Top 9 Stock Analysis Platforms: Ultimate Guide

Introduction

The stock analysis world is quickly changing, bringing along an endless list of creative tools meant to revolutionize your investment experience and increase your financial success. However, the diversity of available options may make your head spin as you look for the tools that truly excel among others and boast the performance and value helping them stand out. To save you the hassle, our team of experts has conducted thorough research and testing of the top stock analysis tools that have hit the market. In this article, we will reveal the 9 tools that outperform their competitors in terms of their most important features, pricing policies, and overall user journey. Use our guide whether you are a seasoned investor or just a beginner, and make a choice that will place you at the very top of the investment game, bringing you real results.

Website List

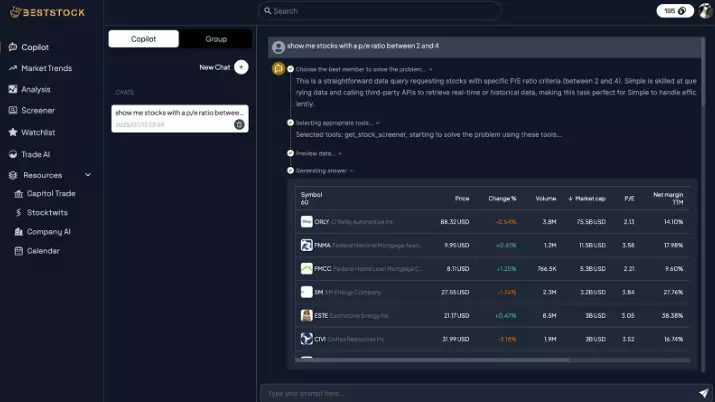

1. BestStock AI

What is BestStock AI

BestStock AI is a tool that helps stock traders analyze financial data and research investments much more effectively with the use of AI. It provides a data process automated with actionable intelligence and auto-generated reports that helps make quick, educated decisions. BestStock AI provides investors with market insights and company financials—plus a basic stock average calculator so you can easily keep track of your average entry price.

Features

- AI-based analysis that accelerates financial data processing to speed up decision making based on information and data

- Enhanced corporate financials with US stock cash flow and earnings transcripts

- Daily AI-driven insights, carefully curated research to help you plan and execute your investing strategies

- Advanced statistical and business analysis for comprehensive market knowledge

- Easy, simple search and reference -- user interface so you can spend time browsing instead of typing.

Pros and Cons

Pros:

- AI-driven financial analysis to get insights fast, for actionable decisions

- Complete access to The Information’s archives and database of company documents

- Easy research stream that limits work done by hand

- Market commentary and selective research with AI-produced analysis authored by strategists on the ground.

Cons:

- Fees may be more expensive than other financial analysis options.

- Limited access is available offline for some functions.

- It will take practice to become good with more advanced tools.

2. stockanalysis

What is stockanalysis

StockAnalysis is a complete service to give investors free information on over 100,000 stocks and funds as it includes data of all the companies in the SP500 index. It's the #1 reason why my website exists and this is to give you, the user as well as other individuals like you access to reliable stock prices, financial reports and charts all that could help you decided where to invest your money at. With extras such as stock screeners, market movers and comparisons, StockAnalysis is a great resource for those investors (beginning or experienced) who want to navigate the stock market in an intelligent way.

Features

- Huge database with capacious info on more than 100,000 stocks and funds: complete ticker information, accurate performance, latest breaking news, indexes, trading data etc.

- Live stock prices, news, financials, forecasts and charts to help you make more informed decisions for the shares you love

- Comprehensive stock screener and custom comparison tools to aid traders in their market analysis

- Market heat map that displays market volume size, expiry time, payout ON and payout OFF based on a user's selected risk tolerance.

- Intuitive watchlist features to track your stocks and check performance

Pros and Cons

Pros:

- Access to timely and accurate information on more than 100,000 stocks, funds, indexes and more!

