Wide fluctuation likely as OI bases spread

Call Open Interest (OI) bases at OTM and ITM strikes alerting major fluctuations if either side of breakout happens; Nifty’s rollover was 83.39% into Nov F&O series as against 77.97% and 3-mth average of 79.31% with a rollover cost of 115.35 points

After a relief rally on Friday preceded by heavy fall last week, the options data on NSE is pointing to narrowed down space between resistance and support levels. The resistance level declined by 600 points to 19,200CE and the support level remained at 19,000PE for the second week. However, Call Open Interest (OI) bases at Out of The Money (OTM) and In The Money (ITM) strikes are indicating a possible major fluctuation if either side of breakout happens.

Dhirender Singh Bisht, associate vice-president (technical research-equity) at SMC Global Securities Ltd, said: “Analysing Nifty’s derivatives data revealed notable Call writing at the 19,200 and 19,500 strikes. Conversely, Put writers displayed activity, particularly at the 19,000 and 18,800 strike points.”

The 19,200CE has highest Call OI followed by 19,500/ 21,000/ 19,600/ 20,050/ 19,700/ 19,300 strikes, while 19,200/ 19,450/ 19,350/ 19,300 strikes recorded moderate addition of Call OI, while OTM strikes from 19,700 and ITM strikes from 19,050 witnessed fall in OI.

At the Put side, maximum Put base is seen at 19,000PE followed by 17,600/ 18,800/ 18,900/ 18,500/ 18,700/18,300/19,100 strikes. Further, reasonable addition of Put OI is seen at 19,000/ 18,900/ 19,050 18,500/18,150/ 18,000 strikes. Minor Put OI decline was recorded at few select strikes.

“Nifty experienced a minor recovery, finding support at the 200-day exponential moving average and closing above the psychologically significant level of 19,000 levels. However, on the weekly chart, Nifty settled with a loss of over two per cent, mirroring a similar trend in Bank Nifty. PSU bank and FMCG sectors demonstrated relative strength in comparison to the overall market, while media, metal and commodity sectors lagged behind,” added Bisht.

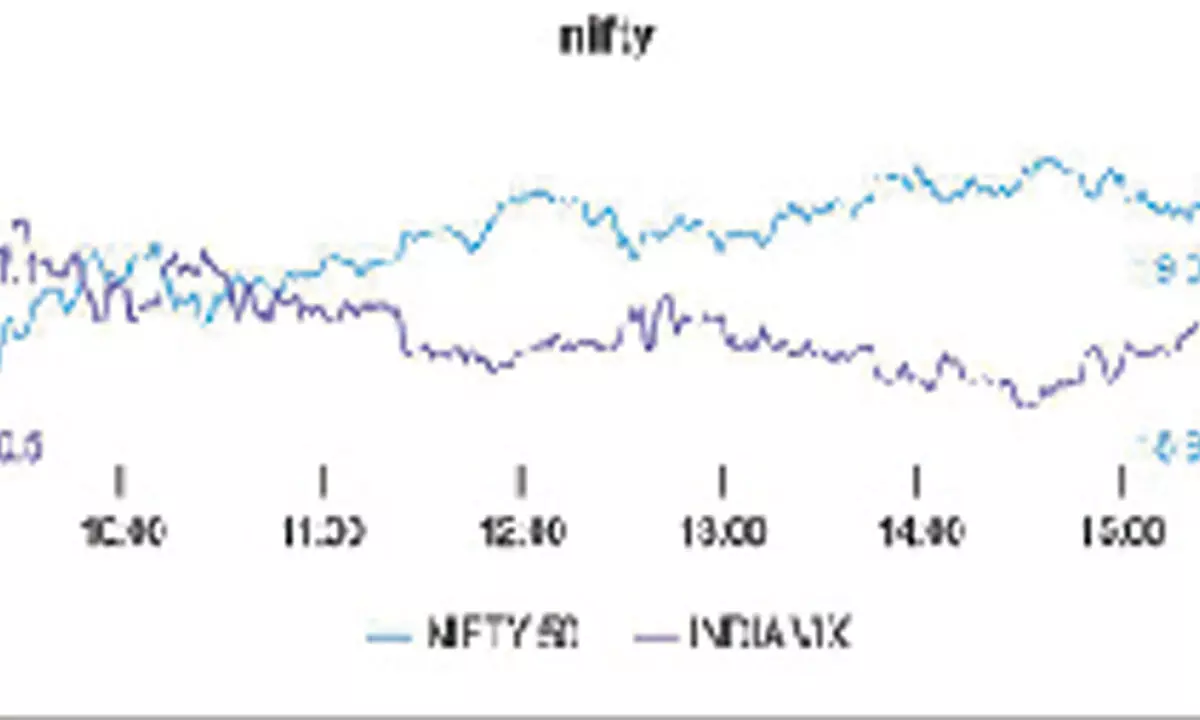

BSE Sensex closed the week ended October 27, 2023, at 63,782.80 points, a heavy fall of 1,614.82 points or 2.46 per cent, from the previous week’s (October 20) closing of 65,397.62 points. During the week, NSE Nifty too nosedived by 495.40 points or 2.53 per cent to 19,047.25 points from 19,542.65 points a week ago.

Bisht forecasts: “Nifty is expected to trade in a range of 19,200 and 18,800 in the upcoming week. The strategy of sell on rise is recommended as long as Nifty trades below the 19,200 mark.”

“Currently, the Nifty’s rollover rate showed a jump as compared to the preceding month. In the prior month, the rollover rate stood at 76 per cent, whereas in the current month, it rose to 83 per cent. The rollover rate for the November series is above the average of the past three months. On the flip side, Bank Nifty dropped in rollover rate of 79 per cent, slightly in line with the average of the last three months. As per rollover data suggested, we can expect a good momentum in Nifty whereas Bank Nifty can be laggard in momentum due to less rollover rate,” said Bisht.

“Implied Volatility for Nifty’s Call options settled at 11.89 per cent, while Put options concluded at 12.89 per cent.

The India VIX, a key indicator of market volatility, concluded the week at 11.73 per cent. The Put-Call Ratio of Open Interest stood at 1.22 for the week,” observes Bisht.

Bank Nifty

NSE’s banking index closed the week at 42,782 points, further lower by 941.05 points or 2.15 per cent from the previous week’s closing of 43,723.05 points.

“In Bank Nifty, the highest Call Open Interest was observed at the 43,000 strike, while on the Put side, it was concentrated at the 42,500 strike,” remarked Bisht.