Navigating IV Crush: Strategies for Options Traders

In the world of options trading, understanding and effectively managing implied volatility (IV) is crucial for success. One of the most significant challenges options traders face is the phenomenon known as "IV crush." When the implied volatility of an option goes down, the value of the option goes down as well, even if the price of the underlying object stays the same, this is called IV crush. This can have a significant impact on option premiums and, consequently, on traders' profits and losses. In this article, we will delve into what IV crush is, why it happens, and most importantly, strategies that options traders can employ to navigate and potentially profit from it.

What is IV Crush?

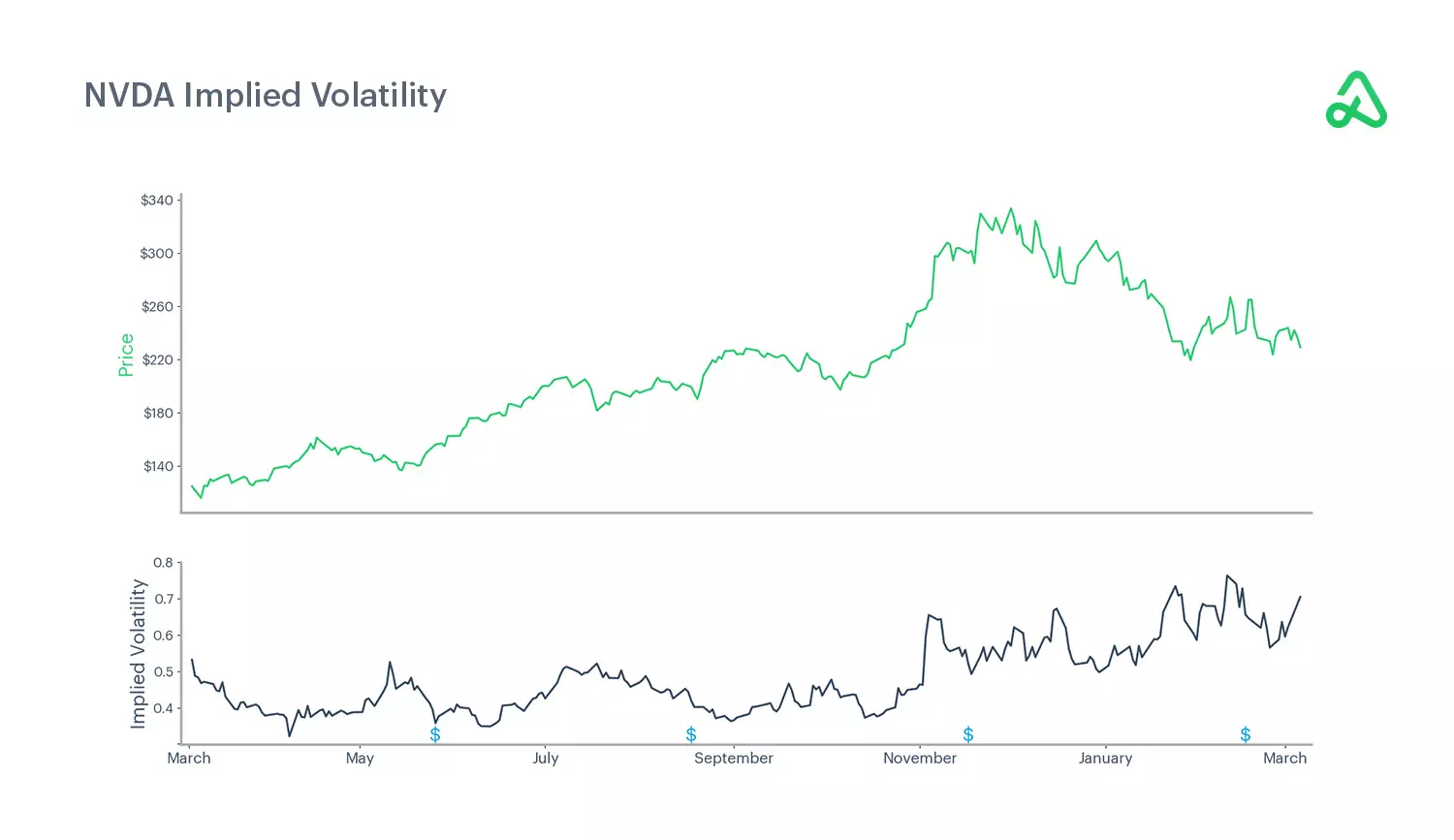

Implied volatility represents the market's expectation of future volatility of the underlying asset, and it plays a vital role in determining an option's price. Generally, when there is uncertainty or anticipation of significant price movements in the underlying asset, implied volatility tends to rise, leading to higher option premiums. Conversely, when uncertainty decreases, implied volatility tends to fall, resulting in lower option premiums.

IV crush typically occurs after significant market events, such as earnings announcements, product launches, or regulatory decisions, when there is a sudden decrease in uncertainty. Traders who hold options positions, particularly those with long positions, may experience a sharp decline in the value of their options due to the decrease in implied volatility, even if the price of the underlying asset remains stable.

Strategies for Navigating IV Crush

While IV crush can pose challenges for options traders, there are several strategies they can employ to mitigate its impact or even profit from it. Here are some key strategies:

1. Sell High-IV Options Before Events: One approach is to take advantage of elevated IV levels before anticipated market events. Traders can sell options with high implied volatility, such as straddles or strangles, to capitalize on inflated premiums. By selling options with high IV, traders can benefit from IV crush if the volatility decreases after the event, leading to a decline in option prices.

2. Use Spread Strategies: Spread strategies, such as vertical spreads or calendar spreads, can help traders mitigate the impact of IV crush. In these plans, you buy and sell options with different strike prices or expiry dates at the same time. Traders can protect their options portfolios from the effects of IV crush by setting up spread bets.

3. Employ Iron Condors: Iron condors are a popular strategy for trading options in neutral market conditions. This strategy involves selling an out-of-the-money call spread and an out-of-the-money put spread simultaneously. This lets traders make money from time decay and a drop in implied volatility, which both lead to IV crush.

4. Hedge with Options on Volatility Indices: Another approach to navigate IV crush is to hedge options positions with options on volatility indices, such as the VIX (CBOE Volatility Index). These options can provide protection against adverse moves in implied volatility, helping traders offset losses resulting from IV crush.

5. Roll Positions: If traders anticipate IV crush but still want to maintain their options positions, they can consider rolling their positions to later expiration dates or different strike prices. By rolling options positions, traders can adjust their exposure to changes in implied volatility while potentially minimizing losses or maximizing gains.

6. Diversify Strategies: Diversification is key to managing risk in options trading. By employing a combination of strategies, such as selling options, buying options, and employing spread strategies, traders can diversify their exposure to different market conditions and mitigate the impact of IV crush on their overall portfolio.

Conclusion

IV crush is a common occurrence in options trading, particularly after significant market events. While it can pose challenges for traders, understanding the factors driving IV crush and implementing appropriate strategies can help mitigate its impact or even profit from it. By selling high-IV options, using spread strategies, employing iron condors, hedging with volatility indices, rolling positions, and diversifying strategies, options traders can navigate IV crush with confidence and potentially enhance their trading performance. As with any trading strategy, it's essential to carefully assess risk and implement risk management measures to protect capital and achieve long-term success in options trading.