Cash seizures up ahead of polls in five states: Nitin Gupta

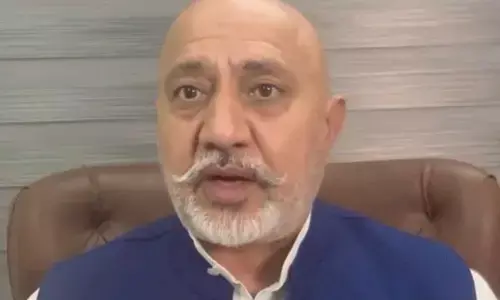

New Delhi: In the run-up to the Assembly elections in five states, the Income Tax department has seized more unexplained cash as compared to elections held in those states earlier, CBDT chairman Nitin Gupta said on Wednesday.

Gupta said that prior to both state assembly and Lok Sabha elections, the enforcement agencies, including the I-T department, increased surveillance and got information about unexplained cash and jewellery on toll-free numbers created for the purpose.

“The states where we are right now in elections we have seized more cash than what was seized in the corresponding time in the state assembly elections or Lok Sabha 2019,” Gupta told reporters here.

He said pre-election monitoring of unexplained cash and surveillance is very intense and the entire activity is coordinated at the level of the Election Commission and state election authority.

According to sources, in poll-bound Rajasthan this year there has been a three-fold increase in the total seizure of illegal cash, liquor, drugs, gold, silver etc. Such seizures, which were Rs 322 crore in 2021 and Rs 347 crore in 2022, have risen to Rs 1,021 crore till October 2023.

Chhattisgarh, Telangana, Rajasthan, Madhya Pradesh and Mizoram are going to poll in November.

In July, the apex authority in indirect tax, the Central Board of Indirect Taxes and Customs (CBIC), issued a Standard Operating Procedure (SoP) for tax officers to implement the directions of the Election Commission with regard to the use of freebies, illicit cash, liquor and drugs to lure voters, and asked them to share information with other enforcement agencies.

As per the SoP, tax officers were asked to monitor the distribution of coupon-based or free fuel or cash for alluring prospective voters.

The GST and Customs officials were also asked to set up “flying squads and static surveillance teams” for the effective conduct of road and transit checks of vehicles, and verification of warehouses to curb illegal and prohibited activities.