Trade diversification may help India tame US tariff impact

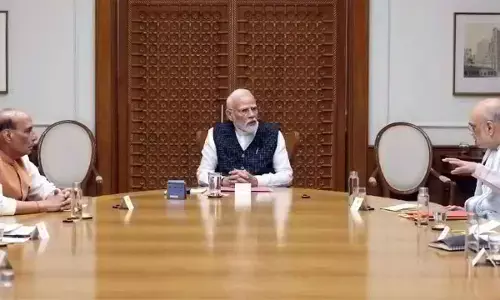

US President Donald Trump’s decision to impose higher tariffs on Indian goods threatens to put $30-35 billion worth of exports to the United States at risk, a move that could shave almost a full percentage point off India’s GDP growth over the next two years. Economists warn that the impact will be deep and widespread, hitting sectors already struggling with global demand uncertainties and forcing businesses to rethink their export strategies. The Narendra Modi government’s response to the situation should reflect poise and pragmatism, not anger.

Indian banks are increasing scrutiny of new loan applications from exporters by asking about exposure to the American market and contingency plans for coping with Trump’s steep tariffs, as reported by Bloomberg. On the ground, stress is already visible. In Tamil Nadu’s Tiruppur, the country’s knitwear hub, exporters say orders are “being paused, redirected, or lost entirely to competitors from Bangladesh, Pakistan, Vietnam, and Cambodia, all of whom have lower US tariffs ranging between 19 per cent and 36 per cent,” according to a news report.

The blow is no less severe in Surat, the world’s diamond-cutting capital. Several companies were forced to halt processing orders for American clients that had already begun for the Christmas season. Trump’s announcement of the additional 25 per cent tariff on diamonds from India came as a shock, particularly because the festive period—just five months away—accounts for nearly half of the annual international sales for many businesses. Industry experts predict that exports of non-industrial diamonds—those intended for jewellery or investment—will be particularly hard hit.

According to the Gems & Jewellery Export Promotion Council (GJEPC), India supplied 68 per cent of the US’s total diamond imports by volume and 42 per cent by value ($5.79 billion) in 2024. Given such a dominant position, even a partial loss of market share could translate into billions in lost revenue and the potential shuttering of thousands of polishing and cutting units. The Modi government has sought to reassure exporters by promising measures to soften the impact of the new US tariffs. However, such pledges are easier made than fulfilled. Trade diversification to other markets may help in the medium term, but replacing the sheer scale and value of the US market will be challenging. Furthermore, the government’s recent geopolitical tilt towards Russia and China—driven by political compulsions—risks complicating efforts to restore trade warmth with Washington.

This strategic shift is particularly troubling. While engaging with multiple global partners is a sensible long-term objective, the US remains one of India’s most significant economic partners, especially in high-value manufacturing, services, and technology. Deterioration in bilateral economic relations now will only magnify the damage from the tariffs. Rather than recalibrating India’s foreign policy in ways that alienate Washington, a more prudent and pragmatic approach would be to prioritise repairing and deepening ties with the US.

Doing so will require deft diplomacy, proactive engagement on trade disputes, and perhaps concessions in other areas of the bilateral agenda. India must make the case—both politically and economically—that it is a critical partner in global supply chains, especially as the US seeks to reduce dependence on China. If corrective action is delayed, the fallout will be felt not only in trade statistics but also in employment figures. That will make the situation worse.