder may need to submit know-your-customer (KYC) documents to process the claim. Even if a natural disaster hampers the insurer's office, the claim settlement process is not affected.

- Don't rely only on home insurance offered with the home loan: Your home loan lender may ask you to buy a home insurance policy along with your home loan. However, most of the home insurance policies bought at the time of availing a home loan, cover the building structure only without any coverage for contents like jewellery, electrical appliances, etc. Therefore, one should go for a comprehensive home insurance only which covers both structure and contents.

The magic thing about home is that it feels good to leave, and it feels even better to come back: Wendy Wunder

We feel helpless whenever a calamity strikes and destroys our house. Though we cannot predict the future, we can build a safety net to fall back in case of mishappening and curtail the impact of adversaries. A home is your asset and insuring it is a full proof way to secure it from all types of dangers and so buy a good home insurance policy and let nothing affects your precious abode—not even Acts of God!