Heavy Call OI bases point to rising resistance level

The resistance level rose by 500 points to 26,000CE, while the support level eased by 500 points to 24,000PE

The resistance level rose by 500 points to 26,000CE, while the support level eased by 500 points to 24,000PE. The 26,000CE has highest Call OI followed by 25,500/ 26,500/ 25,900/ 25,700/ 25,600/ 25,300/ 25,400/ 26,500/ 26,700 strikes, while 26,500/ 26,000/ 25,700/ 25,900/ 25,300/ 25,600/ 26,100 strikes recorded hefty addition of Call OI. And no Call strike witnessed any fall in OI. Coming to the Put side, maximum Put OI is seen at 24,000PE followed by 23,500/ 24,100/ 24,200/ 24,100/ 24,500/ 24,800/ 23,500/ 23,800 strikes. Further, 24,100/ 24,000/ 23,500/ 24,700/ 24,800/ 24,000/ 24,200/ 22,550 strikes have reasonable to heavy build-up of Put OI. Moderal Put OI fall is visible in the 24,900-25,300 range.

Nifty premium fell substantially in the settlement week as FIIs trimmed their longs for the August F&O series. On the other hand, retail traders also lowered their shorts and turned net long for August series.

Despite the sharp 450 points volatility on last Friday, Call option OI remained almost unchanged and no major covering was visible. The highest Call base remains at 26,000 strike for this week. However, Put writing continued and significant OI addition was seen at ATM strikes with 24,000 Put strike holding the highest Call base.

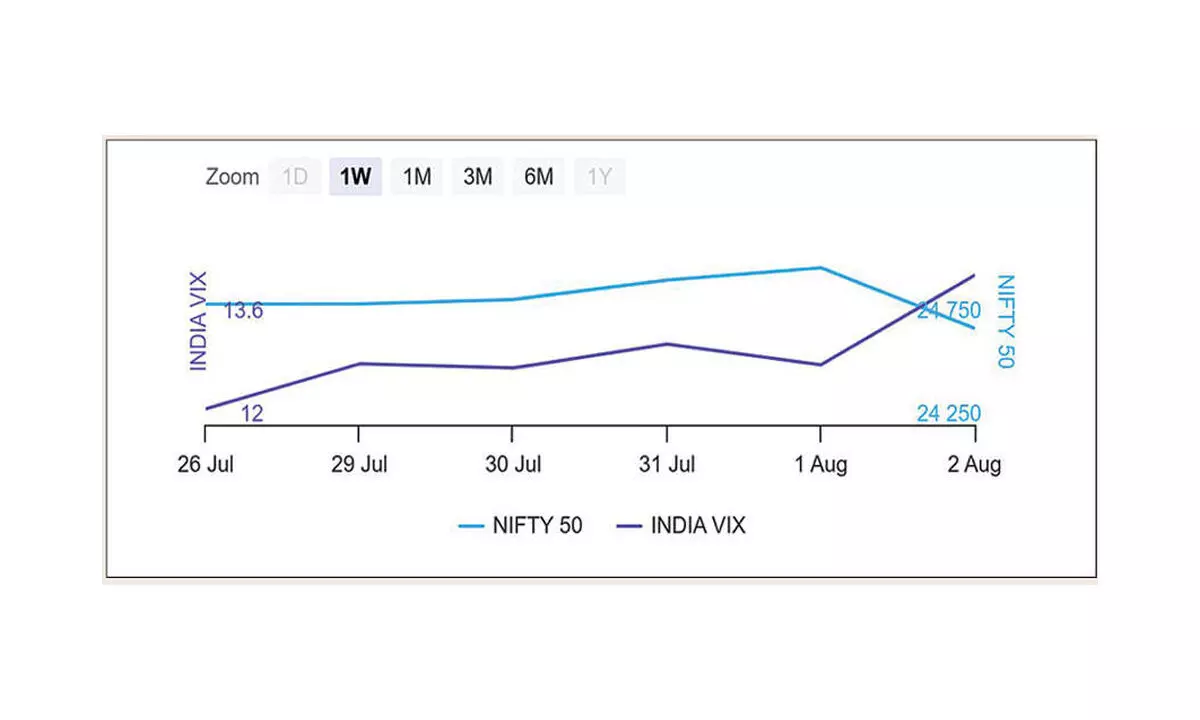

BSE Sensex closed the week ended August 2, 2024, at 80,981.95 points, a net loss of 350.77 points or 0.43 per cent, from the previous week’s (July 26) closing of 81,332.72 points. For the week, NSE Nifty also fell by 117.15 points or 0.47 per cent to 24,717.70 points from 24,834.85 points a week ago.

Nifty rollover was sluggish, while futures OI was lowest since May. India VIX rose 10.75 per cent to 14.32 level on last Friday. The volatility index declined sharply post the budget event and recovered to over 14 level amid the results season. Analysts forecast further drop in volatility as most of the technology and banking majors had already announced their quarterly results.

Put-Call ratio of Open Interest (PCR-OI) was 0.64 and indicates undercurrent bullish bias in the market.

FIIs in the F & O space reduced their long positions sharply in the July F&O expiry and their net long positions in index futures also fell from 3.2 lakh contracts to just 1.3 lakh contracts last week.