- Advanced stock analysis with comparisons, market movers and heatmaps

- Updated information on highest gainers and losers in order to make informed transactions

- Ease of use features such as a stock screener and watchlist for Personal tracking

Cons:

- Lack of flexibility, especially in file import/export and limited range of user definable code may hamper more advanced users that desire fine level analysis.

- Possible performance degradation during high throughput windows, while running big market move days

- New users have to be familiar with stock market terms and analysis tools, a steep learning curve

3. morningstar

What is morningstar

Morningstar, Inc., is a global leader in investment research and offers an extensive line of products and services for individual investors, financial advisors, asset managers, retirement plan providers and sponsors, and institutional investors in the private capital markets. It is focused on providing the tools and knowledge they need to make informed financial decisions in order to achieve their investment objectives. Through providing comprehensive ratings, performance data and insightful educations materials, Morningstar provides both retail and institutional investors huge value.

Features

- State-of-the-art security to protect your data and privacy

- Workflows that can be customized to streamline your processes and increase productivity

- Robust integration choices for well-liked third-party apps

- Friendly onboarding to make sure you get off to a fast start

- Variable pricing options to accommodate different budgets and needs

Pros and Cons

Pros:

- The best independent research coverage on all U.S. stocks, funds, and ETFs.

- Simple star ratings and medal tiers for easy comparisons among friends.

- Strong sell side research analyst reports provide context to financial measures and valuation.

- Sophisticated data, screeners and portfolio analysis support thorough research.

- There are wide category classifications to benchmark performance and risk.

Cons:

- Star ratings look backward, and sometimes they can be misinterpreted as forecasts.

- Ratings and popularity may indeed be procyclical, driving up buy-high behavior.

- Methodologies may underweight recent manager turnover or idiosyncratic risks.

- High-end features and data depth are expensive for individual investors.

- User interface and taxonomy might be difficult for newcomers to get accustomed to.

4. wallstreetzen

What is wallstreetzen

Wall Street Zen is stock market analysis software for profitable part-time investing. It is powered by a proprietary quant model that has an impressive track record for predicting stocks, with valuations and 115 factors evaluated to find A-rated stocks (average annual return of +32.52%). WallStreetZen believes that anyone can make good investment decisions, and through their stock screeners, industry rankings, and top- analysts insights they have made it possible for everyone to stay ahead of market trends.

Features

- High-tech quant model that scours through 115 proven factors to find high-growth stocks

- Average 12-Month Return of +32.52% for A-rated stocks

- Recommendations on buy-the-dip stocks, to take advantage of market swings And much more.

- Analysis from top experts to help refine your stock strategy

- Easy-to-use interface for trading stock along with quick and easy stock screening.

Pros and Cons

Pros:

- High upside potential, with A rated stocks returning an average of 32.52% annually

- Detailed Review screening 115 proven factors to find the best stocks

- Timely investment ideas from top-rated financial experts

- Easy navigation to trade stocks with user-friendly surroundings to explore stock ideas

Cons:

- There are not many options to filter stocks based on certain criteria, offering only basic stock filters.

- Could be a learning curve for those who have not used stock screeners

- Feature rich, lots of data and sometimes information overload

5. marketbeat

What is marketbeat

MarketBeat is a full financial news organization offering investors everything they need to know about the stock market in one place. It aims to provide users with the insights necessary to make wise choices, including commentary from market pros, key trends and individual stocks. MarketBeat is a one-stop shop for stock market investors who want all the latest news, insights and information.

Features

- Early stock-market insights on how to navigate recessions and capitalize opportunities

- Get expert analysis on trending stocks with real strong growth potential

- Full market coverage - keeping you in the know on critical trades and sector moves

- Multimedia (including MarketBeat TV) to help you learn as well as stay informed of the other ins and outs of the markets and investment strategies.

- Breaking news coverage across the markets for key stocks such as those on the Dow, S&P 500 and Nasdaq.

