Centre to decriminalise Income Tax Act, PMLA

These steps are being taken to catapult the country to a $5 trillion economy, says Union Finance Minister Nirmala Sitharaman

These steps are being taken to catapult the country to a $5 trillion economy, says Union Finance Minister Nirmala SitharamanThe NDA government at the Centre is moving to decriminalise the Income Tax Act and the Prevention of Money Laundering Act (PMLA) as part of steps towards restoring business confidence.

New Delhi: The NDA government at the Centre is moving to decriminalise the Income Tax Act and the Prevention of Money Laundering Act (PMLA) as part of steps towards restoring business confidence.

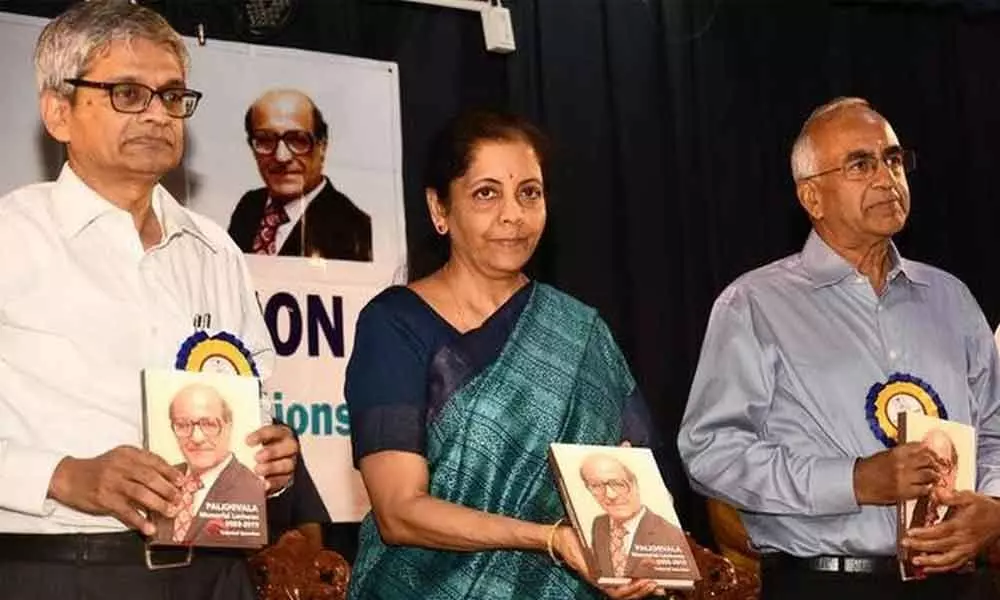

These are among the steps being taken to catapult the country to a $5 trillion economy, Union Finance Minister Nirmala Sitharaman has said.

In her address on the "roadmap to a $5 trillion economy" at the Nani Palkhivala centenary celebrations in Chennai late on Sunday, the Minister said that decriminalising corporate laws, settling tax disputes and rapid privatisation of state-run firms were among the steps that the government was taking to achieve the target.

The government has spoken about changes to be made in the Companies Act to decriminalise several procedural lapses and those that do not affect the public interest to ease compliance.

As part of this exercise, around 46 penal provisions will be amended to either remove criminality or to restrict the punishment to only fine.

The next step is to extend this exercise to laws dealing with income tax and money laundering. "I have gone through this (Companies Act) with a comb. We are working to decriminalise companies and ensure that no other Acts including Income Tax Act and PMLA, have such provisions," Sitharaman said.

The assurance of rationalising penalty provisions in Income Tax Act comes just over a week before she presents the union budget.

The minister's assurance that the government was trying to ensure that businesses are not looked with suspicion, is in line with Prime Minister Narendra Modi's statement in his Independence Day speech last year that wealth creators should not be viewed with suspicion as wealth can be distributed only when it is created.