RBI Goes For Steepest Interest Rate Cut In 5 Yrs: Home, auto loans get cheaper

New Delhi: Home, auto and other loans are likely to cost less as the Reserve Bank of India (RBI) cut interest rates by a larger-than-expected 50 basis points on Friday and unexpectedly reduced the cash reserve ratio for banks to make available more money to lend in a bid to boost the economy.

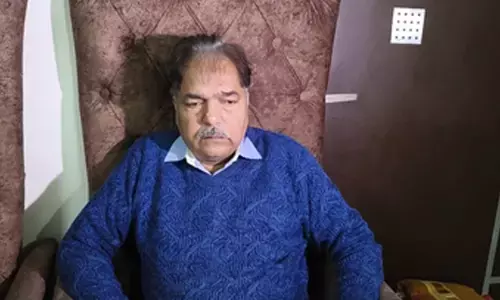

The RBI's six-member monetary policy committee, headed by Governor Sanjay Malhotra and consisting of three external members, voted five to one to lower the benchmark repurchase or repo rate by 50 basis points to 5.5 per cent.

It also cut the cash reserve ratio by 100 basis points to 3 per cent, adding Rs 2.5 lakh crore to already surplus liquidity in the banking system.

With the latest reduction, the RBI has now cut interest rates by a total of 100 basis points in 2025, starting with a quarter-point reduction in February - the first cut since May 2020 - and another similar-sized cut in April.

The central bank, at the same time, changed its monetary policy stance from 'accommodative' to 'neutral' which means rates could increase or decrease in future depending on incoming data, with Malhotra stating that it may have limited space for further easing.

The repo rate is the rate at which the RBI lends money to banks to meet their short-term funding needs. With the latest cut in the repo rate, all External Benchmark Lending Rates (EBLR) linked to it will come down. And if the banks fully pass on this to the borrowers, equated monthly instalments (EMIs) on home, auto and personal loans will decline by 50 bps.

RBI, Malhotra said, expects lenders to pass on lower borrowing costs to consumers and boost credit growth with the additional cash they would have following the cut in cash reserve ratio by 100 basis points to 3 per cent. The cut in CRR will take effect in four stages between September and December. "Today's monetary policy actions should be seen as a step towards propelling growth to a higher aspirational trajectory," he said, adding the aspiration is for growth of between 7 per cent and 8 per cent.

Giving rationale for the decision, the RBI Governor said inflation or price rise has softened significantly over the last six months from above the tolerance band in October 2024 to well below the target, with signs of a broad-based moderation.