Banks may 'hate' Apple for this credit card

- Apple launched a credit card with Goldman Sachs and MasterCard

- Apple is offering cash back every day called Daily Cash

- Apple's credit card to be available in the USA later this year

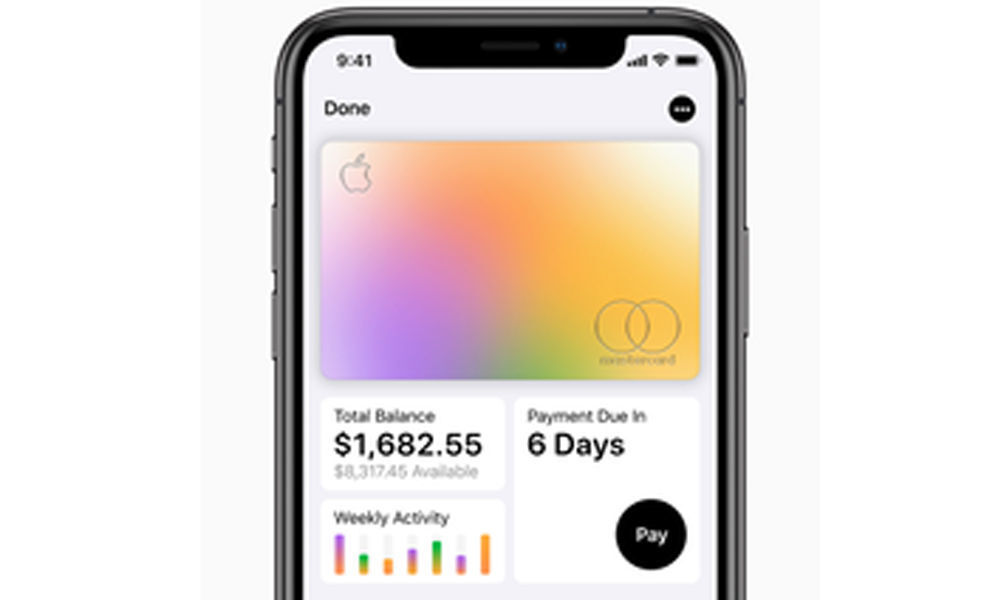

At its special event here in Cupertino, Apple launched a new unique credit card, in partnership with Goldman Sachs and MasterCard.

Apple claims that this "Apple Card transforms the entire credit card experience by simplifying the application process, eliminating fees, encouraging customers to pay less interest and providing a new level of security and privacy." Apple will offer perks like cash back every single day called Daily Cash.

It's a different approach to the financial services business and maybe they can just have the financial bigwigs looking over their shoulders.

Available in the USA by the end of this year, Apple Card also offers a reward program that is clearer than other credit cards with Daily Cash, says Apple.

For those who want to register for the Apple Card, they can do it in the iPhone Wallet application. Customers will receive a percentage of each purchase amount of the Apple Card back as Daily Cash. Each time customers use the Apple Card with Apple Pay, they will receive 2 per cent Daily Cash. Customers will also get 3 per cent of Daily Cash on all purchases made directly with Apple, including Apple Stores, App Store and Apple services.

In places where Apple Pay is not available, the technology giant based in Cupertino has also designed a titanium Apple Card. Interestingly, there is no card number, CVV code or export date, which is a norm on other credit cards.

Apple also uses machine learning to make it easier to use. Not only that, but it also uses Apple Maps to tell people exactly where the users with the card have spent. Purchases are automatically aggregated and organized by categories coded by colour, such as Food and Beverages, Shopping and Entertainment. To help customers better understand their expenses, Apple Card provides summaries of weekly and monthly expenses.

As of now, it is not clear when and how the Apple Card will reach other countries besides the USA.