‘No new GST on carpets in UP’: CM Yogi Adityanath

Share :

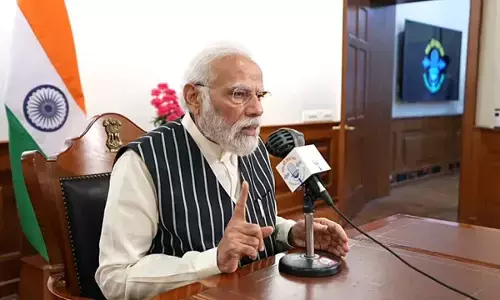

Lucknow: Uttar Pradesh Chief Minister Yogi Adityanath informed on Saturday that the government has not imposed a new Goods and Services Tax (GST) or tax on carpets.

“No new GST or tax has been imposed on carpets,” the Chief Minister said while participating in the inauguration ceremony of the 49th International Carpet Fair, organised under the auspices of CEPC.

The event was organised to promote the crafts and craftsmen of the world-renowned carpet city of Bhadohi.

He also informed that the government has created new opportunities for the people through the recent free trade agreements with the UAE and the UK, which will help further growth.

While addressing a programme on the upliftment of crafts and craftsmen, the Chief Minister said that India’s traditional artisans and craftsmen have made a significant contribution to establishing India as a global economy.

The Chief Minister said that checks for financial amounts were also provided to the beneficiaries of various schemes.

“I assure you that the government always stands with full commitment alongside traders and entrepreneurs,” he said.

The Chief Minister also said that the state government has not only revived agriculture and farming but also the textile industry and the MSME sector.

“This sector has created the most employment in the state,” the Chief Minister said.

Last month, the Central government reformed the GST, which reduced tax rates of a range of daily-use items for consumers

The GST Council simplified the indirect tax system into a two-tier structure of 5 per cent and 18 per cent from a four-tier structure of 5 per cent, 12 per cent, 18 per cent and 28 per cent.

This significant tax rationalisation is expected to boost the economy and consumers, contributing to the overall socio-economic development in the country.