AP Governor Abdul Nazeer launches Climate Action Fund

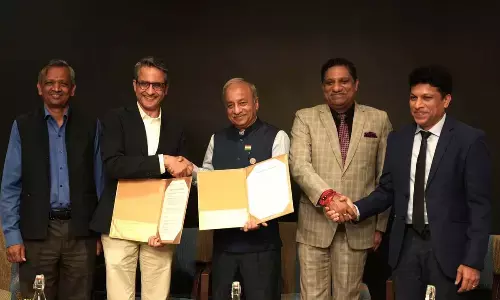

Dr A Sridhar Reddy, Chairman, and AK Parida, General Secretary & CEO of Indian Red Cross Society, AP State branch, handing over a cheque towards Climate Action Fund to Governor and President of IRCS of AP S Abdul Nazeer at Raj Bhavan in Vijayawada on Thursday

Governor S Abdul Nazeer, who is also the President of Indian Red Cross Society, Andhra Pradesh State Branch, launched the Climate Action Fund (CAF), at a programme held in Raj Bhavan here on Thursday

Vijayawada (NTR district): Governor S Abdul Nazeer, who is also the President of Indian Red Cross Society, Andhra Pradesh State Branch, launched the Climate Action Fund (CAF), at a programme held in Raj Bhavan here on Thursday. This was constituted for the first time in the country to mitigate the impact of climate change.

Dr N Shesa Reddy and Dr Suguna of Aditya Educational Institutions and Vice-Chairman of IRCS, Kakinada district branch, mobilised donations from 58 institutions and 70,000 Junior Red Cross and Young Red Cross volunteers up to Rs 40 lakh towards contribution to the Climate Action Fund. They handed over the cheque for Rs 40 lakh to Governor Abdul Nazeer on this

occasion.

Dr Sridhar Reddy, Chairman and Ashwini Kumar Parida, General Secretary and CEO of Indian Red Cross Society, AP State branch, explained that the Climate Action Fund will be utilised to alleviate human suffering in calamities like drought, floods, cyclones, earthquakes and other natural disasters and to create awareness on the impact of climate change and to build community resilience. About 10 lakh JRC and YRC volunteers will act as Climate Action soldiers in creating awareness and building capacities of the communities and the contribution to the Fund is eligible for exemption under Sec.80G and 12 A of the Income Tax Act, 1961.