Pros and Cons

Pros:

- Market trends and stock performance at a glance for high-level investment decisions

- Coverage of a variety of stocks, such as tech and recession-proof choices

- Contributions from multiple analysts with diverse perspectives add depth to each research report

- Market updates from the most important news sources and hundreds of publications worldwide keep you informed across 200+ regions and markets.

Cons:

- Information can quickly get outdated in a fast-moving market.

- Possibility for multiple authors to have differing views, leading to confusion by investors.

- Little emphasis placed on long-term investment strategies; focuses on short-term movements in the market.

6. IG

What is IG

IG is an all-around online broker which facilitates trading in a range of financial markets such as shares, forex, indices and cryptocurrencies. Its primary function is to offer users access to some of the best trading tools, interactive education materials, and up-to-the-minute market information that enables both new and experienced traders in making sound trading decisions. Enter integrated goals by marrying an intuitive interface with advanced features, IG takes the trading experience to a whole new level and seeks to unlock limitless investment potential for its users.

Features

- User friendly UI for easy navigation and exciting user experience

- Live analytics and reporting to empower decision-making with insights that matter

- Scalable options that can expand as your business does and comply with your changing needs

- Powerful tools for collaboration that will increase your team-performance and communication

- Its flexible pricing packages can scale to fit businesses of any size or budget

Pros and Cons

Pros:

- Wide access to markets and thousands of instruments, with various product types for trading and investment.

- Rigorous supervision and going public improve trust and operational transparency.

- Powerful in-house and mobile platforms with integrations such as ProRealTime, L2 Dealer, MT4 and TradingView.

- Competitive fees and discounts for high-volume traders on a wide range of assets.

- Robust research and education ecosystem that includes video content, signals and programs.

Cons:

- No MetaTrader 5 support, and less symbols when using MetaTrader compared to IG’s platform.

- Doesn't have built in copy trading so social and auto strategy options are limited.

- Availability and the payment methods you may use to fund your account can vary from one region to another, resulting in slower or more expensive funding.

- Inactivity fees and overnight financing can eat into returns for low-volume or leveraged traders.

- It can have a bit of a learning curve and initial platform setup and customization is not simple.

7. tiomarkets

What is tiomarkets

TIOmarkets is an online trading platform that allows users to trade various financial instruments such as forex, indices, commodities, stocks and crypto currencies. It primarily aims to empower traders with its high level of trading conditions including the ECN-like spreads and flexible leverage up to 1:500, and it provides them with an efficient customer service available 24/5. With TIOmarkets’ low minimum deposit, everyone from beginners, to professional traders can access the markets.

Features

- Competitive trading conditions, starting from spreads of 0.0 pips for our good-value liquidity mix and best execution policy

- Commission-free trading available for VIP Black and Standard accounts

- Access to wide range of markets - Forex, indices, commodities and cryptocurrencies

- Low account minimums so you can start playing with as little as $20

- 24/7 customer service to help you, whenever and however you need it on your trading journey

Pros and Cons

Pros:

- Competitive trading conditions, with 0.0 pips spreads

- Commission free trading available

- Large variety of instruments: currency, indexes, stocks and commodities

- Low minimum deposit to open an account, which is accessible for beginning traders.

Cons:

- Limited details on mobile app function

- Possible fees on other not mentioned account types

- There is not enough information on how long their customer support takes to respond

8. stocktitan

What is stocktitan

Stock Titan is a platform powered by AI which provide to you real time stock market news for your stocks, so that you won't miss any information specially when the number of finance stories are huge! It’s primarily designed to help traders make better decisions with the help of a specialized news feed and cutting-edge tools such as Rhea-AI, which gives you sentiment analysis and key insights from recent market news. Traders have complimentary access to Stock Titan’s stock reports — including this latest report on VSTGENOME and TSNSHERPA!

