A glance at history of our Budgets

The primary objective of the budgeting exercise is to ensure efficient allocation of resources, with a view to achieving important national goals, such as, ensuring the stability of the country’s economy, reduction of unemployment and poverty levels, diminishing regional, sectoral and wealth and income disparities. Measures to contain inflation and proposals for changes in the tax structure are also a part exercise. Other important objectives such as facilitating the rapid growth and sustainable development of certain identified priority sectors of the economy are also addressed in the process

As an undergraduate student, studying for my B.Sc. (Honours) degree in Mathematics at Hindu College, Delhi, in the early 1960s, I had chosen History of Science and Scientific Thought as an optional extra subject instead of Hindi, the alternative choice available. In the most fascinating manner, the subject covered the evolution of scientific study, experiment, observation, and inference from the ancient times to modern days. By its very nature, it was more a study of the sequence of events and description, of what transpired during those events, rather than the technicalities of the sciences.

Not being an economist, and having no pretension to being one, I have devoted this week’s column to describing the history of the processes of budget preparation and presentation, at the national as well as the state levels. The piece will restrict itself to the historical aspects, rather than the technical details, of the form and content of budgets, as such.

The budget of a country is expected to present the status of its revenues and expenditure for a particular period of time, usually referred to as the financial or fiscal year, explaining, inter alia, an estimate of the receipts and expenses for the upcoming financial year. Articles 112-117 of the Constitution of India enshrine the powers of Parliament in the enactment of the budget.

The primary objective of the exercise is to ensure efficient allocation of resources, with a view to achieving important national goals, such as, ensuring the stability of the country’s economy, reduction of unemployment and poverty levels, diminishing regional, sectoral and wealth and income disparities. Measures to contain inflation and proposals for changes in the tax structure are also a part exercise. Other important objectives such as facilitating the rapid growth and sustainable development of certain identified priority sectors of the economy are also addressed in the process.

Achievement of the goals is sought to be accomplished through strategies aimed at generating adequate resources for investment, and promoting savings. It is also an opportunity to incentivise the production of goods and services, which the government considers important, and discourage undesirable areas of investment and consumption. In India, the Union government presents its budget (or the Annual Financial Statement as it is referred to in Article 112 of the Constitution of India), in the Lok Sabha every year on 1 February, a recent departure from the past practice of presenting it on the last day of that month. In another significant change, the timing of the presentation of Union budget was moved, in 1999, from 5 pm to 11 pm, as the government felt that the colonial legacy of the timing being convenient to the Government of Britain was no longer relevant.

The first ever budget of India was presented on April 7, 1860, when the country was still under British colonial rule, by the then Finance Minister of India, James Wilson. And the first Union budget of Independent India was presented by first Finance Minister R K Shanmukham Chetty on November 26, 1947.

The processes of the preparation and the presentation of the Union budget are indeed very interesting. The starting point is the ‘Blue Sheet’, a sheet of paper with key numbers considered a blueprint of the budget and kept in the soul custody of the Joint Secretary (Budget) in the Ministry of Finance. Not even the Finance Minister is allowed access to the information in that sheet. The budget is printed in a basement in the North Block where the Ministry is located. Strangely enough, a ritual, known as the ‘Halwa Ceremony’, marks the start of the printing process, after which those officials, who are directly in contact with the budget papers, are locked down there until the budget is presented in Parliament.

In its long history of over a century and a half, the budget drama of the country has seen many actors on the stage. There was, for example, the budget of 1973-74, presented by Y B Chavan, which was described as the ‘Black Budget’ on account of the huge fiscal deficit. Then came the ‘Carrot and Stick Budget’ 1986-87, presented by V P Singh, as it marked the beginning of dismantling of the license and permit raj in India. That budget also introduced the Modified Value Added tax or Mod Vat, apart from launching a crackdown on smugglers, black marketers, and tax evaders.

The budget of 1990-91 presented by Dr. Manmohan Singh was called the ‘Epochal Budget’ as it marked the end of the license and permit raj, and welcomed foreign investments, fundamentally transforming India’s economic framework to an open economy, in line with the spirit of the forces of the worldwide liberalisation, privatisation and globalisation

The star of the story was the 1998–99 budget presented by Chidambaram, also called the ‘Dream Budget’, for the reason that substantial reductions in income tax rates were announced in order to stimulate economic growth and enhance compliance, apart from a Voluntary Disclosure Scheme to recover black money.

Last, but, by no means the least, was the so-called ‘Once-in-a-century Budget’, presented by Finance Minister Nirmala Seetharaman for 2021–22, on account of its strong emphasis on privatisation, increased tax collections and substantial investments in infrastructure and healthcare, apart from significant plans for privatising several public sector undertakings, signaling a major shift in the government’s strategy for managing state owned enterprises.

Incidentally, in a lighter vein I would like to share with the readers a family secret. So far as the family is concerned, there is even a fourth category of budgets, a ‘shoestring budget’! We have never had a problem with making both things meet because, in the first place, we have yet to find those ends! The well-known adage that a husband’s income should be able to catch up with the wife’s expenditure must have had its origin with our family as the example!

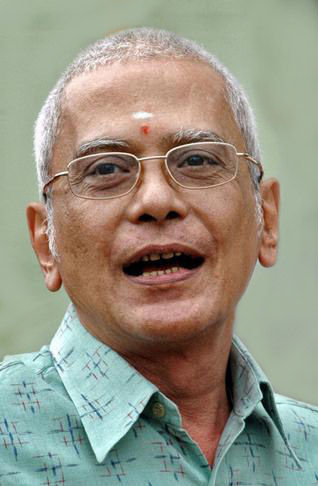

(The writer was formerly Chief Secretary,Government of Andhra Pradesh)