Live

- Analysing Happiness

- Two-day ToT organised for trainers

- Savarkar preferred Manusmriti to Constitution: Rahul

- Daily Horoscope for 15 December 2024: Embrace Today’s Insights of Your Zodiac Sign and Unlock Your Potential.

- Beyond The Flames

- CM warns officials of stringent action

- NDA alliance candidates win all seats

- ‘Resignation of Avanthi Srinivas leaves no impact on YSRCP’

- Congress killers of Samvidhan: Modi

- Bejan Daruwalla’s horoscope

Just In

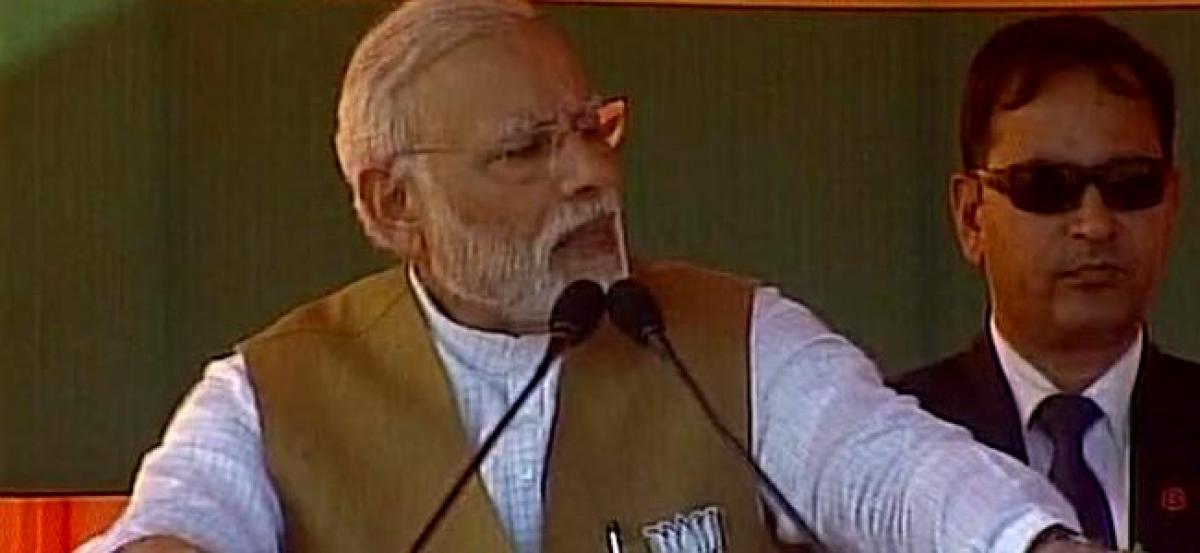

With the resumption of the Budget session of Parliament, Prime Minister Narendra Modi on Thursday hoped for a breakthrough on the Goods and Services Tax (GST) Bill.

New Delhi: With the resumption of the Budget session of Parliament, Prime Minister Narendra Modi on Thursday hoped for a breakthrough on the Goods and Services Tax (GST) Bill.

“The budget session is resuming and I believe the level of the debate, the level of discussions will go very high and the focus will be on the welfare of the country’s poor,” Modi said addressing the media here.

“I also hope there will be a breakthrough on the GST Bill. There is a possibility of that because there has been very positive response from the states as well as all political parties,” he said.

“Debating and discussing democratically, we are moving ahead and I hope the process of GST is completed in this session,” Modi added.

GST, billed as the biggest-ever tax reform in the country, is expected to add at least one percentage points to its GDP growth.

The Centre plans to introduce in Parliament the Central GST (CGST) Bill. After it is ratified, the states will introduce the State GST (SGST) Bill in their respective legislative Assemblies.

The central and state officials will soon start the exercise to determine which goods and services should fall in which tax bracket and the same will be taken to the Council for approval soon.

Together with this, they will also decide the goods and services that would attract a cess on top of the peak rate to create a corpus that can be used to compensate states for any loss of revenue from implementation of GST in the first five years.

The government is looking at GST rollout from July 1.

The Constitutional amendment that paved the introduction of GST is due to lapse in mid-September this year

© 2024 Hyderabad Media House Limited/The Hans India. All rights reserved. Powered by hocalwire.com