RBI goes for status quo on Repo

RBI Guv-led 6-member rate-setting MPC panel preferred ‘neutral’ stance in a unanimous vote; Ongoing uncertainties, frontloaded cuts, core inflation uptick led to status quo; Lowered inflation forecast to 3.1% for FY26 from 3.7%

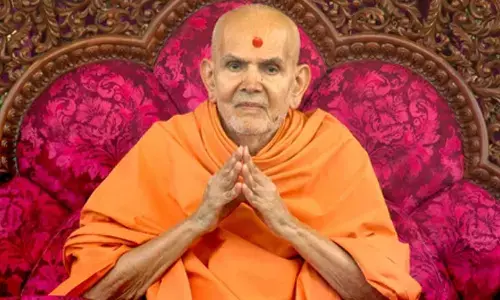

Mumbai: The Reserve Bank of India (RBI) kept its policy interest rate unchanged on Wednesday, as policymakers weighed the risks posed by US President Donald Trump’s trade policies and the uncertainties surrounding the potential for higher tariffs. The six-member rate-setting panel, headed by RBI Governor Sanjay Malhotra, held the repurchase rate at 5.5 per cent in a unanimous vote and decided to continue with a ‘neutral’ stance. The pause follows a 100 basis point cut in interest rate over three bi-monthly MPC meets in 2025.

The Governor said continuing global uncertainties, frontloading of interest rate cuts, and uptick in core inflation prompted the central bank to opt for the status quo at the bi-monthly policy review. While on-track monsoon rains and the approaching festival season are expected to provide buoyancy to the economy, global trade challenges continue to linger, Malhotra said, announcing the decision of the Monetary Policy Committee (MPC). He, however, did not directly speak about US tariff actions. Trump last month slapped a 25 per cent duty on all Indian goods entering the US from August 7, and on Tuesday threatened to substantially hike the tariff for New Delhi’s continued purchase of Russian oil.

“Over the medium-term also, the Indian economy holds bright prospects in the changing world order drawing on its inherent strength, robust fundamentals, and comfortable buffers,” he said. “Opportunities are there for the taking, and we are making all efforts to create enabling conditions through a multi-pronged yet cohesive approach to policy making.”

... pegs India’s CPI inflation at 3.1% for FY26

RBI has pegged India’s Consumer Price Index (CPI) inflation at 3.1 per cent for FY2025-26, as the steady progress of the monsoon and robust kharif sowing are expected to keep food prices in check. RBI Governor Sanjay Malhotra said, “The inflation outlook for 2025-26 has become more benign than expected in June.”