Sell on rallies, hold cash

Sell on rallies, hold cash. In tandem with the global sell-off, the Indian stock markets on Monday fell head-long and suffered the biggest single day loss of 1625 points on the Sensex.

.jpg) As October is considered to be inauspicious for stock markets, more jerks are expected leading to capital loss

As October is considered to be inauspicious for stock markets, more jerks are expected leading to capital loss

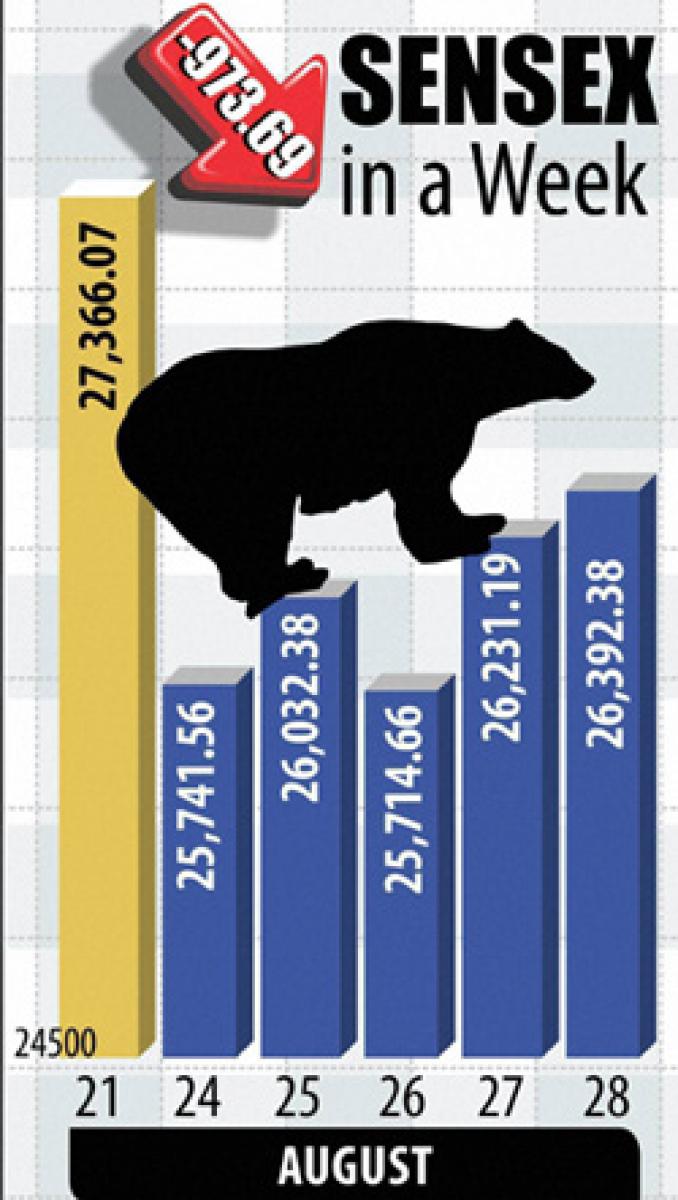

In tandem with the global sell-off, the Indian stock markets on Monday fell head-long and suffered the biggest single day loss of 1625 points on the Sensex. The benchmark index, however, recouped a good part of the loss in the following sessions but still fell short 974 points of the previous week's close.

In the previous week they had suffered a huge loss of 701 points and with the last week's loss of 974 points the total damage would be 1975 points, larger than the fall of 1625 points suffered on last Monday.

The stocks collapsed 10-month low and the rupee hit a fresh two-year low as India felt the tremors of the free-fall in global markets sparked by concerns of a deepening China slowdown. Global markets took sharp knock as investors fretted over the problems in the Chinese economy and the implications thereof on the global economy.

European markets also wilted under the heat of the turmoil in Asia. France, Germany and Britain stocks were down nearly 3 per cent. Even the Dow fell by over 400 points in early deals. Thus the Chinese slowdown not only affected the global stock markets but also brought various currencies and commodities down.

Markets took a sigh of relief on Tuesday and recouped 291 points after Monday's mega plunge, on value-buying in realty, banking and metal stocks. Moreover, recovery in rupee which sharply appreciated by 76 paise to Rs 65.89 intraday for a dollar, also supported sentiment.

But equity benchmarks completely wiped out previous day's gains on Wednesday, tracking sell-off in global markets despite China rate-cut and ahead of expiry of August derivative contracts. However, bulls regained complete control over bears on Thursday, the last day of August series, as equity benchmark climbed up 517 points taking cues from the Wall Street.

Short-covering and value-buying in major heavy-weights like HDFC, ITC and Infosys helped the market barometer to gain. Thursday's massive rally helped the Sensex to continue to look up on Friday, the very first day of the new, September, series in derivative contracts that took the Sensex up 161 points.

Q1 corporate numbers season coming to close is highly disappointing and there no reason to believe that the Q2 would be a game changing as nothing changed in such a short span. On weather, the monsoon has proved to be nearly 50 per cent all over the country and it's going to be a drought this year the impact of which has already started showing in price spiral.

In the meantime, US Fed indicates a rate hike in September and most probably even before the RBI's review meet. This would prompt the FIIs to take capital out even after certain assurances provided to them pertaining to MAT last week.Last but not the least, October is considered to be inauspicious for the stock markets around the globe, as major and frequent shocks have been suffered during October in the long history of stock markets.

The investors who have a short-term perspective, must stay away from the markets and buy only after October or else be prepared for more jerks that might result in capital-loss too. It is better to adopt now will be ‘sell on rallies and preserve the cash’ for the next couple of months and then buy only in November.