Features

- Live news feed specifically for individual stocks to increase visibility

- Cutting-edge AI sentiment analytics models to assess market impact and support your trading decisions

- Lightning-fast news to keep you ahead on in the stock market

- Easy to use, for both the experienced and novice trader

- Powerful features to help you accumulate key knowledge and better your trade performance

Pros and Cons

Pros:

- Lightening-fast updates designed to bring the news to you in real-time individualized stock quotes and personalized financial news on the stocks you care about.

- Advanced AI features such as real time impact analysis and sentiment analysis helps in your trading decisions entertainer cover letter template.

- Customized stock news feed filters out irrelevant finance news for a personalized user experience

- Free version available for users to try before they buy

Cons:

- AI capabilities may be overwhelming to some users and come with a learning curve

- Not much in terms of customization for news feeds may not please everyone.

- Relying on technology may mean occasional buggy or incorrect data during peak usage periods

9. seekingalpha

What is seekingalpha

Seeking Alpha's writers provide a short case based on their views of the company and an even shorter one for the readers to turn around its stock. Its principal function is to arm users with the facts and tools necessary before making an investment decision, ultimately increasing demand for leading companies through communication among our user base. Members have unlimited access to the continually updated library of financial tools and information they need to make wise decisions whether working out how much mortgage they can afford, planning for an extended period of unemployment, or simply staying on top of the ever changing buying/selling environment.

Features

- Breaking stock news that will have no restrictions so you can be in tune with market changes as they happen

- Expert Analysis and Ratings: Get in-depth analysis from your favorite community of experts to help inform your investing decisions

- Easy to use interface built NEW from the ground up, specifically created for easy navigation and access of stock market insight to all investors

- Full set of trading order types including market, limit, stop, and more.

- Frequent updates with stock market news, event and analysis on everything stocks.

Pros and Cons

Pros:

- Exclusive access to breaking stock news, allowing investors to make timely investment decisions

- Robust analysis and robust stock ratings from an informed community

- Extensive coverage of all financial markets including stocks, bonds, commodities and futures

- Easy account creation via several sign-up options

Cons:

- You aren't provided with a lot of customizations for tailored news feeds and alerts

- The volume of news and analysis could be an overload.

- The tools and insights are likely very sophisticated for new investors to learn how to fully use them all

Key Takeaways

- The greatest stock analysis tools vary based on your investment style and market focus.

- Just looking at the price and deciding is not enough, but value potentially generated (and ROI) need to be considered.

- Integration with your current trading systems and financial tools can add to your analysis toolkit.

- The uI and Intuitive navigation are very important to analyzing well and making informed decisions.

- Continuous updates and addition of new features by the stock analysis software reflect a strong focus on user experience and market relevance.

- SecuritySensual is key and DataProtection as well, if analyzing sensitive financial data for example.

- Having access to community help and great documentation could really boost your learning period and can be a life-saver when you have any problems.

- When heeding these insights, investors can adopt better investment strategies that suit portfolio’s needs and improve their stock market report.

Conclusion

There you have the best 9 of stock analysis solutions, and by reading through the brief information accompanied in each review box above, you can now make logical decision on which one to go for as choice goes a long way. Differences between the two Each one approach to investment offers a few pros and cons. To decide which one is better for you, make sure you have the entire picture clear about both of them. They all come with their advantages and disadvantages, so it’s important to think over your own expectations before choosing only the best trading strategy.

The stock analysis world is a rapidly changing environment, and many new features and improvements are available often. We suggest you try out and test ones that serve you now, while considering if they could cover any future demands. Note that the most costly choice isn’t necessarily the best and, particularly when choosing a desktop platform, just because it offers more features doesn’t mean they are the sort of features you need for your trading style or investment philosophy.

Utilize free trials and demos to see these tools in action yourself, and reach out to customer support teams for any questions. The right stock analysis software can make all the difference in your investing success and playing the market regardless if you’re a bullish long-term investor, bearish short-term trader or somewhere in between. Get started on the path to smarter investing now!