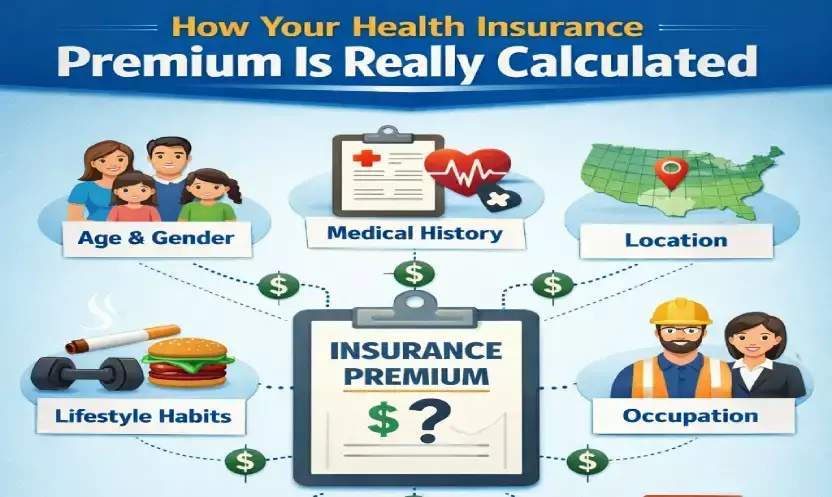

How Your Health Insurance Premium Is Really Calculated

Discover how your health insurance premium is really calculated, including factors like age, medical history, coverage type, lifestyle habits, and policy benefits.

Before buying a policy, many people rely on a health insurance premium calculator to estimate the cost of coverage. While the tool provides a quick number, the premium itself is not random. It is calculated using a combination of personal details, risk factors and policy choices.

Understanding how insurers arrive at this amount helps you make informed decisions, avoid overpaying and choose coverage that truly matches your healthcare needs.

What is Health Insurance and Why Premiums Differ?

Consider health insurance as a financial arrangement that covers medical expenses related to hospitalisation, treatments and certain healthcare services. Premiums differ from one individual or family to another because insurers assess the likelihood of claims before pricing a policy. Each policyholder presents a unique risk profile, which is why two people buying similar coverage may still pay different premiums.

Key Factors that Influence Your Health Insurance Premium

Age of Insured Members

Age plays a crucial role in the calculation of health insurance premiums. Younger individuals generally pay lower premiums because they are less likely to require frequent medical care. As age increases, the risk of hospitalisation also increases, leading to higher premiums.

Medical History and Lifestyle

Pre-existing illnesses, past medical conditions and lifestyle habits such as smoking or excessive alcohol consumption can increase premium costs. Insurers evaluate these factors to estimate future healthcare expenses.

Sum Insured Chosen

The sum insured is the maximum amount of money your policy will cover in a year. A higher sum insured provides enhanced financial protection but also increases the premium, as the insurer’s potential liability rises.

Type of Policy

Premiums vary based on whether you choose an individual plan or a family floater. Family floater policies usually offer better value but are priced based on the age of the oldest insured member.

Add-ons Selected

Optional covers such as maternity benefits, critical illness cover, room rent waiver or restoration benefits enhance coverage. While these add-ons increase premiums, they also reduce out-of-pocket expenses during major medical events.

Policy Tenure

Choosing a longer policy tenure may result in discounted premiums and price stability. Single-year policies often cost more over time compared to multi-year plans.

City of Residence

Healthcare costs differ across various cities. Premiums are generally higher in metro cities, where hospital charges and treatment costs are higher, compared to hospitals in smaller cities or towns.

How to Optimise Your Premium Without Compromising Coverage

- Buying health insurance at a younger age helps secure lower premiums and reduces waiting periods.

- Selecting only essential add-ons prevents unnecessary increases in premium costs.

- Maintaining a healthy lifestyle can positively influence premium pricing over time.

- Reviewing your policy periodically ensures it continues to match your healthcare needs without excess coverage.

Choose TATA AIG Health Insurance with Affordable Premiums

Understanding how health insurance premiums are calculated helps you make smarter, more confident decisions. The right premium reflects a balance between affordability and meaningful protection. TATA AIG health insurance plans offer transparent pricing, flexible coverage options and clear policy terms.

With dependable claims support, a wide hospital network and a user-friendly health insurance premium calculator, TATA AIG helps individuals and families choose health insurance that delivers real value while staying financially prepared for medical needs.