Choppy markets end flat

As the RBI kept the repo rates on hold, the markets have range-bound session and ended on a flat note on Tuesday. Interestingly, the broader markets outperformed benchmarking shares again.

.jpg) Mumbai: As the RBI kept the repo rates on hold, the markets have range-bound session and ended on a flat note on Tuesday. Interestingly, the broader markets outperformed benchmarking shares again.

Mumbai: As the RBI kept the repo rates on hold, the markets have range-bound session and ended on a flat note on Tuesday. Interestingly, the broader markets outperformed benchmarking shares again.

Announcing the key policy statement, the RBI governor Rajan said that the future course of policy action is dependent on fiscal consolidation path being set by the government. The apex bank set the target of below 5 per cent inflation target by March 2017.

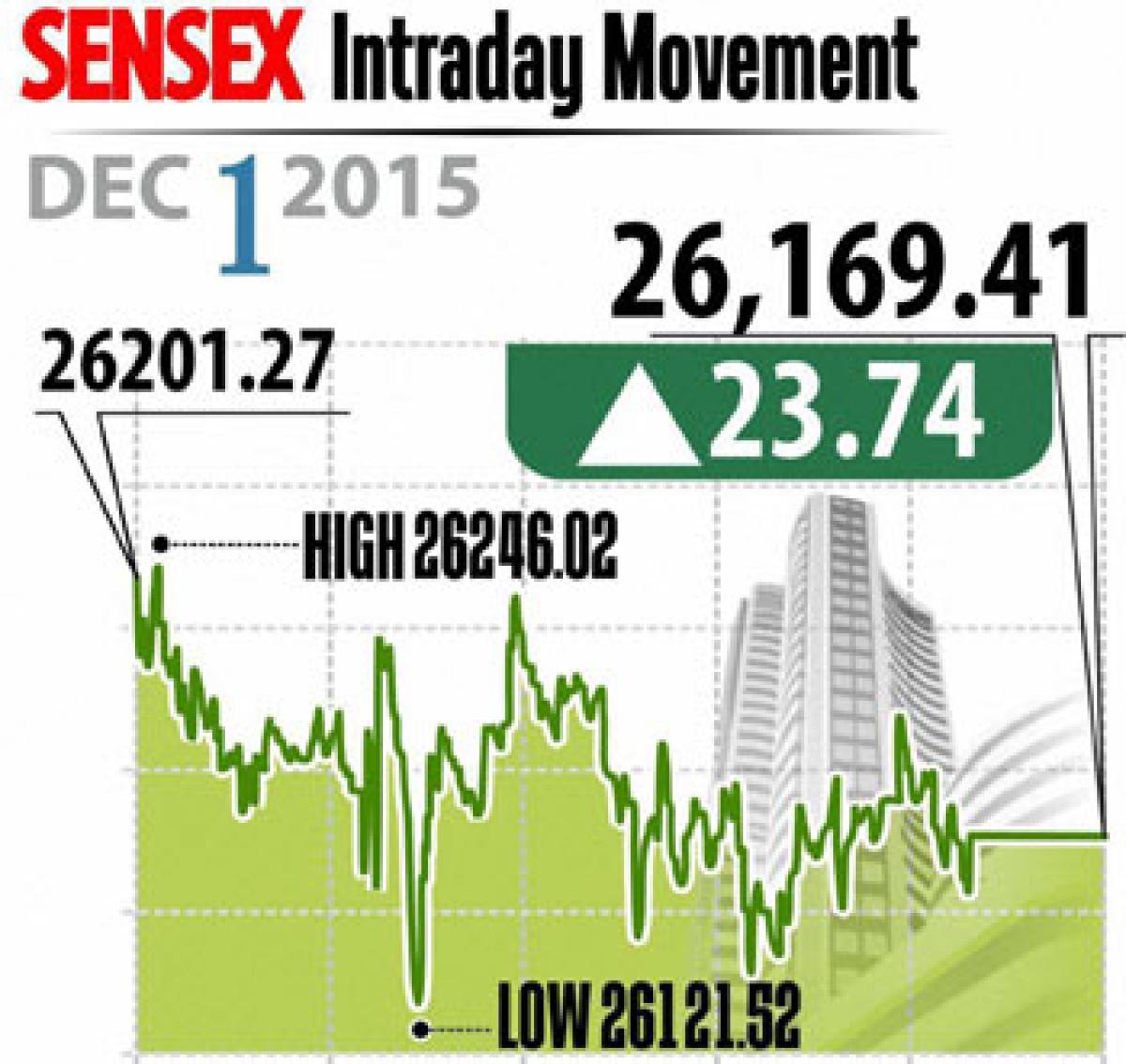

The sensex gained 24 points to close at 26,169 and Nifty up by 20 points to end at 7,955. Meanwhile, the broader markets outperformed with midcap and smallcap indices up 0.8 per cent and 0.5 per cent, respectively.

On the sectoral front, the rate sensitive sectors have mixed response with auto, bank indices down while realty index gained.

From banking pack, Axis bank, Yes bank, Bank of Baroda, Bank of India and Punjab National Bank down below 1 per cent, while SBI, ICICI Bank and HDFC ended flat.

While most of the auto shares closed on weak note after the companies announced monthly sales numbers, as Tata Motors, Hero Moto, Bajaj Auto and M&M fell up to 1.4 per cent. However, metal stocks gained with metal index up over 3 per cent. Hindalco, Vendanta, Coal India and Tata Steel rallied up to 5 per cent.

The gainers: Vedanta, up 4.66 per cent at Rs 94.25; Dr Reddy's Lab, up 3.31 per cent at Rs 3,212.80; Tata Steel, up 3.30 per cent at Rs 237.65; Coal India, up 3.27 per cent at Rs 341.50; and Hindalco Industries, up 3.24 per cent at Rs 79.55.

The losers: Bharti Airtel, down 3.53 per cent at Rs 322.70; Gail, down 1.79 per cent at Rs 358.70; Axis Bank, down 1.54 per cent at Rs 461.65; Tata Motors, down 1.41 per cent at Rs 417.40; and Infosys, down 1.08 per cent at Rs 1,076.65.