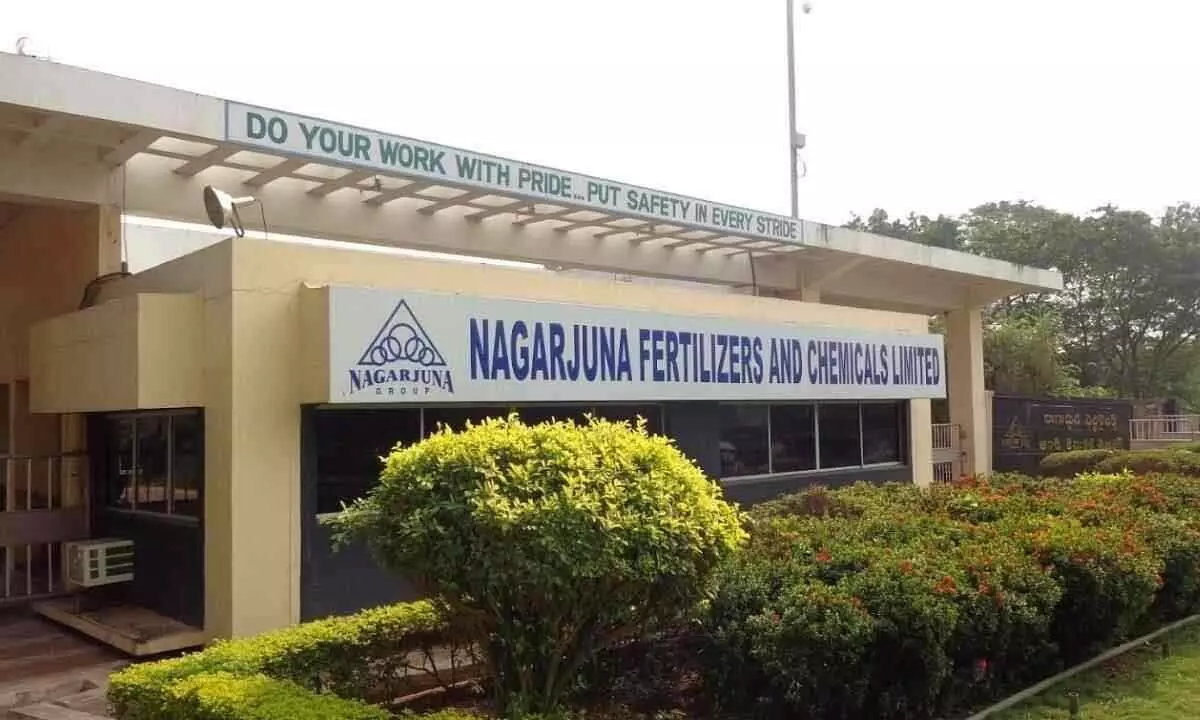

IDBI Bank seeks bids to sell `1,582cr bad loans of NFCL

IDBI Bank on behalf of a consortium of lenders has invited bids to sell Rs 1,582.19 crore of stressed loans exposure they have in Nagarjuna Fertilizers and Chemicals Ltd (NFCL).

Hyderabad: IDBI Bank on behalf of a consortium of lenders has invited bids to sell Rs 1,582.19 crore of stressed loans exposure they have in Nagarjuna Fertilizers and Chemicals Ltd (NFCL).

The notice of the consortium of lenders comes amidst stay order by the National Company Law Appellate Tribunal (NCLAT) against the order of the National Company Law Tribunal (NCLT) at Hyderabad initiating corporate insolvency resolution process against NFCL following an application filed by a foreign operational creditor. The other banks in the consortium led by IDBI Bank include State Bank of India, UCO Bank, Bank of India, Indian Overseas Bank, Punjab National Bank and ICICI Bank. In a web notice dated November 15, IDBI Bank said the consortium of lenders intends to transfer the stressed loan exposure on all cash basis to eligible entities.

IDBI Bank has fixed Rs 810 crore as the reserve price on all cash basis with 100 per cent protection for outstanding bank guarantees of Rs 87.67 crore.

The prospective eligible bidders were asked to submit expression of interest (EoI) and conduct due diligence. While November 17 is fixed as last date for submission of EoIs, the due diligence by interested parties would begin from November 17 to close by December 2. The last date for submission of bids by the prospective buyers would be December 3. While making it clear that the prospective buyers should not be funded and backed by the promoters or guarantors of NFCL, the consortium of lenders said it reserves the right to negotiate with the successful bidder for improvement in the bid amount as the lenders may deem fit to seek revised bids.

Earlier in April 2016, Switzerland-based Key Trade AG, a foreign supplier (operational creditor) of NFCL, had obtained a favorable order from the London Court of International Arbitration on its dues the Indian fertilizer firm and later moved the Telangana High Court seeking to attach certain properties of NFCL. The Telangana High Court, while admitting the execution petition filed by Key Trade AG, had ordered attaching the properties of NFCL. Aggrieved by this, NFCL approached the Supreme Court but could not get any relief. Accordingly, the fertilizer firm provided the payments in its books of accounts.

Meanwhile, IDBI Bank had moved the Supreme Court claiming that the current assets and fixed assets attached by the court were already mortgaged to the banks.