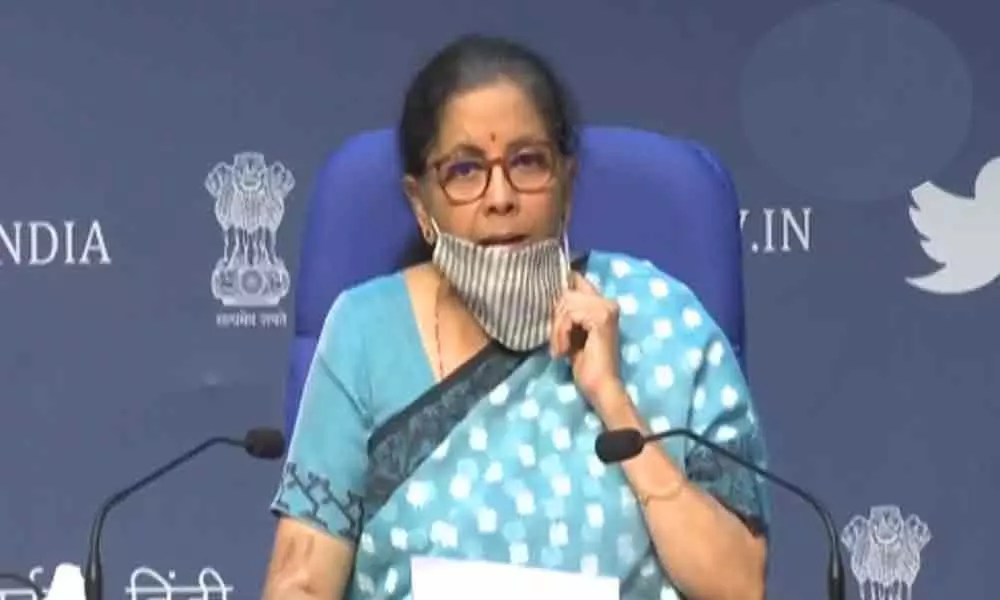

Nirmala Sitharaman announces Rs 30k-crore liquidity scheme for NBFCs, HFCs, MFIs

Finance Minister Nirmala Sitharaman

Finance Minister Nirmala SitharamanFinance Minister Nirmala Sitharaman on Wednesday announced a Rs 30,000 crore special liquidity scheme for non-banking finance companies (NBFCs), housing finance companies (HFCs) and micro-finance institutions (MFIs).

New Delhi: Finance Minister Nirmala Sitharaman on Wednesday announced a Rs 30,000 crore special liquidity scheme for non-banking finance companies (NBFCs), housing finance companies (HFCs) and micro-finance institutions (MFIs).

Speaking to the media here, Sitharaman noted that these finance institutions are finding it difficult to raise money in debt markets and many institutions have not been able to take advantage of the recent relaxations given by the government and the Reserve Bank of India.

Under the scheme, investments will be made in both primary and secondary market transactions in investment grade debt paper of these institutions.

She said that the scheme will support the previous initiatives of the government and the central bank to boost liquidity. The securities under the scheme will be fully guaranteed by the Central government. As per the government, the scheme would provide liquidity support to mutual funds along with NBFCs, HFCs and MFIs and create confidence in the market.

Further, the government has also announced Rs 45,000 crore partial credit guarantee scheme for NBFCs.

Under the scheme, first 20 per cent loss will be borne by Cenre, and even unrated papers will be eligible for investment, enabling NBFCs to reach out even to MSMEs in far-flung areas.