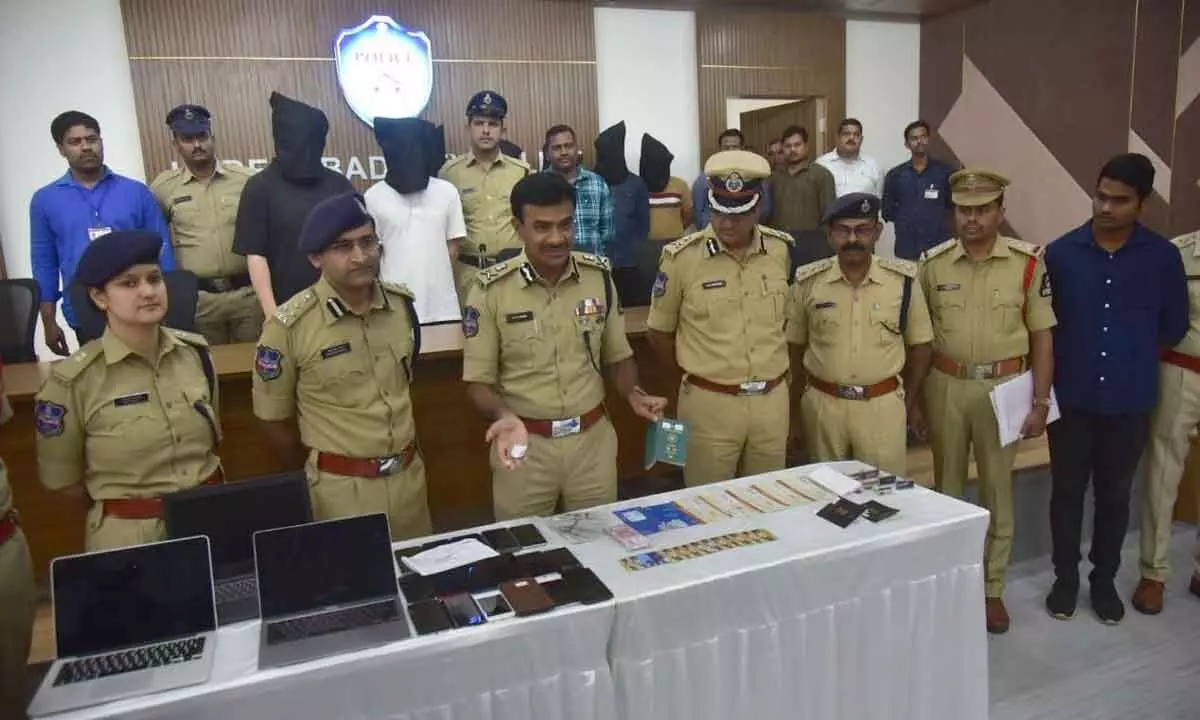

Hyderabad: City police busts Rs 903 crore Chinese investment fraud

City cyber crime police arrested 10 accused, including two Hyderabadis, a Chinese and a Taiwanese national, for running a Hawala scam from Delhi and Mumbai in an investment fraud.

Hyderabad: The City cyber crime police arrested 10 accused, including two Hyderabadis, a Chinese and a Taiwanese national, for running a Hawala scam from Delhi and Mumbai in an investment fraud.

Based on a complaint lodged by a Tarnaka resident, that he was cheated after investing Rs 1.6 lakh in an investment app called LOXAM, the cyber crime police registered a case and took up an investigation and it was found that the complainant's money was deposited in an Induslnd Bank account in the name of Xindai Technologies private limited, opened by one Virender Singh in the name of the company.

When Virender was arrested and interrogated in Pune, he revealed that he had opened the bank account in the name of Xindai Technologies on the orders of one Jack from China and gave the internet banking credentials to Jack.

During the investigation it was also revealed that the bank account of Betench Networks private limited and Xindai Technologies share the same phone number. One Sanjay Kumar of Delhi opened the account of Betench Networks on the instructions of Lec alias Li Zhounjau and sent the credentials to Pei and Huan Zhuan in China. Similarly, he opened another 15 bank accounts and sent them to one Chu Chun-yu of Taiwan, who is temporarily residing in Mumbai and was arrested yesterday.

Chu Chun-yu then sent the account details and internet banking credentials along with SIM cards to other countries and Lec Li Zhounjau arranged a commission of Rs 1.2 lakh per bank account opened to Sanjay Kumar and Virender Rathor.

Money was then transferred from the account of Xindai Technologies to 38 other bank accounts, including the bank accounts of Syed Sultan and Mirza Nadeem Baig from the city. Mirza and Syed opened the accounts for receiving the commission as per the instructions of Parvez, who in turn gave those bank accounts to Imran, residing in Dubai. Imran along with others used these two bank accounts for investment frauds.

A large amount of money from the 38 accounts of Xindai Technologies went to Ranjan Money Corp and KDS Forex private limited. One Navneet Kaushik inturn sent the money received in the bank account to forex exchanges being run in the name of international tours and travel businesses.

He converted the money received in rupees to US dollars in cash and gave it to Sahil Bajaj and Pankaj. The forex exchanges although licensed by RBI, have repeatedly flouted the RBI guidelines with respect to exchanging activities.

Sahil and Pankaj joined hands with other fraudsters and transferred the above money abroad through hawala transactions.

The transactions made to the Ranjan Money Corporation's account have tuned Rs 441 crore in seven months and transactions worth Rs 462 crore was done to the account of KDS Forex private limited. Upon investigating further, it was noted that frauds have been committed through hawala transactions to the tune of Rs 903 crore and so far Rs 1.91 crore have been frozen in various bank accounts in this case.