Markets gain over corporate numbers

The stock markets ended higher for the second straight session on Friday. Brisk buying across counters as the oil prices are getting stabilized that helped the rally.

Mumbai: The stock markets ended higher for the second straight session on Friday. Brisk buying across counters as the oil prices are getting stabilized that helped the rally.

Analysts see asset quality and global volatility as major drivers for the future of the market. Besides, most of the companies that have announced earnings for December beat the market expectations.

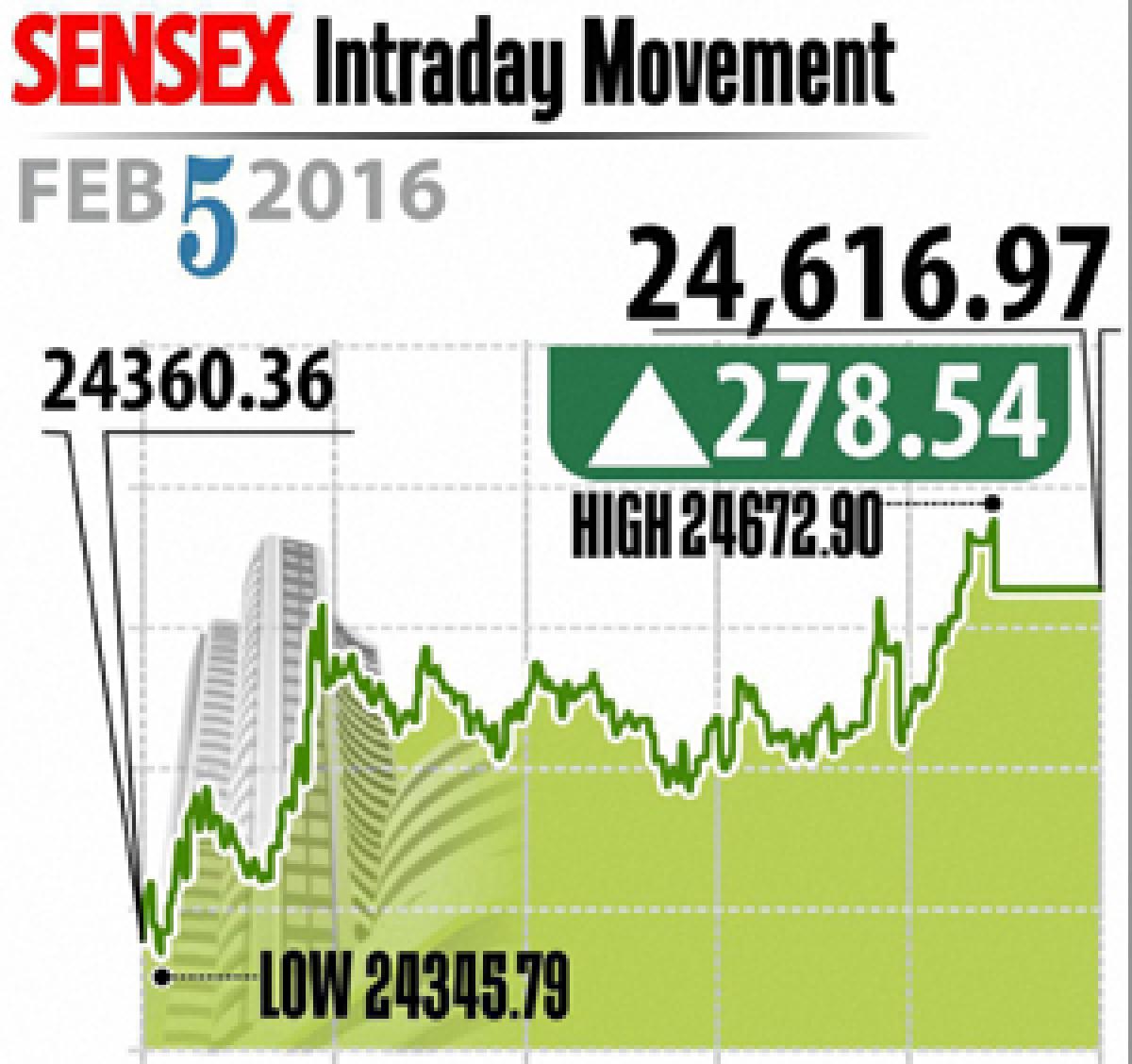

Sensex closed higher by 278 points at 24,617, Nifty up by 85 points to closed at 7,489, below the psychological level of 7,500. However, broader markets outperformed the index stock with midcap and smallcap indices gaining up to 1.9 per cent.

All most all the sectoral indices reported gains with pharma up 3.9 per cent followed by metal 3.73 per cent and PSU Banks 3.63 per cent, however, energy sector reported 0.07 per cent.

From metal pack, Tata Steel ended over 3 per cent, Vedanta up by 9 per cent and Hindalco up by 3.7 per cent. Also banking stocks witnessed buying interest with Axis Bank, SBI, ICICI Bank, HDFC Bank and HDFC ended higher between 0.5 per cent and 4 per cent.

However, the technology space reported mixed response with Wipro and Infosys down 0.2 per cent and 0.4 per cent respectively, with TCS gained 0.4 per cent. On the other hand, Adani Ports, Maruti and GAIL ended down tup to 3 per cent.

The gainers: Lupin, up 9.04 per cent at Rs 1,801.45; Axis Bank, up 4.40 per cent at Rs 398.90; Cipla, up 3.58 per cent at Rs 569.95; Tata Steel, up 3.47 per cent at Rs 234; and Tata Motors, up 3.47 per cent at Rs 337.25.

The losers: Gail, down 3.69 per cent at Rs 341.50; Maruti Suzuki, down 1.86 per cent at Rs 3,723.25; Adani Ports, down 1.58 per cent at Rs 211.20; NTPC, down 1.03 per cent at Rs 124.70; and Infosys, down 0.42 per cent at Rs 1,174.95.