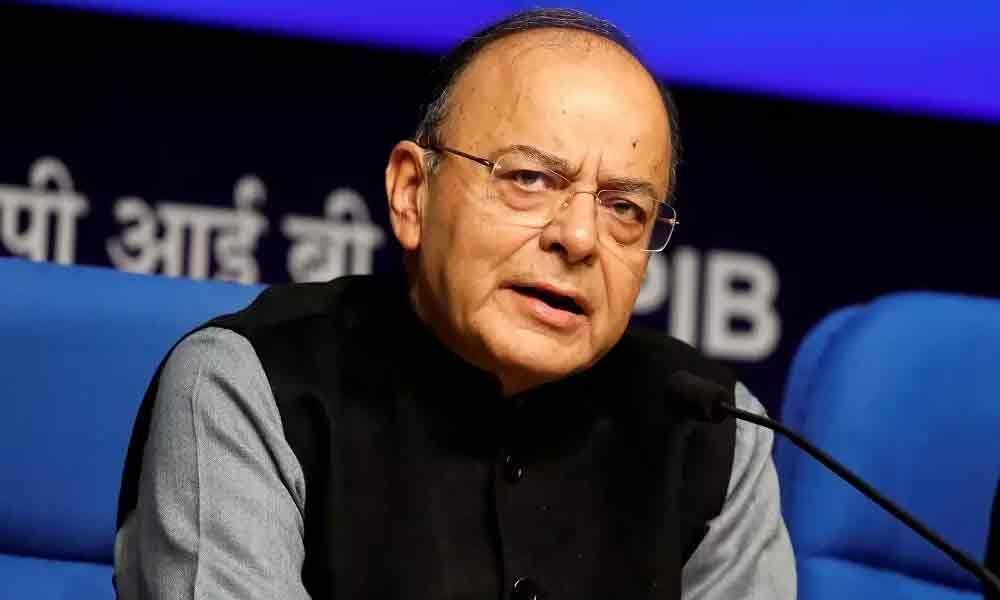

GST proved to be consumer-friendly : Arun Jaitley

Former finance minister Arun Jaitley, who introduced the Goods and Services Tax (GST) on July 1 in 2017, on Monday stated that it "proved to be both consumer and assessee friendly."

NEW DELHI: Arun Jaitley took to a blog and wrote: "After two years, one can confidently argue, without fear of contradiction that GST proved to be both consumer and assessee friendly. The high taxation of pre GST era pinched the consumers' pocket and acted as a disincentive against tax compliance. The last two years have seen each of the meetings of the GST Council reducing the tax burden on consumers as the tax collections improved."

"The assessee base in the last two years has increased by 84%." Giving "a response to certain misconceived ideas," Jaitley said: "Many warned us that it may not be politically safe to introduce the GST. In several countries, governments lost elections because of the GST. India had one of the smoothest transformation. Within the first few weeks of the implementation, the new system settled down." On GST's simplification and compliance, he said: "There is now a single registration system which works online and the procedures for the trade and business are reviewed and simplified regularly."

"GST merged seventeen different laws and created one single taxation. The pre-GST rate of taxation as a standard rate for VAT was 14.5%, excise at 12.5% and added with the CST and the cascading effect of tax on tax, the tax payable by the consumer was 31%. The GST changed this scenario completely. Today, there is only one tax, online returns, no entry tax, no truck queues and no inter-state barriers." He highlighted that the GST Council "worked on the principle of consensus" which "added to the credibility of the decision making process. Except on luxury and sin goods, the 28 per cent slab has almost been phased out. Zero and 5 per cent slabs will always remain. As revenue increases further, it will give an opportunity to policy makers to possibly merge the 12 per cent and 18 or cent slab into one rate, thus, effectively making the GST a two rate tax," he wrote.