Chirala: Merchants demand withdrawal of GST on textiles

Merchants demand withdrawal of GST on textiles

- Merchants say that there will be no profit for them if GST is increased to 12%

- Warns that they would continue the agitation until the government withdraws the GST

Chirala: Expressing temporary relief over the government's decision to withhold the GST hike on textiles from 5 per cent to 12 per cent from January 1, merchants appealed to the government to completely withdraw the proposal.

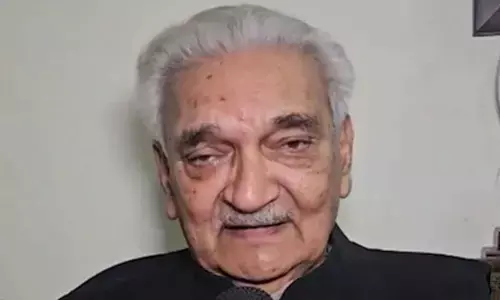

Speaking to 'The Hans India', secretary of Mahatma Gandhi Market Textiles Merchants Association in Chirala, Polisetty Venugopala Rao and its former president Sriram Srinivasa Rao stated that most of the textile market is mostly dependent on small traders, who can't invest more in the business. They said that merchants will give the textiles to small and marginal traders on loan and they would repay the amount after a few months. The duo lamented that the already existing GST of 5 per cent has ruined the profits of composite GST merchants and the small and margin traders to a considerable amount when compared with the regular GST merchants. By increasing the GST to 12 per cent means they won't get any profit on the textiles, as they have to pay tax at the end of the month even though the traders didn't pay them back, they explained.

Venugopal Rao and Sriram said the 5 per cent tax is already damaging the business of small traders and composite merchants as the big players in the market are making money by providing the same product for a low price. The merchants said that there is no tax on textiles until recently and demanded the government to completely withdraw the GST, instead of withholding the hike from 5 per cent to 12 per cent. They said that they would not rest with the government's decision of postponing the hike for a few weeks and announced that they would continue the agitation until the government withdraws the GST.