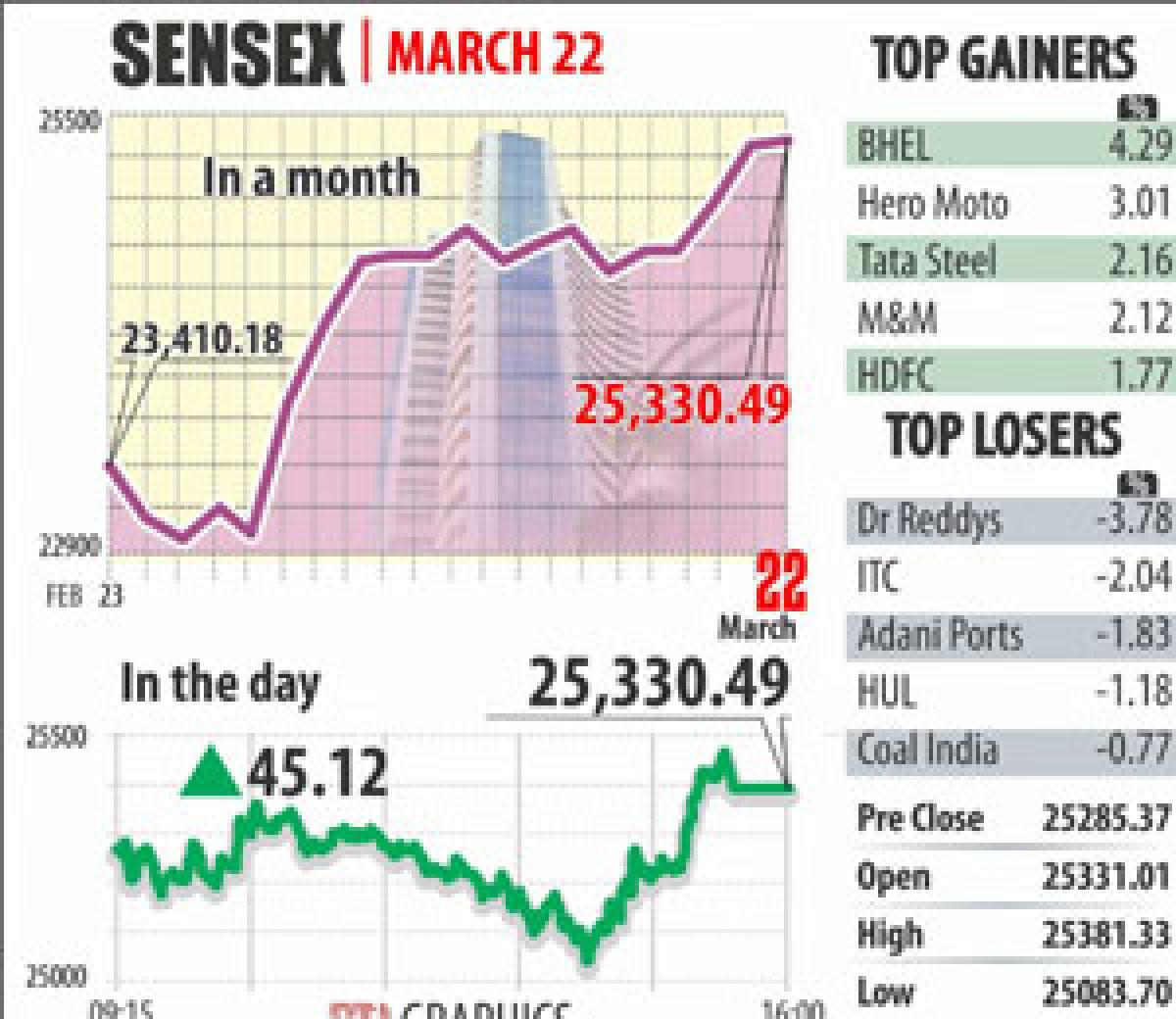

Sensex climbs for third day Brussels attacks keep lid on gains

The benchmark sensex on Tuesday closed in the positive territory for the third straight day, but the day\'s gain was limited to just 45 points after deadly terror attacks in Brussels sent markets globally into a tailspin.

Mumbai: The benchmark sensex on Tuesday closed in the positive territory for the third straight day, but the day's gain was limited to just 45 points after deadly terror attacks in Brussels sent markets globally into a tailspin.

The closing was a fresh 11-week high of 25,330. The modest rise came on the back of investors sticking with their buying activity amid sustained foreign inflows.

In a trade marked by choppiness, the 30-share barometer opened higher, but quickly slipped into the red zone after profit-booking in recent gainers kicked in. A decisively weak trend overseas after the explosions at the Brussels airport and a local metro station dragged the broader index further down.

However, buying towards the fag end wiped off the losses as the gauge settled at 25,330.49 with a moderate gain of 45.12 points, or 0.18 per cent.

It had gained 608 points in the previous two sessions on increasing prospects of RBI lowering interest rates and continued foreign capital inflows.

The NSE Nifty-50 slid further as profit-booking weighed, but managed to close above the 7,700 level at 7,714.90, a gain of 10.65 points, or 0.14 per cent. In sync with the overall trend, the broader markets displayed a firm trend, with the mid-cap index rising 0.52 per cent and the small-cap index 0.27 per cent.

"The government's new defence policy and the interest rate cut on small savings plan has been a welcome note to the market. On the global front, the series of blast in Brussels has hit the European market," said Vinod Nair, Head-Fundamental Research, Geojit BNP Paribas.

Traders said sentiment remained positive as investors have been building up bets in anticipation of a policy rate cut by RBI in its policy review early next month. Foreign portfolio investors (FPIs) net purchased shares worth Rs 1,396.33 crore on Monday, provisional data showed.

BHEL topped the list of gainers with 4.29 per cent, Hero MotoCorp 3.01 per cent, Tata Steel 2.16 per cent, M&M 2.12 per cent, HDFC 1.77 per cent, TCS 1.24 per cent and RIL 1.19 per cent. Defence stocks in particular were lapped up after the new defence procurement procedure (DPP) focusing on India-made products and fast-tracked acquisition process was cleared.