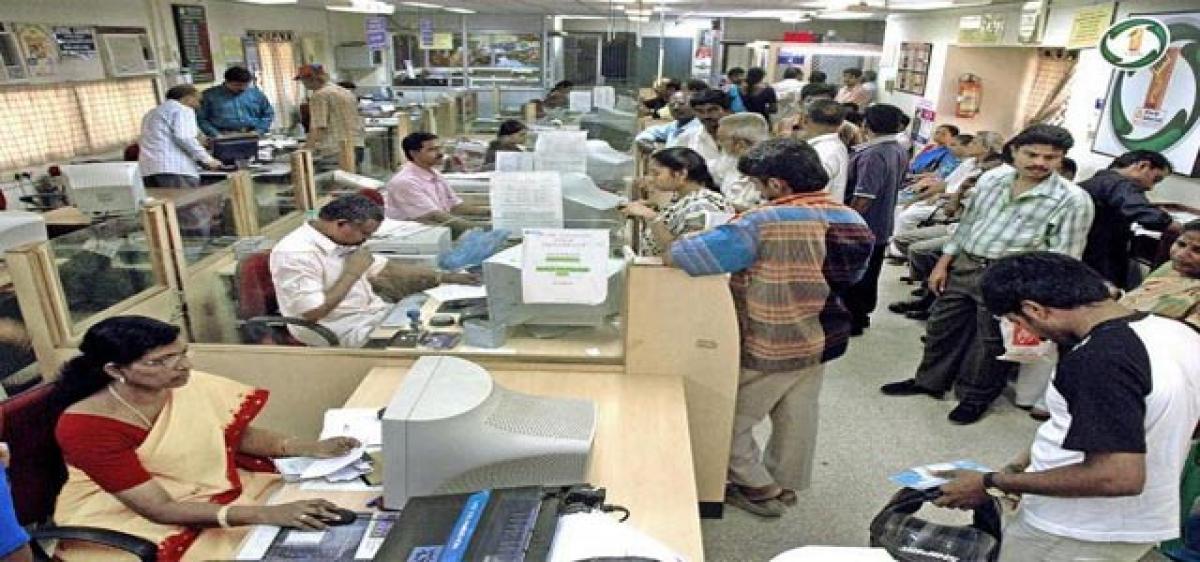

Bank officials burdened with thousands of new accounts

Bank officials are facing a problem with the opening of many new accounts, in the back drop of demonetisation of Rs 1000 and Rs 500 currency notes. There are 2744 fair price shop dealers in the district. The district administration directed to introduce Micro ATMs in the fair price shops.

Bank officials are facing a problem with the opening of many new accounts, in the back drop of demonetisation of Rs 1000 and Rs 500 currency notes. There are 2744 fair price shop dealers in the district. The district administration directed to introduce Micro ATMs in the fair price shops.

Andhra Bank is opening 2000 accounts, IDFC is opening the remaining. The branch managers have taken permission from their head offices to open the new accounts after which the Micro ATMs will be set up in the fair price shops.

Labour department directed the employees and workers working in the shops and establishments to open new accounts to transfer salary through internet banking. Similarly, private schools and convents are asking the employees to open the bank accounts to get their salaries transferred to them.

This is happening in all the districts in the state. The banks would have to open more than one lakh accounts in the state within a short span of time and give account numbers and pass books.

As a result the work pressure has been on the rise for bankers, bank managers, officers and other staff for the last 15 days. Managers are informing the head office on the number of accounts that are being opened. An awareness programme on how to handle these Micro ATMs should be conducted at these Fair Price shops.

The branch managers on one hand are signing on the applications and pass books to open new accounts and on the other hand adjusting the available cash to be distributed among the customers.

A senior manager at Andhra Bank said that he has been working up to 10 am in the bank. He has also mentioned working through Sunday and the Barath Bandh on Monday. He added about the problem he faces to distribute the limited cash he has in the bank among the customers.

There is an 80 per cent gap between demand and supply of cash. In addition to this, when the ATMs run out on cash, phone calls keep coming in from the customers. Employees who have taken salaries in the schools and other shops and establishments, come back to the bank to draw their earned cash. With the increase in accounts there is an increase in work load as well.

Meanwhile, the government directed Guntur Mirchi Yard to take up cashless payments. The farmers will have to open bank accounts to get money for chillis from the buyers.