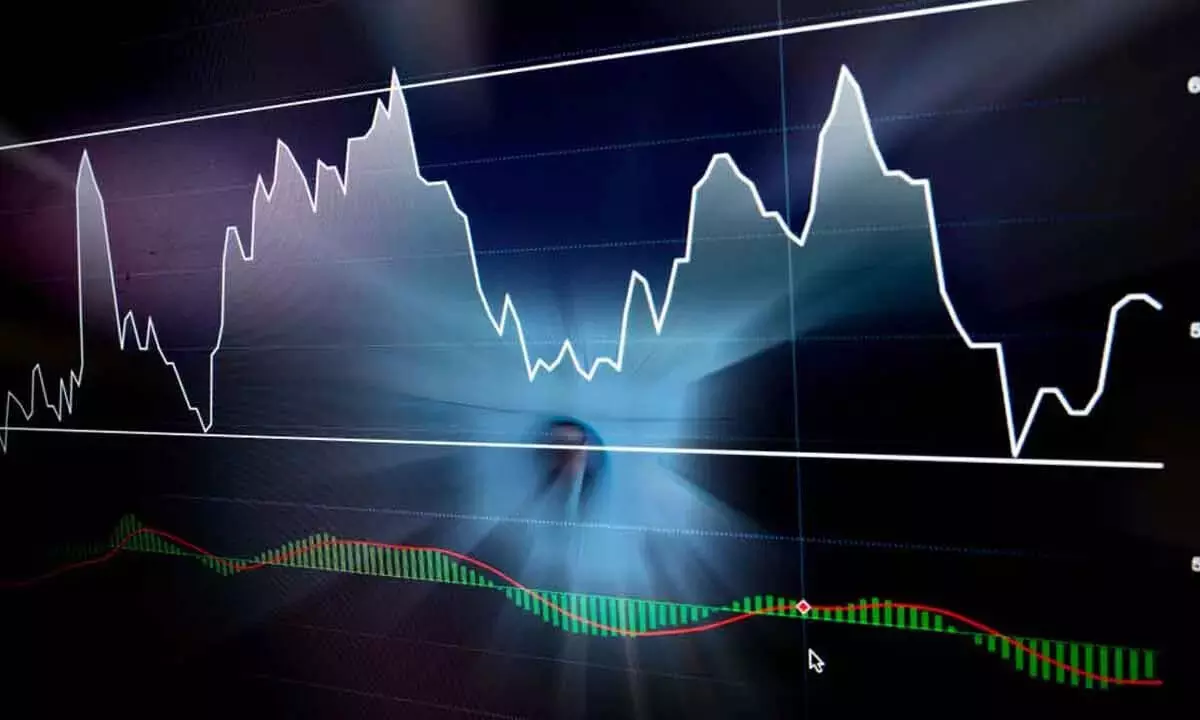

MACD indicates fresh sell signal

Representational image

NSE Nifty ends flat after moving near an all-time high.

NSE Nifty ends flat after moving near an all-time high. The benchmark index gained at the beginning of the week, but the intensified profit booking in the last two days erased the gains. The Nifty gained just 29.3 points or 0.16 per cent. BSE Sensex also ended flat with a 0.13 per cent gain. The broader indices outperformed as the Nifty Smallcap-100 and Midcap-100 advanced by 1.17 per cent and 0.55 per cent. On the sectoral front, the Nifty Auto and Energy indices were the top gainers with 1.65 per cent and 1.61 per cent, respectively. On weaker market internals and low VIX, the benchmark index has formed the second-highest level in its lifetime. The relative strength and the momentum completely waned.

The Nifty has formed a candle similar to the bearish engulfing on Thursday and got confirmation for its negative implications. The 7-day flat base breakout on Wednesday failed to continue its momentum and registered a failed breakout. As it closed below the 8EMA and closed below the previous day's low for two consecutive sessions, it has given an initial sign of reversal. 29th March, it has provided a breakdown signal. The 20DMA acted as a support line during the 46-day uptrend, which has three flat bases. A failed breakout is enough to conclude that the trend has reversed. It must form a lower swing low, which is a recent base low of 18,464. The 20DMA is also at a similar level of 18,443.

The RSI is on the 60 line, and a decline below 56 will confirm its negative divergence implications. Weekly RSI has been flattened for the last two weeks. The MACD has given a fresh sell signal. The commodity channel index shows that the index is at its short-term top.

When the markets are trading at a new high with no momentum or relative strength, it is not the time to take fresh exposure to the market. As long as the Nifty trades above 20DMA 18,443 points, do not be bearish and wait for a reversal confirmation. The existing portfolios need to be evaluated with the aim of protecting the profits. If the market gets a confirmed reversal signal, better exit the significant chunk of the portfolio.

(The author is Chief Mentor, Indus School of Technical Analysis, Financial Journalist, Technical Analyst, Trainer and Family Fund Manager)