Understanding hedging

Understanding hedging

Understanding hedgingHedging is a useful practice that every investor should know about it

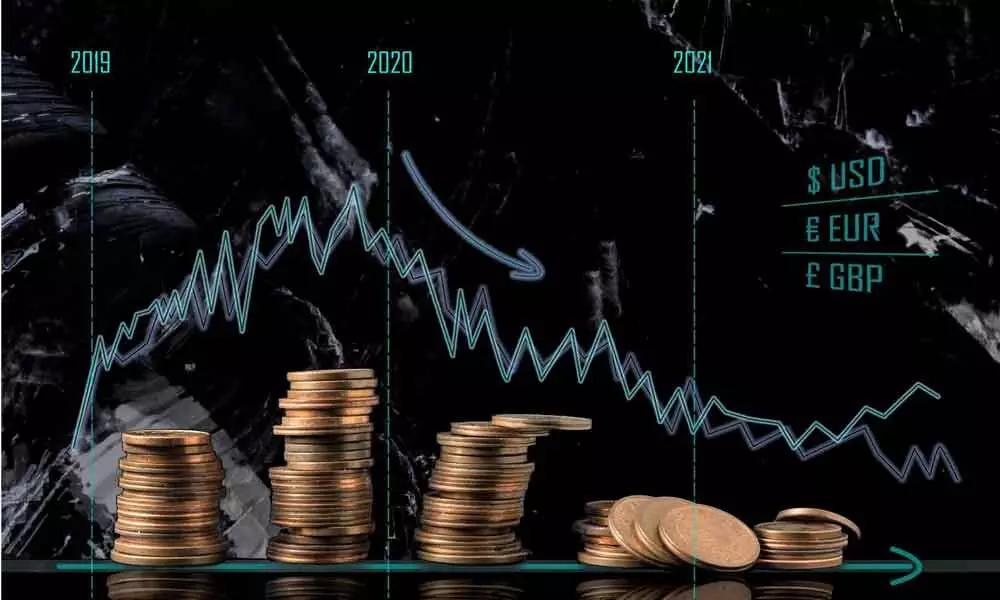

Hedging is a useful practice that every investor should know about it. In financial markets, hedging is a way to get portfolio protection.

And capital protection is as important as capital appreciation. It is one of the risk management strategies employed to compensate for the losses in investments by taking an opposite position in a related asset.

Hedging strategies typically involve use of financial instruments known as derivatives, which are options and futures (F&O) contracts.

To understand hedging better, we can compare it with an insurance product. If you take a health insurance policy and if there is a sudden medical emergency then this insurance gives proper hedging to our finances.

However, in financial markets, hedging is not as simple as paying an insurance every year for coverage. Investors hedge one investment by making a trade in another. For example, if you have bought 100 shares of a company X at Rs100.

Obviously, you would gain when price increases, but since trading is a probability and not certainty and if the price comes down to Rs90, you would be in a loss.

So, in order to protect your capital, you take a counter position by buying a Put option to protect your capital from large downside moves, but the option will cost you since you have to pay its premium.

Similarly, to protect your capital you can go short in futures, which is available in a predetermined fixed lot size. Thus, a reduction in risk will always mean a reduction in potential profits.

So, hedging for the most part is a technique, not by which you will make money, but by which you can reduce the potential loss. If the investment, against which you are hedging, makes money you have typically reduced your potential profit.

If the investment loses money, your hedge if successful reduces that loss. To protect capital against the volatility and uncertainty of prices hedging strategy is used mostly by FIIs and DIIs.

The goal of hedging is not to make money, but to protect our capital from losses. Hedging comes with cost where we have to pay premium for an option and if you are investing in futures then you have to go by the lot size of that particular asset.

So, hedging is a price that you pay to avoid uncertainty. Hedging a portfolio is not a perfect science and things can go wrong. All the risk managers always aim for perfect hedge, but it is difficult to achieve in practice.

(The author is a homemaker who dabbles in stock market investments in free time)