The Rise of Online Investment Platforms: Transforming the Way We Invest

Millennials make up 47% of the working population in India, and the majority of them want to manage their wealth by themselves.

Millennials make up 47% of the working population in India, and the majority of them want to manage their wealth by themselves. The shifts in technology and rapidly increasing financial awareness among the millennial and Gen Z Indians have radically changed the retail investment landscape as it is today.

A decade earlier, investing would have meant tedious paperwork, long queues in banks, and days waiting for approval. However, today, with the advent of an online investment platform, the face of wealth creation has evolved into a simple process where a smartphone and a working internet connection are all you need to get started.

Transformation of Online Investment Platforms

A survey found that 90% of investors in India today prefer using online investment platforms over a broker or a distributor. Online investment platforms have made the typically shy Indian millennial into an informed investor engaging in goal-based investing. This is due to several advantages and perks online investment platforms grant to the common investor.

1. Easy Accessibility

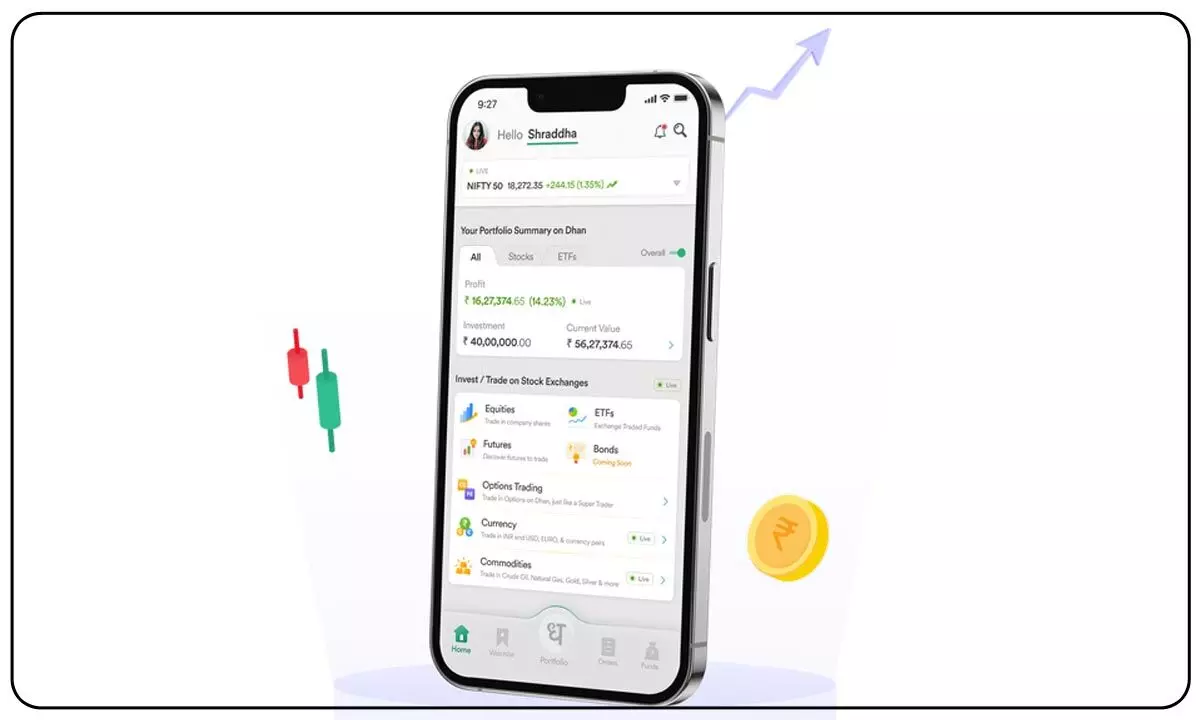

Investment platforms allow easy accessibility to the share market and a variety of investment options. What’s more – investors can view the share prices and the performance of their portfolio in real-time or seek advice from experts.

Most investment platforms have their own user-friendly mobile investing app that allows buying and selling securities with a single click while on the go. Additionally, online investment platforms offer state-of-the-art infrastructure and interfaces to make investing via their platforms and mobile investing app quick and easy. This helps investors access the market and their investments anytime, anywhere and make informed decisions.

2. No Need for Middlemen

Online investing removes the need for a broker or middleman, bridging the gap between the market and the investor. Everything including different asset classes, how to invest, track and relevance is accessible and in front of investors.

The investing process becomes faster and more cost-efficient. With no broker, investors are in greater control over their investments. They also do not require to pay heavy fees for brokering and do not have to wait on a call to execute a transaction. This helps investors enter and exit their investments more accurately and leverage a competitive price.

3. Cost-Effective and Efficient

Investors can determine the proportion of investments in their portfolio while saving on costs and commissions. Investors don’t need to pay charges to begin investing in the markets.

Online investment platforms allow investors to choose from a wide array of investments. They can invest in forex, gold, commodities, mutual funds, or even an upcoming IPO as per their risk appetite. This is cost-effective as well as efficient for investors.

Conclusion

Online investment platforms have changed how people invest making investing effortless. The last few years have seen a rapid increase in investing and a positive change in investors' attitudes toward building wealth for the long term. If you are also planning to start your investing journey, consider Dhan, India’s one of the leading online investment platforms.