BBMP to conduct 'Khata Andolan'

BBMP to conduct ‘Khata Andolan’

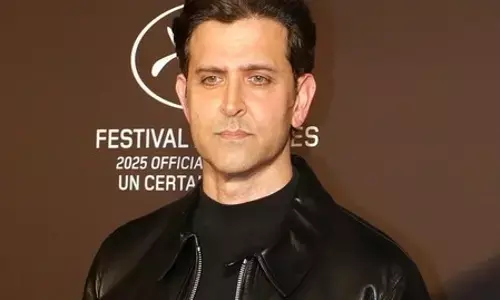

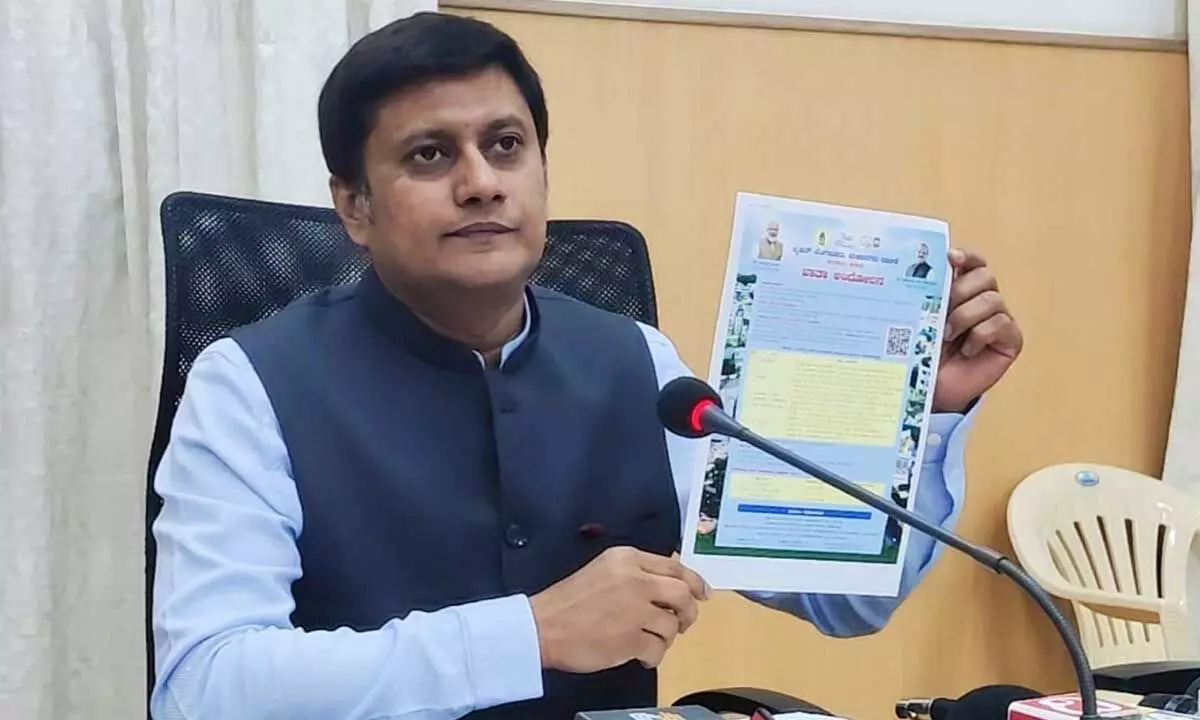

The Bruhat Bengaluru Mahanagara Palike (BBMP) Special Commissioner (Revenue) Dr RL Deepak on Friday spoke about the “Khata Andolan” being launched by the Revenue Department of BBMP.

Bengaluru: The Bruhat Bengaluru Mahanagara Palike (BBMP) Special Commissioner (Revenue) Dr RL Deepak on Friday spoke about the "Khata Andolan" being launched by the Revenue Department of BBMP.

"Khata Andolan" programme is being launched from February 27 to bring all the assets under the jurisdiction of BBMP in the city corporation registers and bring them under the purview of property tax and to provide complete information in this regard to the public, said Special Commissioner, RL Deepak.

Therefore, help desks are being set up in the offices of Assistant Revenue Officers (ARO) in all zones of the Corporation and the said help desks will be functioning from 11 Am to 4 Pm. The property owner will be given complete information regarding the new khata registration, he said.

Through the Khata Andolan programme, property owners under the corporation can apply by contacting the offices of the Assistant Revenue Officers of the concerned department and submitting the property documents.

Applications for registration of accounts shall be verified and details of assets shall be registered within prescribed time limits and brought under the purview of property tax, he added.

Zonal Deputy Commissioners are appointed as Nodal Officers to supervise the work of Khata Andolan. For more information in this regard, the public may visit the corporation's website http://bbmp.gov.in/ to get the telephone number and office address of the concerned Assistant Revenue Officers.

The property would be listed in the Form-B register if any of the minimum needed documents are unavailable. The applicable fees for registering the Khata in the Form A Register.

As 2% of Stamp Duty from every Registered Deed or Rs 500 whichever is higher. No charges for registering the Khata under the Form B Register.

Accepting or rejecting such applications. Through this helpdesk, applications for Khata will be received, and the necessary documents will be checked against the checklist. The applicant will receive the checklist as an acknowledgement, indicating any missing documents.

What is Khata?

Khata is an account of assessment of a property, recording details about your property such as size, location, building area and so on for the purpose of payment of property tax. It is also a kind of identification of the person who is primarily liable for payment of property taxes. However, a Khata does not establish the ownership of the property.

Who can apply for Khata?

The citizens who own property within BBMP and do not possess any Khata (in Form A or B) can approach the jurisdictional offices of the Assistant Revenue Officer for obtaining the Khata.

Where and how to apply?

The list of these offices, together with their addresses, wards, and contact information for the assistant revenue officer, is provided in Annexure-A. Citizens can approach such Helpdesk (between 11:00 am and 4:00 pm of every working day) in every office of the Assistant Revenue Officer to answer all inquiries on obtaining the Khata.