8 Reasons to Buy ULIPs

Unit-Linked Insurance Plans (ULIPs) are a great instrument that offers dual benefits of insurance and investment. Thanks to the revised guidelines of Insurance Regulatory and Development Authority of India (IRDAI),

Unit-Linked Insurance Plans (ULIPs) are a great instrument that offers dual benefits of insurance and investment. Thanks to the revised guidelines of Insurance Regulatory and Development Authority of India (IRDAI), ULIPs have undergone a complete makeover with lower charges. The new breed of ULIPs today deserves a new perspective. Let's have a look at the key facts which make ULIPs an effective investment product.

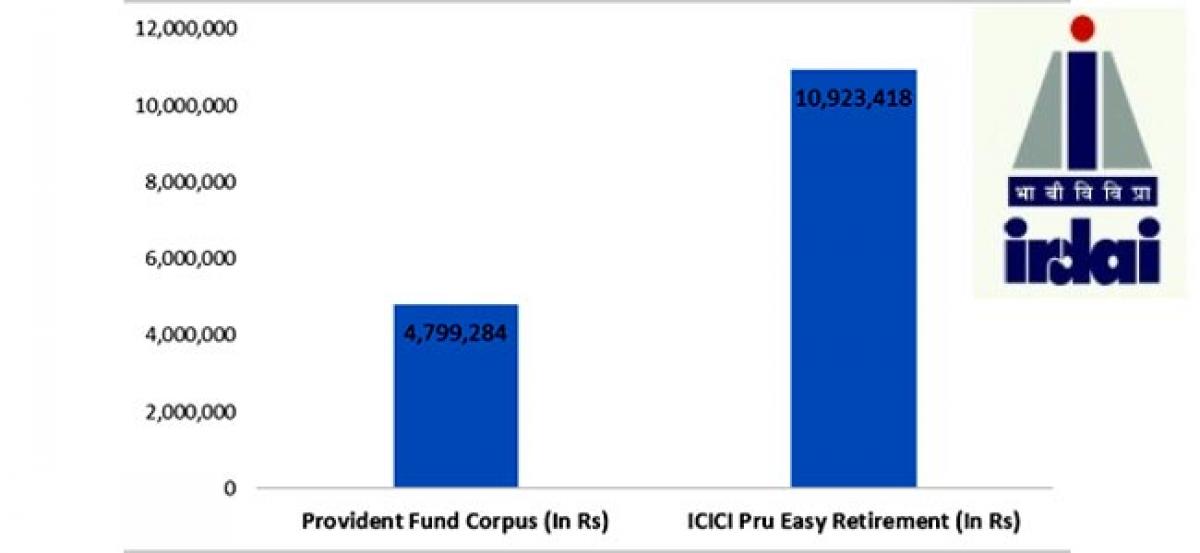

1. Wealth creation: Asa market-linked product, ULIPs invest a portion of your premiums in both equity and debt to generate high returns over a period. As a result, these plans are apt to plan your long-term financial needs, like child's education, retirement, etc. For instance, most of the people rely on their provident fund to financially secure their retirement. However, if we compare, ULIP retirement plans emerge as a clear winner.

2. Assured benefits: Various ULIP plans offer assured benefits to protect your investment from the market volatility. It means your invested amount will remain safe, and you will never lose it. For instance, ICICI Pru Guaranteed Wealth Protector offers assured benefit or fund value, whichever is higher on maturity. Here, assured benefit is 101% of the sum of all premiums paid. Here many would ask why to buy an equity-oriented plan if all one needs is a stability that is also offered by conservative instruments, like PF, bank FDs, etc. The answer is simple— debt doesn't generate high returns as equities in the long run, which is proved in the above point.

3. Transparent structure: ULIPs are transparent, which means all commissions and charges are detailed in the policy document. Moreover, in ULIPs, there are caps on charges and commissions, which are evenly distributed throughout the policy tenure. It means more part of the premium will be invested in the market to earn returns for you. It is better than any other investment products in which a major portion of the first-year premium is allocated towards charges and commissions only.

4. Tax benefits: An investment of up to Rs 1.5 lakhs is tax-free under Section 80C. The only condition is that the premium amount should not be more than 10% of the sum assured under the ULIP. Further, the maturity payout or withdrawal is tax-free under Section 10(10D). Also, riders like critical illness, accidental death, are exempted from the tax.

5. Switches: Almost every ULIP allows switches in the fund. It can be used to re-balance your investment portfolio during market volatility. Some insurers offer limited free switches and charge a certain amount for additional switches. One should note that ULIP is not only about equities. Smart investors can also move within debt when interest rates are expected to fall.

6. Goal-based planning: ULIPs encourage commitment and discipline among investors. These plans have a lock-in period of five years. You can use ULIP investments to plan for key milestones like child's education or marriage, retirement, home loan repayment, etc. By combining equity with debt, you will be able to manage your risk profile, depending on factors like age, income, etc.

7. Top-up your investment: ULIPs allow investors to invest excess amount through periodic top-ups. Moreover, top-up premiums also enjoy tax benefits as regular policies.

8. Easy to buy: In today's internet-driven world, you can buy ULIPs online also from the comfort of your home. It makes the entire process quick and easy.

Undoubtedly, ULIPs are making strides towards improvements as compared to their earlier avatar. By investing in Unit-Lined Insurance Plans, you can enjoy triple benefits— life cover, high returns, and tax saving, with least chances of losses. The earlier you bought the ULIP, the better it is for you in the long-run. So buy ULIPs now to secure yours and family's future financially.