F&O data holds upside move cautious

Rollback of surcharge on FPIs may curtail offloading; Put-Call ratio OI at 0.84 indicates OTM Call writing

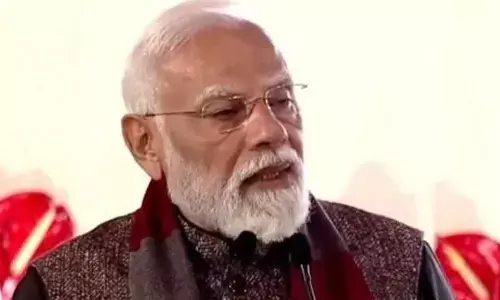

The key indices of domestic bourses reversed from six month-low as stimulus hopes are expected to drive markets higher. Latest announcement by the Prime Minister Narendra Modi-led NDA government to revive auto demand and roll back FPI surcharges can turn the current sentiment positive for investors.

But the upside move may be limited ahead of the August F&O series expiry this Thursday. Further, the global markets are still sluggish and any bounce back at a higher level may not be sustainable, observe derivatives analysts.

After reeling under pressure of sharp sell-off, NSE Nifty reverted from lower levels in anticipation of some positive outcome. However, the writing at 11,000 Call strike suggests the upsides are limited till August expiry.

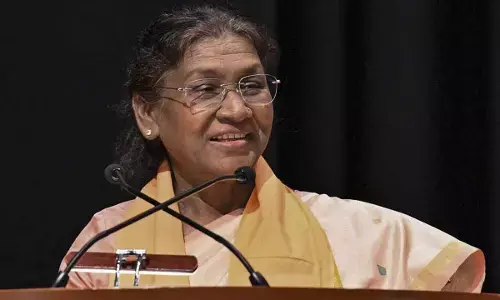

Dhirender Singh Bisht, senior research analyst (derivatives) at SMC Global Securities, said: "After bloodbath in the Indian market, indices bounced back in anticipation of reversing the surcharge on FPI by FM. Friday evening, the FM announced the same what market was expecting."

"From derivative front, Call writers were seen active in 11,000 strike, while marginal Put writing was observed at 10,700 strike. Call writers are seen shifting to lower bands ever since Nifty has breached 11,200, levels which clearly indicate that bears are likely to keep control over markets moving forward as well."

BSE Sensex closed the week at 36,701.16 points, a net fall of 649.17 points or 1.73 per cent, from previous week's close of 37,350.33 points. Registering a drop of 218.45 points or 1.97 per cent, NSE Nifty ended at 10,829.35 points as against 11,047.80 points.

Elaborating the technicals, Bisht said: "From the technical front, Nifty and Bank Nifty both the indices has given a sharp breakdown below the triangle pattern, which is also a bearish signal for the markets as we might witness more downside into the prices.

On the chart, the market tests the support level of 10,640 and manages to close at 10,830 levels even though the chart structure is still not positive."

He further holds the view that unless the market is not trading above 11,150 level, the trend is bearish.

"The global markets are still weak and any bounce back at a higher level will not be sustainable. We expect that as far we are holding below 11,000 levels in Nifty (spot) the current trend is likely to remain bearish and markets should move towards 10,500. However, any technical bounce towards 10,850-10,900, which would be a key supply zone, should use for creating fresh short positions," remarked Bisht.

According to ICICI Direct.com, Nifty Open Interest (OI) rose from 17.5 million shares to 20mn and this also signifies towards the short formation by FPIs in the index.

Money flow is seen in technology, FMCG and telecom heavyweights. The stocks from these sectors may remain resilient in the coming sessions. Volatility has consistently found resistance near 18 per cent.

Hence, the option writing strategies can be adopted in the current expiry week. Lowering volatility and time decay should come in favor of such strategies, observes ICICI Direct.com.

"The implied volatility of Calls was up and closed at 18.04 per cent, while that for Put options closed at 16.87 per cent.

The Nifty VIX for the week closed at 17.29 per cent and is expected to remain volatile. PCR OI for the week closed at 0.84, which indicates OTM Call writing," adds Bisht.

Bank Nifty

The selling pressure by FPIs has hammered down the NSE banking index. Registering a heavy fall of 1,256.35 points or 4.45 per cent, NSE banking index Bank Nifty ended the week at 26,958.65 points as against previous week's close of at 28,217 points.

The current price ratio of Bank Nifty-Nifty fell to 2.50 and the ratio could see a bounce if the Bank Nifty manages to move above 27,500.