Experts intrigued by inclusion of electoral bonds in new IT Bill

Experts are intrigued by the new Income Tax Bill, 2025 retaining provisions related to electoral bonds, which were rendered unconstitutional by the Supreme Court last year, saying it could be because of legislative oversight or the government's intention to bring it back in some other form.

New Delhi : Experts are intrigued by the new Income Tax Bill, 2025 retaining provisions related to electoral bonds, which were rendered unconstitutional by the Supreme Court last year, saying it could be because of legislative oversight or the government's intention to bring it back in some other form.

Electoral bonds have been mentioned in the new Income Tax Bill's Schedule VIII which deals with 'Income not to be included in the total income of political parties and electoral trusts'.

In a judgement passed on February 15 last year, the Supreme Court had scrapped the Centre's electoral bonds scheme of anonymous political funding, calling it "unconstitutional" as it was "violative" of the right to freedom of speech and expression and right to information.

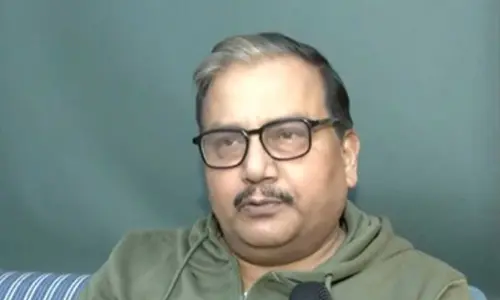

Under the existing Income Tax Act, 1961, donations received from companies and individuals through electoral bonds are exempt in the hands of political parties. The government has brought in a new Income Tax Bill to replace the 64-year old I-T Act. The 622-page Bill is a simplified version of the existing Act which has become complicated over the years because of over 4,000 amendments. About the electoral bond related provisions in the new I-T Bill, AMRG & Associates Senior Partner Rajat Mohan said the mention of electoral bond provisions in the new Income Tax Bill could be because of a legislative oversight, or a deliberate move to keep the door open for a modified version of the scheme in the future.